Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

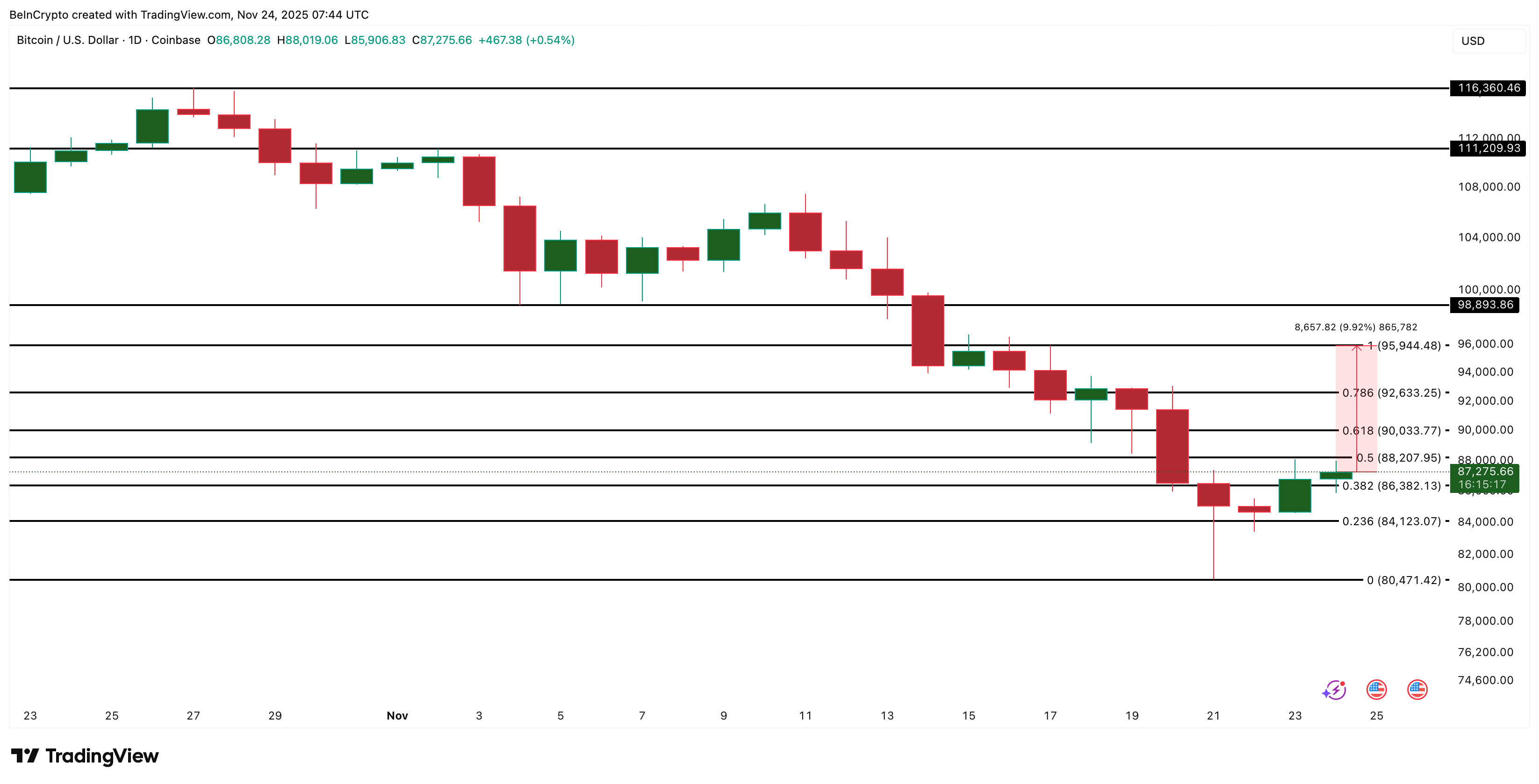

Bitcoin is up 2% today and has already gained almost 9.4% from this week’s lows near $80,400. The move looks strong, and the bounce was expected for a technical signal that worked before.

But a great danger is created at the same time near an important level. He can decide whether to continue or fail at the next barrier.

Sponsored

Sponsored

The first sign of momentum appeared.

Between April 8 and November 22, the price of Bitcoin made a higher low, while the Relative Strength Index (RSI) made a lower low. The RSI measures whether momentum is rising or falling by comparing recent gains and losses. This pattern is called hidden bullish divergence. Weak sellers appear even when the chart looks weak.

The same pattern appeared between April 8 and October 26, creating a retracement movement of 8.53%. this time, Bitcoin is already going up For 9.38%, which means that the signal is verified again.

Want more insights into currencies? Subscribe to Editor Harsh Notaria’s daily cryptocurrency newsletter here.

But the recovery now faces an obvious problem.

A bearish crossover of the Exponential Moving Average (EMA) is forming. The exponential moving average reacts faster than the simple moving average because it gives more weight to recent prices. Now, the 100-day EMA is about to break below the 200-day EMA.

Sponsored

Sponsored

Traders consider this a bearish crossover because it often indicates downward pressure that lasts for weeks. There is also Bitcoin shows above the surface.

