Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Note that the XRP price remains within the boundaries of a parallel bearish channel, which is a negative technical formation that begins around mid-July.

However, the symbol that powers the Ripple ecosystem managed to buck the trend as the cryptocurrency saw $446 million in outflows last week.

Sponsored

Sponsored

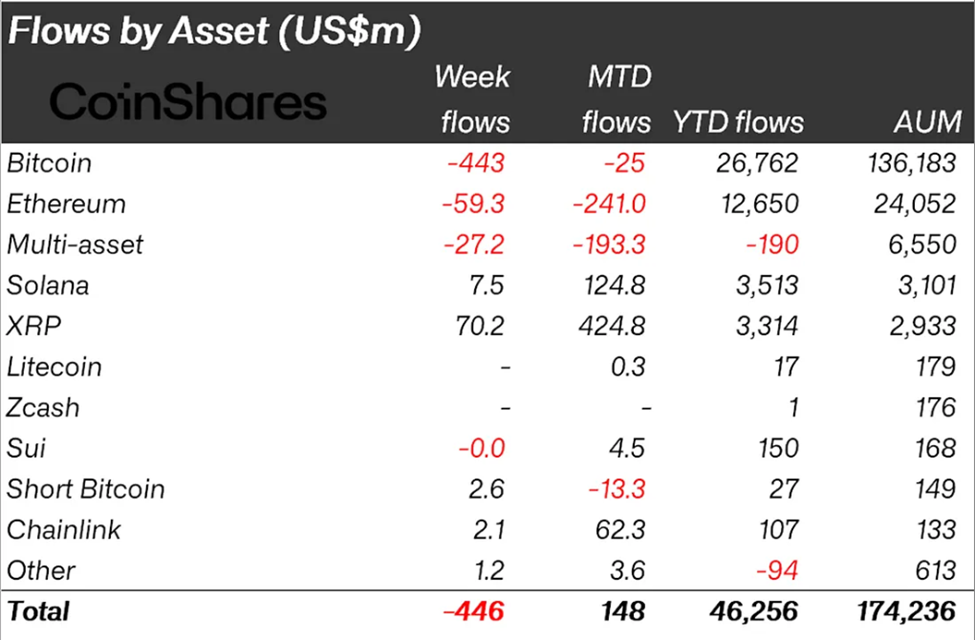

According to the latest Coinshares report, flows from the cryptocurrency market reached $446 million last week, a figure slightly lower than the negative inflows of $952 million in the week ending December 20. Where she was seen.

Over the past two weeks, however, XRP has been able to buck the trend, seeing positive flows while losing major assets like Bitcoin and Ethereum.

After recording positive flows of $62.9 million in… The week before ChristmasPositive flows in XRP reached $70.2 million last week. In contrast, Bitcoin and Ethereum recorded negative impacts of $443 million and $59.3 million, respectively.

This indicates that investor sentiment has not yet fully recovered… As stated in one of his excerpts.

Sponsored

Sponsored

James Butterville, head of research at Quenchers, attributes the perceived positive sentiment in XRP and Solana to the launch of their respective ETFs in mid-October.

Butterville added that since the launch of the index funds in the United States in mid-October, they have seen inflows of $1.07 billion and $1.34 billion respectively, bucking the negative sentiment seen in the rest of the assets.

BeinCrypto confirmed in a report that the XRP ETF maintained a string of consecutive positive inflows, which probably contributed to last week’s record $70 million.

Sponsored

Sponsored

Positive flows were recorded in XRP-related funds, but the price of Ripple was confined to a bearish technical formation, with short hands waiting to react to the price on any slight recovery. Series data and graphs tell a different story depending on… This source.

As long as the XRP price remains within the boundaries of the channel, it is likely to continue the downward trend. Breaking and closing below the support of $1.77 can open the way for a drop to $1.50, that is, about 20% lower than the current levels.

Ask the question: How can this fate be avoided when there are more selling hands than buying hands waiting to react to the price on every small recovery? The sales volume profiles (red horizontal bars) show where the sellers are positioned, while the green horizontal bars indicate where the buyers are positioned.

You see relative strength index (rsi)which is a momentum indicator, which the sellers have the advantage, because it remains below the 50 level. This reinforces the correction phase, and the indicator sticks after a prolonged decline, which usually indicates momentum pressure.

Sponsored

Sponsored

At the same time, the Awesome Oscillator indicator registered a green light, but it is still in the negative territory. This means that the bears are starting to lose momentum, but the bulls have not intervened decisively.

Any minor RSI bounce failed to break below the midline, with the price remaining at the upper border of the descending parallel channel, indicating that the trend is still ongoing.

You ask the question that will change the picture for the xrp price? Be sure that a clear break of the RSI above 50, especially with the channel breaking to the upside, will be the first sign of a trend change.

Buyers should watch for a breakthrough and a successful retest of the price above the upper trend line in the channel. Until then, the demonstrations remain temporary and the technical rebounds are only for relief.