Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

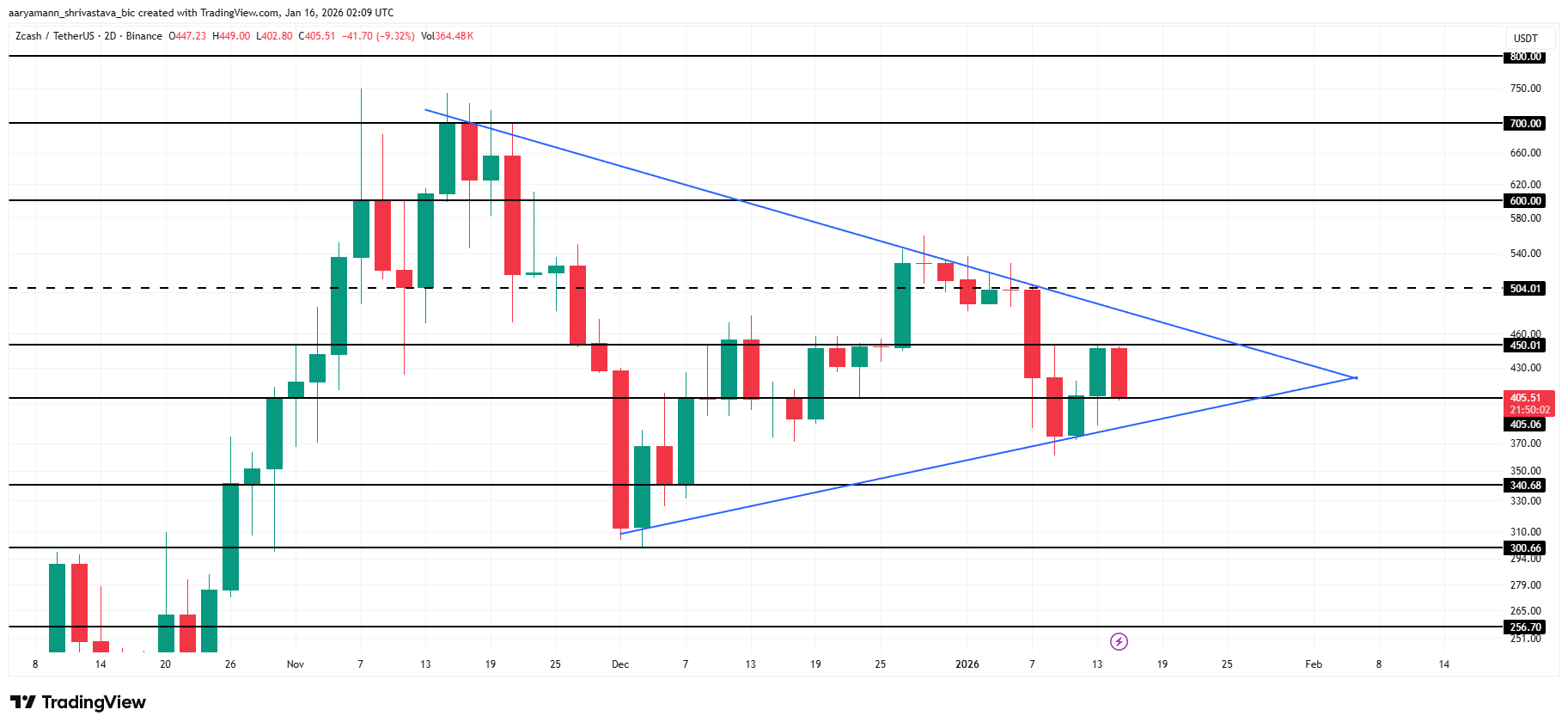

Zcash has entered a calmer phase after weeks of intense volatility, with a noticeable decrease in price volatility. This slowdown led to the formation of a symmetrical triangle pattern, characterized by a narrowing of higher and lower lows.

As the ZEC index compresses into this structure, traders are watching closely, as investor behavior determines the next crucial move.

