Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

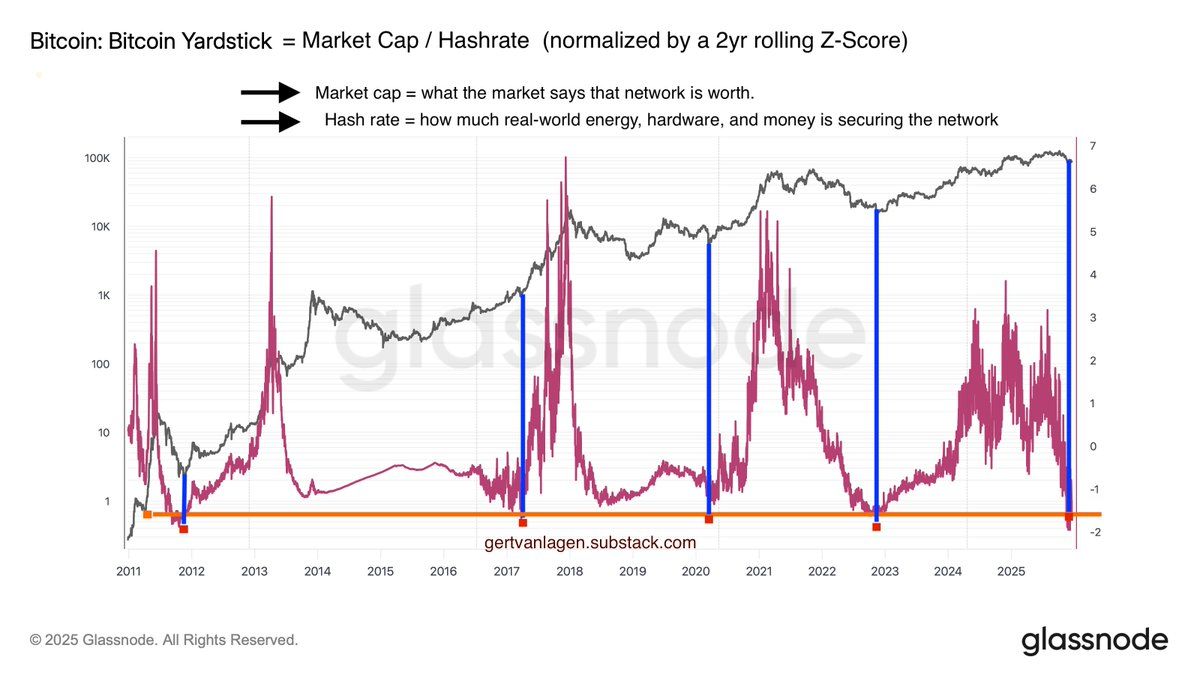

Bitcoin may be approaching one of the most important turning points in recent years. The Leading Valuation Index, a benchmark for BTC, currently reads -1.6 standard deviations below its long-term average, indicating the deepest decline in the leader’s value since the 2022 dip market low.

Historically, this level has coincided with cycle lows, including 2011, 2017, 2020 and 2022.

Sponsored

Sponsored

The benchmark measures the market price of Bitcoin against the cost and power required to secure its network. This includes mining infrastructure and operating expenses.

“BTC benchmark at -1.6σ = Bitcoin is insanely undervalued. Other events: 2022 bear market low, 2020 Covid low, base pre-breakup in 2017, 2011 bear market bottom… All events coincided with a strong buildup… The bottom was also in place.” books Analyst Geert van Lagen in a post.

At the same time, the reduction signal coincides with unprecedented accumulation activity. In the last 30 days, he bought… Bitcoin whales and tycoons 269,822 Bitcoin is worth about $23.3 billion. According to Glassnode data, this is the largest monthly backlog since 2011.

Sponsored

Sponsored

“Biggest accumulation in 13 years. Four-year cycle is over;” The Supercycle is here.” books Cryptocurrency analyst Kyle Chase.

Most of this purchase took place in The wallets contain between 100 and 1000 Bitcoin. This indicates that both high net worth individuals and small institutions are warming to a potential market downturn.

Sponsored

Sponsored

Despite the record accumulation and decrease in value, he coped Bitcoin price Downward pressure this year. According to Bloomberg ETF analyst Eric Balchunas, recent losses are modest compared to previous gains.

The launch contributed Bitcoin Fast Funds Early 2024 on previous highs, pushing the asset to then record highs near $69,000 in March 2024.

Overall, Bitcoin returned 155.42% in 2023 and 121.05% in 2024 before seeing a 7% decline since the beginning of the year. This suggests that the current decline may be a natural correction after exceptional gains.

Sponsored

Sponsored

Analysts point out that market rallies often begin not when hopes are high, but rather when investors are tired.

“We are no longer afraid, we are tired. I am tired of waiting. I am tired of believing. But listen, market demonstrations do not begin when hope is high; they begin when people are tired, frustrated and ready to give up. “books Ash Crypto Analyst.

The convergence of historical valuation declines, record whale accumulation, and declining leverage suggest that Bitcoin may be approaching another cyclical turning point.

While the timing remains uncertain, these indicators highlight a unique window of potential opportunity for long-term investors.