Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

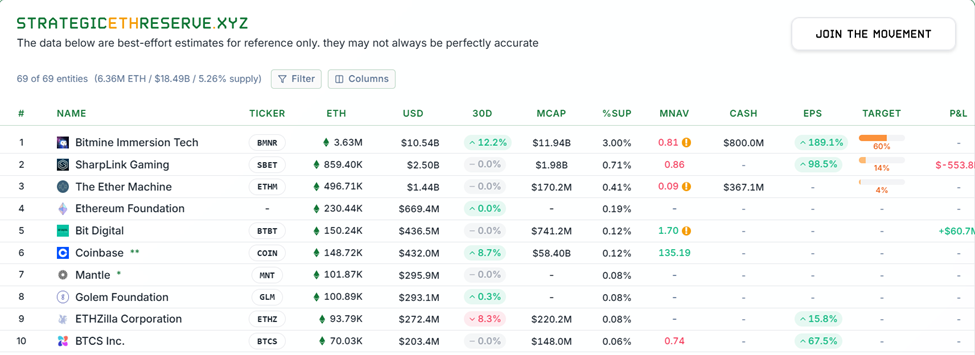

Bitmain has revealed one of the largest Ethereum reserves ever recorded, 3.63 million ETH. However, the reported average purchase price of $2,840 drew immediate dismay from analysts who said the calculations did not add up.

This update is important because Bitmain is now closing in on its long-term goal of owning 5% of all Ethereum, a limit that Fundstrat called “5% alchemy.”

Sponsored

Sponsored

In an update on November 24, Bitmain (BMNR) reported total assets of $11.2 billion in cryptocurrencies, cash and “aggressive bets.” The company owns 3,629,701 ETH, 192 BTC, a $38 million stake in Eightco Holdings, and $800 million in unencumbered cash.

According to Bitmain, 3.63 million ETH were accumulated at an average price of about $2,840 per token. At current market levels above $2,900, the position would be slightly profitable.

Chairman Thomas “Tom” Lee said that Bitmain now owns 3% of the Ethereum network.

Sponsored

Sponsored

Bitmain also published weekly Ethereum purchases, showing a large and sustained flow throughout October and November.

| Period (end of week) | The amount of Ethereum bought |

| November 24 | 69,822 ETH |

| November 17 | 54,156 ETH |

| November 10 | 110,288 ETH |

| November 3 | 82,353 ETH |

| October 27 | 77,055 ETH |

| October 20 | 203,826 ETH |

| October 13 | 202,037 ETH |

| October 6 | 179,251 ETH |

This accumulation strengthens Bitmain’s position as the largest ETH treasury in the world, and it is also the second cryptocurrency treasury overall after MicroStrategy, which holds 649,870 BTC for $57 billion.

Sponsored

Sponsored

Lee said the recent decline in cryptocurrency prices is consistent with “hit liquidity since October 10” and weak technical conditions.

However, note that ETH has already approached the expected minimum of $2,500 by Finstrat.

Bitmain highlighted the rapid growth of BMNR as one of the most actively traded stocks in the United States. Average daily trading volume was $1.6 billion (five-day average through November 21), ranking the stock 50th nationally, behind MasterCard and ahead of Palo Alto Networks.

Sponsored

Sponsored

Despite the optimistic disclosures, market observers quickly challenged Bitmain’s stated base. Blockchain analyst account LockOnChain estimated the average purchase price of Bitmain at around $3,997, representing an unrealized loss of more than $4 billion.

Another analyst wrote in: Tweet The “$2,840” reported by Bitmain only reflects the Ethereum spot price at the time of the company’s publication and not the current average purchase price. Other users calculated an implied average closer to $3,800 to $4,000.

They asked in Tweet: “Your average purchase price for ETH should be around $3,840… is this accurate?”

Bitmain has yet to address the discrepancy or provide details to support its stated cost base. So, now all eyes are on whether Bitmain will clear their calculations, continue to accumulate ETH every week, and reach the 5% limit of the token.

With the network of auditors “MAVAN” produced in the place they are preparing to publish With the beginning of 2026 and the market profile of BMNR growing, Bitmain’s treasury strategy is likely to remain central to the Ethereum ecosystem in the coming months.