Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The price of XRP is up about 33% from its December 31 lows, and is up about 11% in the last 24 hours. The move represents one of the strongest short-term rebounds for XRP in months, and comes after a long-term consolidation phase.

The rally improved the broader XRP price outlook, but confirmation is still incomplete. The technical momentum is increasing, but the signals on the chain show the market entering a sensitive profit zone. Whether XRP can extend higher now depends on how the price behaves around a critical resistance zone.

Sponsored

Sponsored

XRP’s recovery started after forming a triple bottom near the $1.77 level. This area has served as a support many times and has now become the structural foundation of the elevation.

The momentum indicators are starting to support people. The 20-day EMA is close to the 50-day EMA. The modified EMA gives more weight to recent prices, so when a faster EMA moves above a slower one, it often signals a shift toward bullish momentum. It was Bullish transit confirmed Historically it supports trend continuation rather than short-term rebounds.

Want more icon insights like these? Subscribe to Editor Harsh Notaria’s daily Crypto newsletter here.

The behavior of the volume supports this view, but with caution. The trading volume on the balance sheet, which tracks whether the volume flows into or out of an asset, has crossed the downtrend line. This indicates that buyers are participating in the discovery. However, the OBV has not yet achieved a clear increase despite the rising trend of the XRP price, which indicates that the buying pressure is improving, but not accelerating significantly.

In addition, the increase in OBV slowed down slightly near the $2.41 area, as shown in the chart. Also, the long candlestick shows that sellers can return to this level.

Sponsored

Sponsored

Together, these signals improve XRP price forecastbut it still needs price confirmation at higher levels.

The data on the chain adds complexity to the setup.

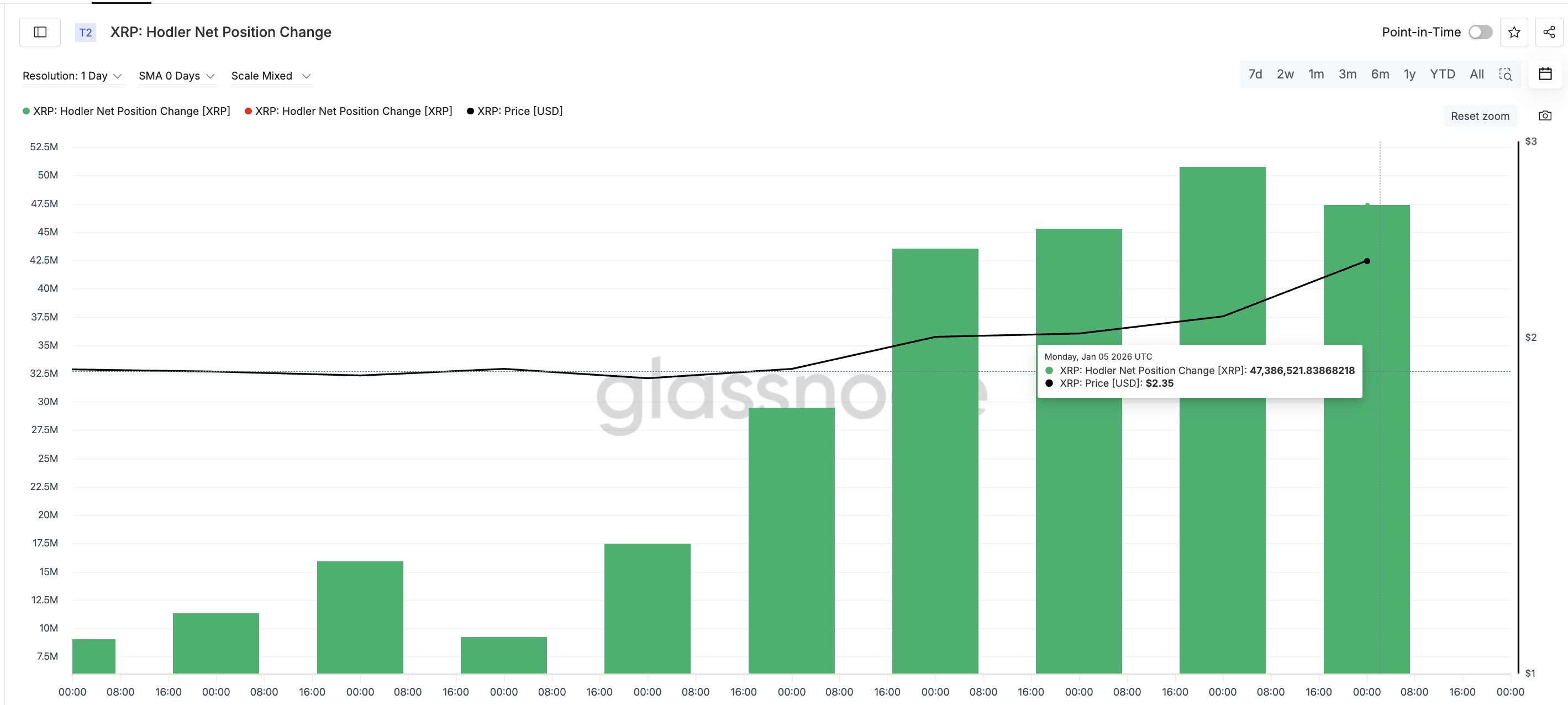

Long-term holders are still accumulating. Long holders are wallets that have held XRP for long periods and have historically sold less. Since December 30, this group has increased its net assets from about 9 million XRP per day to about 47 million XRP. This represents an increase of more than 420% in the net accumulation during the rally phase, confirming the continued persuasion.

