Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin (BTC) whales and sharks have continued to accumulate over the past nine days, even as small retail investors reduced their exposure, pointing to what Santiment described as “optimal conditions” for a potential breakout.

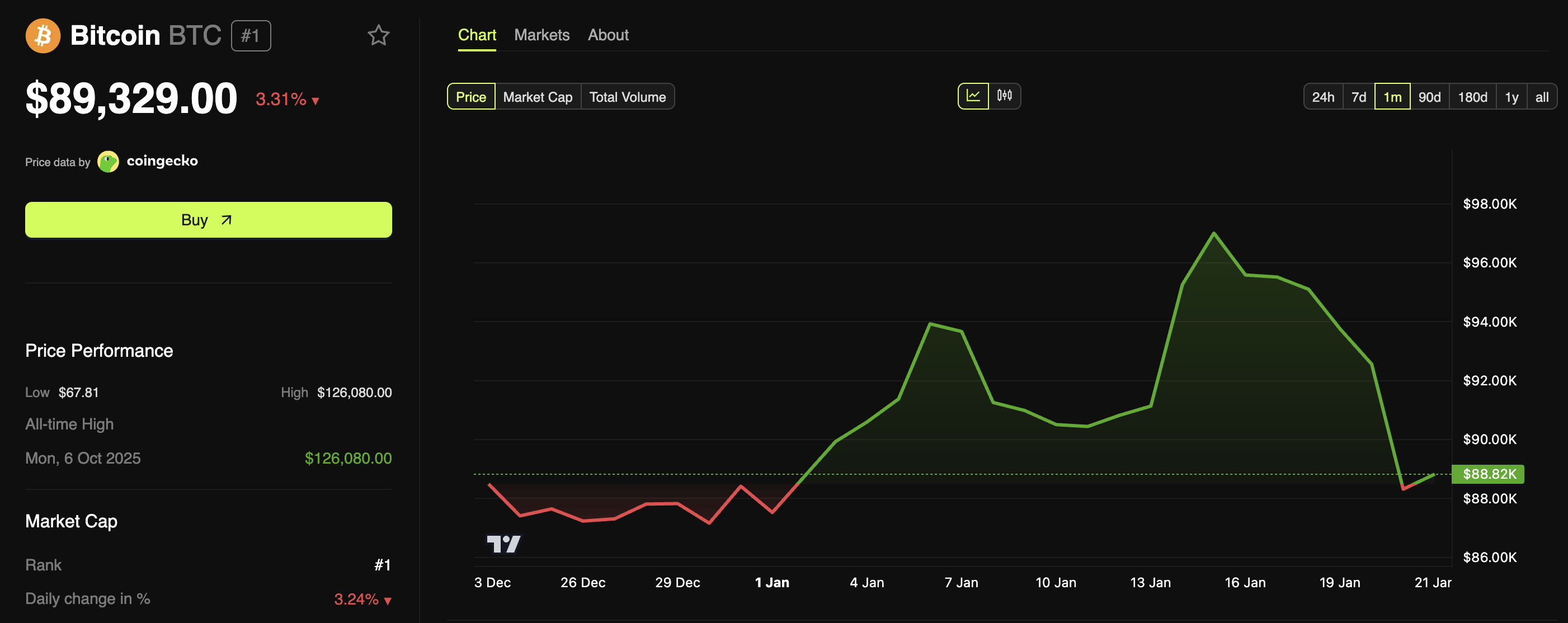

This divergence between large and small holders comes amid increased volatility, as Bitcoin has erased almost all of its 2026 gains.

After a hard end to 2025, the new year has begun In a positive way For Bitcoin. Cryptocurrencies rose more than 7% in the first five days of January, supported by renewed optimism in risk assets. However, the momentum was short-lived, as market turmoil quickly returned.

Sponsored

Sponsored

Despite a brief recovery last week, broader market conditions deteriorated again after US President Donald Trump announced tariffs. Customs duties intended for 8 countries In the European Union, which resulted To the renewed uncertainty. The news put pressure on risk assets and contributed to another decline in the cryptocurrency market.

Data from BeInCrypto Markets showed that Bitcoin fell by 6.25% in the past week. Yesterday, it fell below the $88,000 level for the first time in The beginning of the year.

At the time of writing, the largest cryptocurrency was trading at $89,329, down 3.31% during The last 24 hours.

in spite The fluctuations, the whale sharks continued In increasing exposure. Data from Santiment shows that wallets holding between 10 and 10,000 BTC have purchased 36,322 coins, worth $3.2 billion at current market prices, over the past nine days. This represents a 0.27% increase in stakes for large investors.

This cumulative trend contrasts sharply with the behavior of individual investors. Small holders sold 132 coins in nine days, a decrease of 0.28% in their collective holdings.

This usually indicates that weaker hands leave during the price decline, while more experienced investors buy the dip.

“The optimal conditions for a crypto boom are when the smart money accumulates and unloads retail. Geopolitical issues aside, this pattern continues to reinforce a long-term bullish skew,” he said. Post .

It is worth noting that despite the accumulation of smart money, expectations about Bitcoin remain divided. Some market observers argue that Bitcoin is sending… Bear market signals, which is increasing From the risk of further decay. Others point to emerging indicators It supports the argument For long-term recovery.

For now, Bitcoin’s sensitivity to broader macroeconomic developments remains a key factor to monitor. Whether the asset continues its downward trend in the near term or begins to regain ground will likely depend on how global risk sentiment develops.