Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Crypto whales begin to make clear movements as December approaches, and their activity reveals where the next phase of strength is expected to come. Instead of selling in the volatility of late November, large holders increased their exposure to a mix of mid-cap and large-cap currencies.

Buying also appeared as prices stabilized, making accumulation even more important. These models give an early look at the assets the Whalers believe they could gain in December.

Athens (ENA) stands out As one of the clearest signals of what crypto whales buy for potential earnings in December. The token has risen by 21.3% in the last seven days, and instead of using this power to take profits, the big holders are adding more.

Sponsored

Sponsored

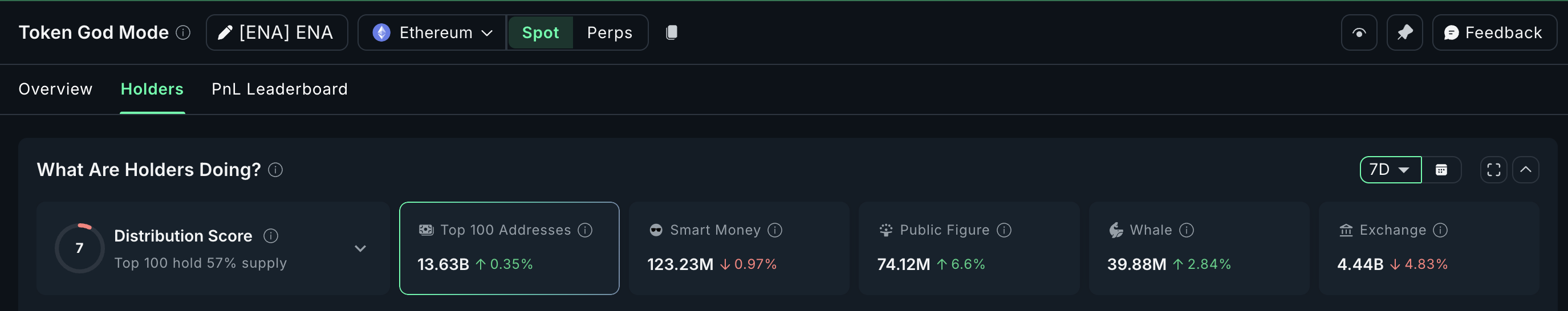

Whale wallets increased their ENA holdings by 2.84% this week, bringing their total to around 39.88 million ENA. This means that the whales have earned about 1.1 million additional tokens.

The first 100 addresses or mega whales also increased their balances by about 0.35%, adding almost 50 million ENA. Buying whales in an already strong week usually indicates that more confidence is on the horizon.

Want more insights into icons like these? Subscribe to Editor Harsh Notaria’s daily cryptocurrency newsletter here.

On the 12-hour chart, Athens is still trading in a symmetrical triangle, indicating a matchup between buyers and sellers. The important level is $0.28. A clear daily break above this level – which has rejected any rally attempts since November 25 – could lead to moves towards $0.30 and even $0.32.

If ENA fails to maintain the level of $0.27, it risks slipping below the low limit of the triangle, which opens the way for a return towards $0.21, especially if the demand for whales cools down.

Sponsored

Sponsored

Ripple is the second asset bought by cryptocurrency whalesperhaps for earning potential in December. The accumulation model here is much stronger than what we saw on Athena. Two large groups of whales gathered significantly during the last week of November.

The largest holders – wallets containing more than 1 billion Ripple – have added about 150 million Ripple since November 25. At current prices, this equates to about $330 million of new exposure.

The 10-100 million group has been more aggressive, adding about 970 million Ripple since November 23, worth about $2.13 billion at current prices.

With Ripple trading close to $2.20, this new whale exposure entered the market during a week in which the token gained more than 16%, reinforcing that these buyers add strength rather than weakness.

This rally comes at a technical turning point. Ripple spent almost two months defending the support of $1.77, a level that was tested twice – on October 10 and again in late November – forming an initial double bottom structure. This foundation is now considered the foundation of any strength in December.

Sponsored

Sponsored

To continue the uptrend, the Ripple price must break $2.30, a resistance that has rejected every bullish attempt since November 15. Every day it closes above that open area $2.45 and $2.61, where the next supply rallies are located.

If Ripple falls below $2.11, the bullish structure will collapse. A deeper retest at $1.81 becomes a possibility – but that will only happen if the whale accumulation turns into a distribution.

Cardano remains on the list because The cryptocurrency whales have started to circulate Towards the big coins again, after Ripple. Two large ADA groups bought during the latter part of November.

The largest holders, wallets with more than 1 billion ADA, began to add on November 24. Since then, they have accumulated 130 million ADA in total. The 10-100 million group started buying on November 26 and added 150 million ADA. Both groups have achieved net positivity in a few days, showing new conviction even as the symbol trades near its recent lows.

Sponsored

Sponsored

With the trade ADA Close to $0.41, this large whale accumulation is a significant amount of capital returning to the market. The purchase also happened in the same period in which ADA saw a slight rebound, 5% on a weekly basis, making the snapping even more noticeable.

In the 12-hour chart, ADA shows a record bullish divergence. Between November 4 and November 21, the price made a lower low while the Relative Strength Index (RSI), which measures momentum, made a higher low.

This type of divergence often indicates that there is a trend reversal forming below the surface. The first signs of this transformation are already visible.

To gain strength in December, ADA needs a strong candle close above $0.43. A break above this level opens a path towards $0.52, which will turn the short-term structure bullish. If ADA loses $0.38, the bullish formation weakens and the reversal signal may fail.