However, pressure on earnings is also increasing. The long-term holder index NUPL, which stands for Net Unrealized Profit or Loss, measures the amount of profits retained by long-term holders. NUPL has returned to levels last seen in early December.

Sponsored

Sponsored

At those levels around 0.48-0.49, XRP has been corrected By about 14% in the next nine days. This does not guarantee a repeat, but it does indicate that the market is once again in an area where gains have been historically high.

It is important that the accumulation of Hodler has slowed down over the last two days, which is evident when reviewing the previous measure. Long holders also added profits, but at a slower pace since January 4, suggesting that buyers have become more selective as prices rise and NUPL rises.

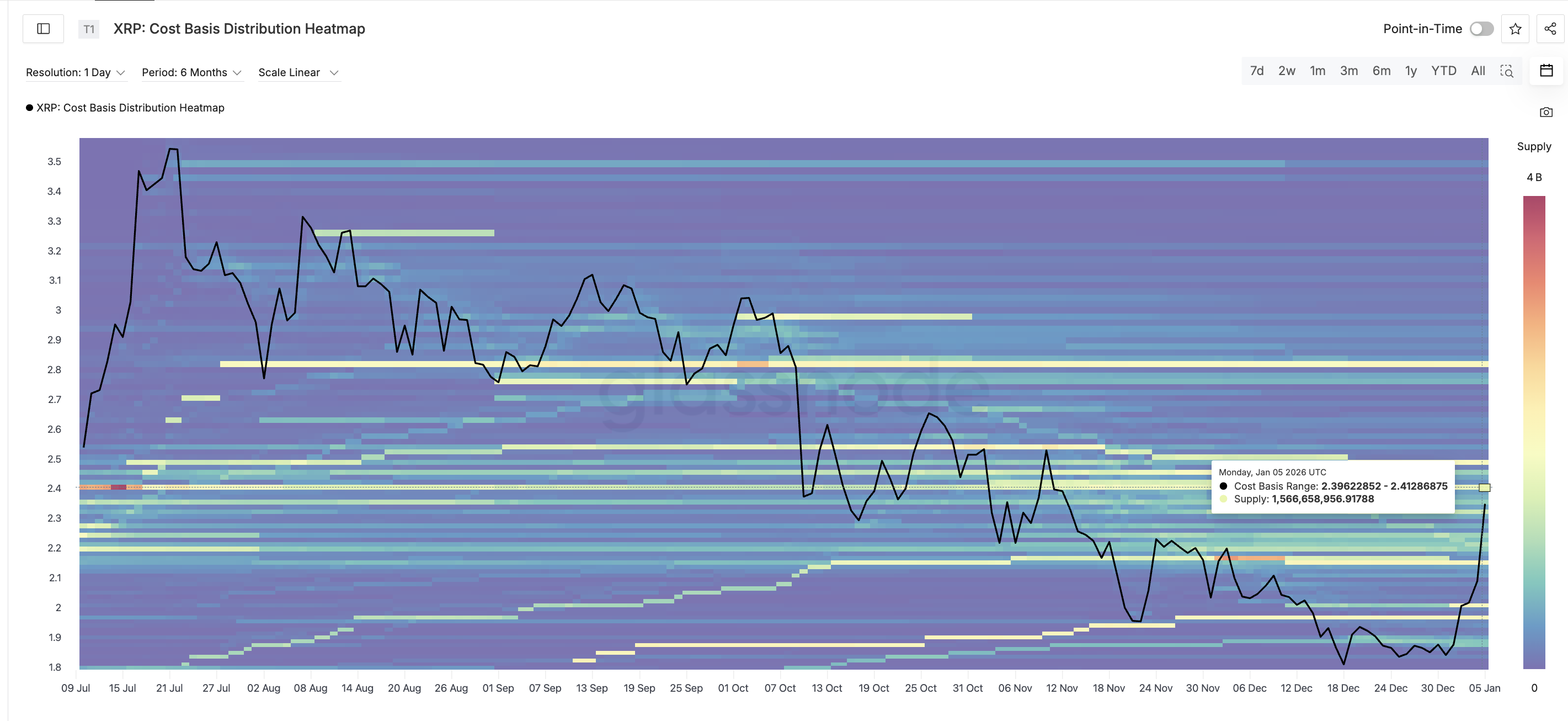

All technical and chain signals are converging near the $2.41 area.

Sponsored

Sponsored

The cost-based distribution map highlights this region as a large supply cluster. The cost base shows where the coins were first purchased. Between $2.39 and $2.41, about 1.56 billion XRP were collected. When the price returns to such areas, many holders sell to break even, creating resistance. How to stand out XRP price chart Previous that resistance zone.

This explains why XRP stopped near $2.41 and why OBV stabilized while NUPL continues to grow.

For the bullish XRP price forecast to remain valid, XRP needs a clean daily close above $2.41. If this happens, the upside offer will weaken, with the next upside target near $2.69. This represents an additional increase of approximately 13% over current levels.

If XRP fails to recover $2.41, the downside risk increases. Initial support is near $2.26, followed by deeper support at around $1.90. Even in a pullback scenario, the broader structure remains intact as long as the price remains above $1.77.

XRP’s rally has momentum, but it is now entering its most important test. The next stage of the XRP price prediction depends not only on the indicators, but on whether the buyers are decisively able to turn $2.41 from the resistance into support.