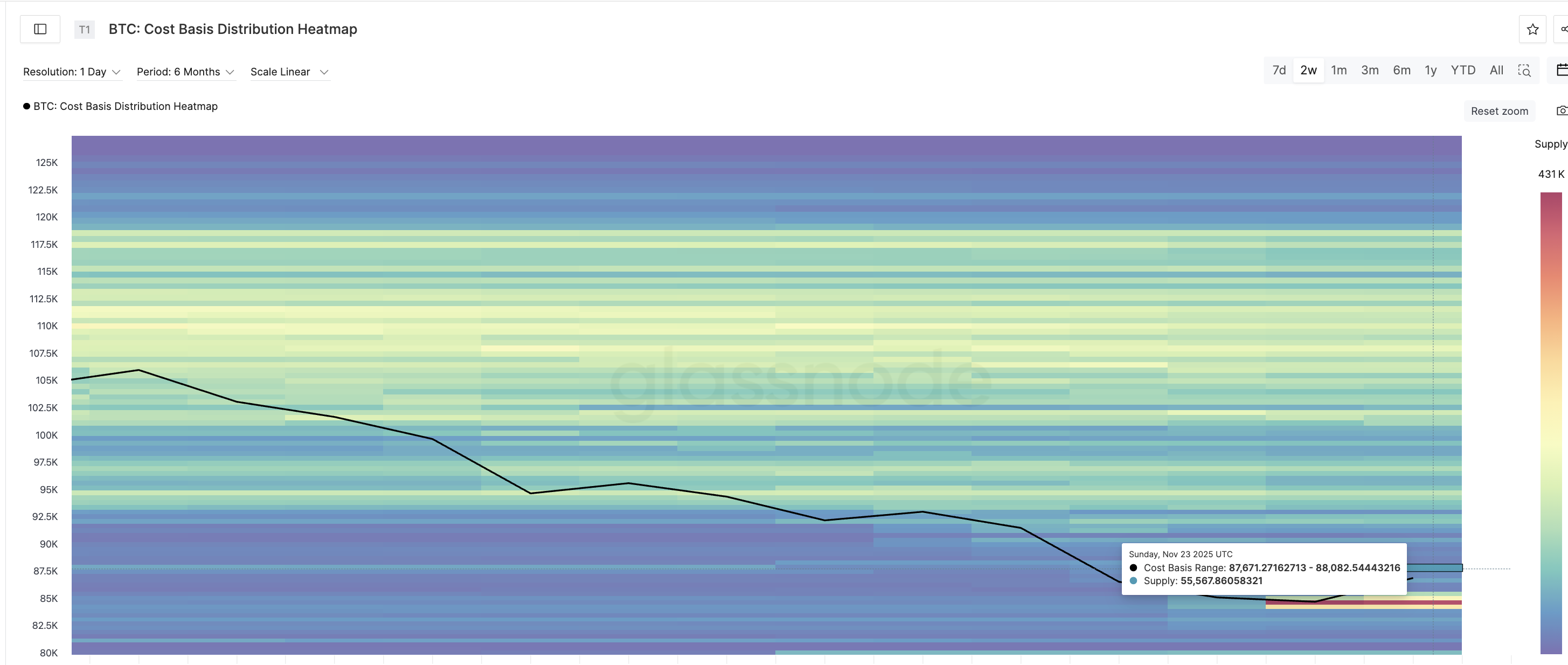

The heavy cluster now sits above the price between $87,671 and $88,082 – the level where many owners expect to sell at breakeven. This cluster contains about 55,567 Bitcoins, with an estimated current value of about $4.83 billion.

Most rebounds slow down when they hit these cross areas. So the rebound is based on momentum, but it also makes its first big test almost immediately.

Sponsored

Sponsored

The area around $88,000 is all decided now. Bitcoin must surpass $88,200 to turn this bounce into something real. This area aligns with the wide range in the heatmap and the 0.5 Fibonacci level from the recent decline.

A pure daily close above this range opens the way towards $92,600.

If buyers remain active, the next stretch is near $95,900 – the same area where the last major collapse in Bitcoin price started.

Sponsored

Sponsored

A stronger transition is only possible if two things happen together:

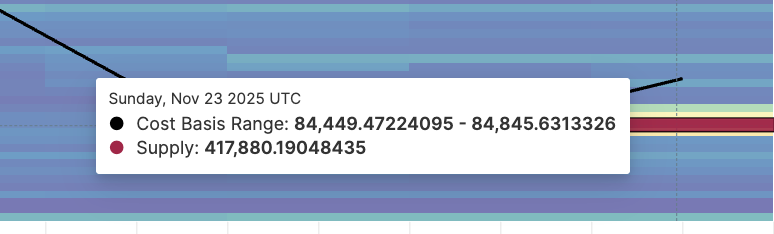

If the crossover is completed first, it usually covers the bounce and pushes BTC price at the lowest. On the upside, the $84,449-$84,845 range remains the strongest support, according to the core cost heat map. This range contains approximately $35.38 billion of Bitcoin.

The concurrent level on the price chart is at $84,100. Bitcoin turned this rally into a protective plan after breaking above it.

While this area maintains its position, the deeper side remains limited. If it breaks again, Bitcoin could fall towards the $80,000 area again, invalidating the bounce theory.