Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the US Crypto Morning News Brief – your essential summary of the most important developments in the crypto world for the day ahead.

Grab a cup of coffee and get ready for the latest twist on Wall Street: a Bitcoin company is preparing to enter the New York Stock Exchange. Shareholders have approved a major merger, putting billions of bitcoins under one roof and signaling a change in the way crypto interacts with traditional markets.

Sponsored

Sponsored

Cantor Equity Partners (CEP) shareholders have voted to approve the merger with TwentyOne Capital, clearing the last major hurdle to getting the deal done.

The transaction is expected to close, subject to standard closing conditions, on December 8, 2025. Upon completion, the combined entity will operate under the name TwentyOne Capital and begin trading the following day (December 9).

The company will be led by the CEO of Strike. Jack Mallersand Tether and Bitfinex retain a majority stake. The company positions itself as the first Bitcoin company to prepare for a public listing, offering investors a regulated path to gain exposure to the cryptocurrency.

“Following the completion of these transactions, the combined entity will operate as TwentyOne Capital, and its Class A common stock will trade on the New York Stock Exchange (“NYSE”) beginning December 9, 2025 under the symbol XX1,” the company said in its announcement. Advertising text.

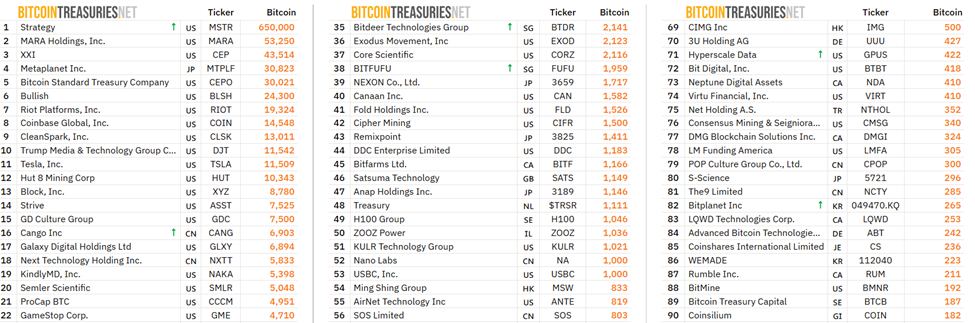

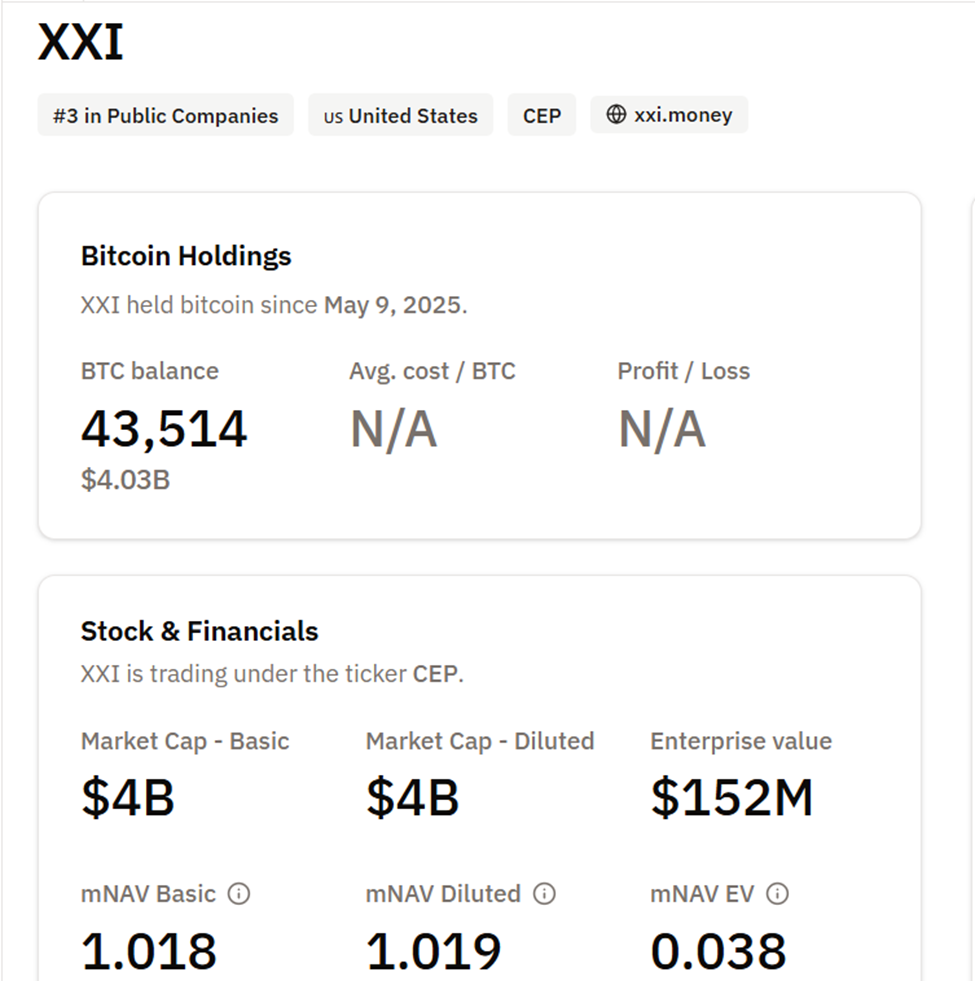

TwentyOne Capital currently owns 43,514 BTC, valued at around 4 billion, making it the third largest Bitcoin holder among listed companies after Strategy and.Mira Holdings.

The company is focused on “efficient capital accumulation via Bitcoin” and plans to introduce a “Bitcoin per share” metric. This metric will allow contributors to track Bitcoin ownership in real-time with on-chain auditable safety evidence.

Sponsored

Sponsored

“This listing provides a transparent and regulated way for investors to access Bitcoin without directly holding the asset,” the company added.