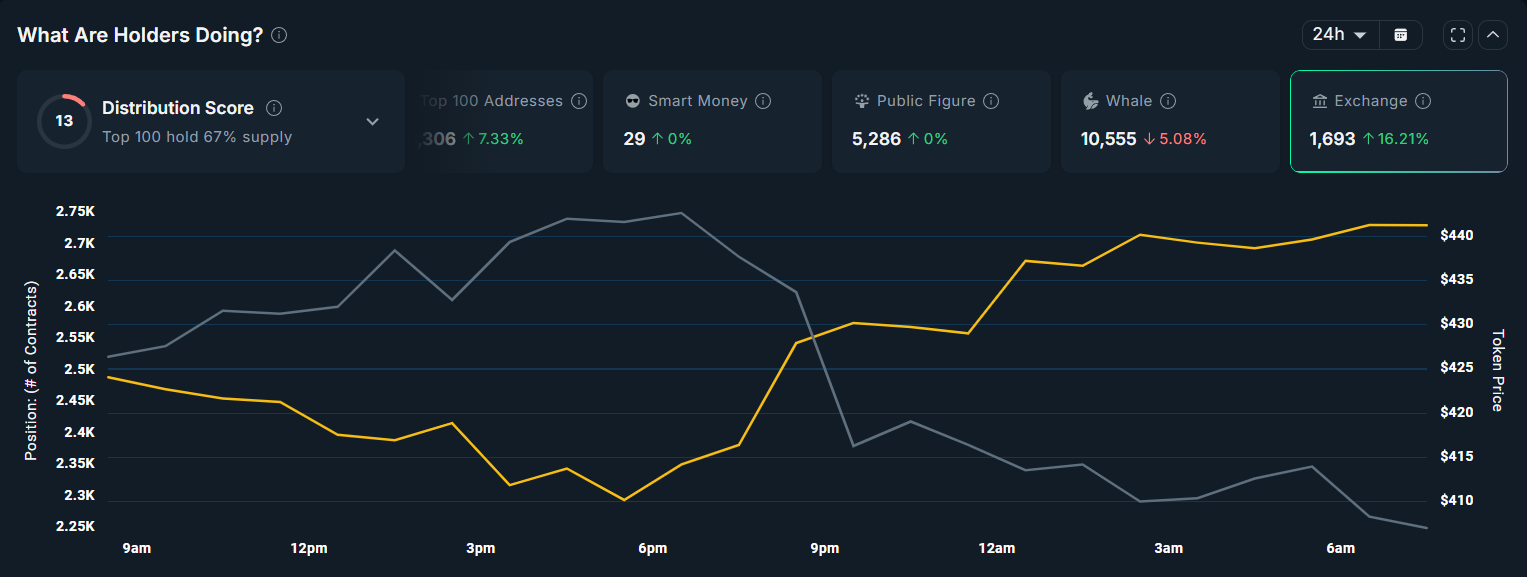

String data refers to Caution is growing among Zcash holders. Nansen indicators show continued growth of ZEC balances on central exchanges. This trend usually indicates the intention of investors to sell, as currencies are moved from private wallets to trading venues in anticipation of further decline.

Sponsored

Sponsored

The 16% increase in exchange balances in the last 24 hours indicates that holders prefer to preserve capital over accumulation. This behavior reflects low confidence and adds additional selling pressure, which can affect the price during consolidation phases.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

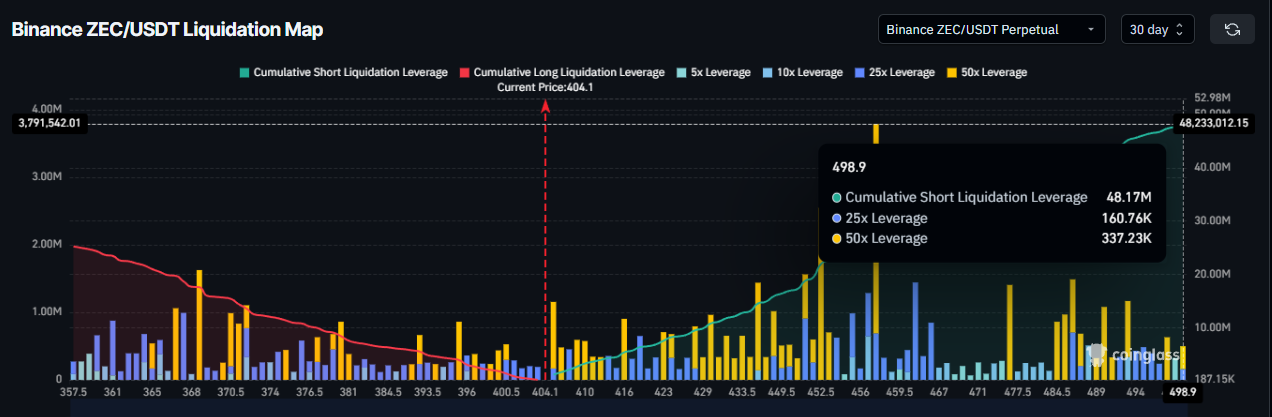

Selling pressure often spills over into the derivatives markets, increasing the risk for liquidation. In the case of Zcash, the settlement chart shows an asymmetry that currently limits the downward acceleration. The short position makes a much higher exposure near $500, for a total of about $48 million, compared to $25 million in long exposure gathered near $357.

This imbalance means that short sellers are in a relatively immune position at the moment, while long traders bear more immediate risks. if The ZEC index fell Long positions have been liquidated, bullish participation may weaken further. This result will likely reduce the demand for leverage, keeping futures activity quiet until clearer directional signals emerge.

ZEC continues trading In a symmetrical triangle, the highs and lows are printed close together. This structure is usually preceded by a sudden movement with volatility pressure. As the price approaches the top, traders should expect a decisive breakout or breakout, driven largely by spot market flows and derivatives positions.

Current conditions favor downside risks on the air side. Continued selling and trade balances increase the possibility of a collapse below $405. A move towards $340 will likely trigger long liquidations. This sequence can deepen the leaks, causing… The price of Zcash is pushing towards $300 level as bullish conviction erodes.

An upside alternative remains possible if selling eases pressure and capital flows return. A clean break above the upper boundary of the triangle near $504 will invalidate the bearish setup. Such a move would force a short sale, which could open a quick advance towards $600 as momentum shifts decisively in favor of buyers.