put on Appearance at the New York Stock Exchange TwentyOne Capital also acts as a bridge between operations related to digital currencies and traditional financial markets, which can enhance investors’ access to digital assets.

Conor Kenny, a popular user on x (Twitter), said that it “…offers investors a new way to gain exposure to Bitcoin via the financial markets.”

The announcement comes amid widespread discussions about the banking sector’s relationship with companies linked to digital currencies. In late November, Jack Mallers revealed that JPMorgan Chase suddenly closed their personal accounts Without explanation, they raise fears of “unbanking” in the cryptocurrency industry.

Paolo Ardoino, CEO of Tether, described the move as an opportunity for managers of cryptocurrency companies to operate independently of central financial institutions.

Sponsored

Sponsored

These tensions coincide with a broader market scrutiny. JP Morgan is currently watching Possible revaluation of the MSCI index That may affect companies with large Bitcoin reserves, such as MicroStrategy.

Analysts estimate that index changes could result in billions of dollars from passive funds, perhaps as much as… $9 billion for MicroStrategy.

As TwentyOne Capital prepares to trade under the symbol “XXI” on December 9, market participants have been monitoring trading volume, investor interest, and the reception of Bitcoin for metrics.

The listing could set a precedent for other cryptocurrency companies seeking exposure in regulated markets, potentially expanding institutional and individual participation in the Bitcoin economy.

Sponsored

Sponsored

Here’s a roundup of other US cryptocurrency news to follow today:

| Strategy (MSTR) | $188.39 | $187.82 (-0.30%) |

| Coinbase (COIN) | $276.92 | $275.85 (-0.39%) |

| Galaxy Digital Holdings (GLXY) | $27.05 | $26.93 (-0.44%) |

| MARA Holdings (MARA) | $12.47 | $12.45 (-0.16%) |

| Riot Platforms (RIOT) | $15.64 | $15.57 (-0.45%) |

| Core Scientific (CORZ) | $16.55 | $16.50 (-0.30%) |