Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The cryptocurrency market is showing its first notable recovery after a significant drop in November, and by many metrics it now looks like the same conditions seen around Thanksgiving in 2022 and 2023.

Bitcoin retook the $91,000 level, Ethereum returned above $3,000, and the broader market rebounded to be cautiously green. This recovery comes as traders head into the long weekend in the US, which has historically set the tone for December.

The Fear and Greed Index data still shows an improvement in sentiment from 11 last week to 22 today, although it is still in “extreme fear”.

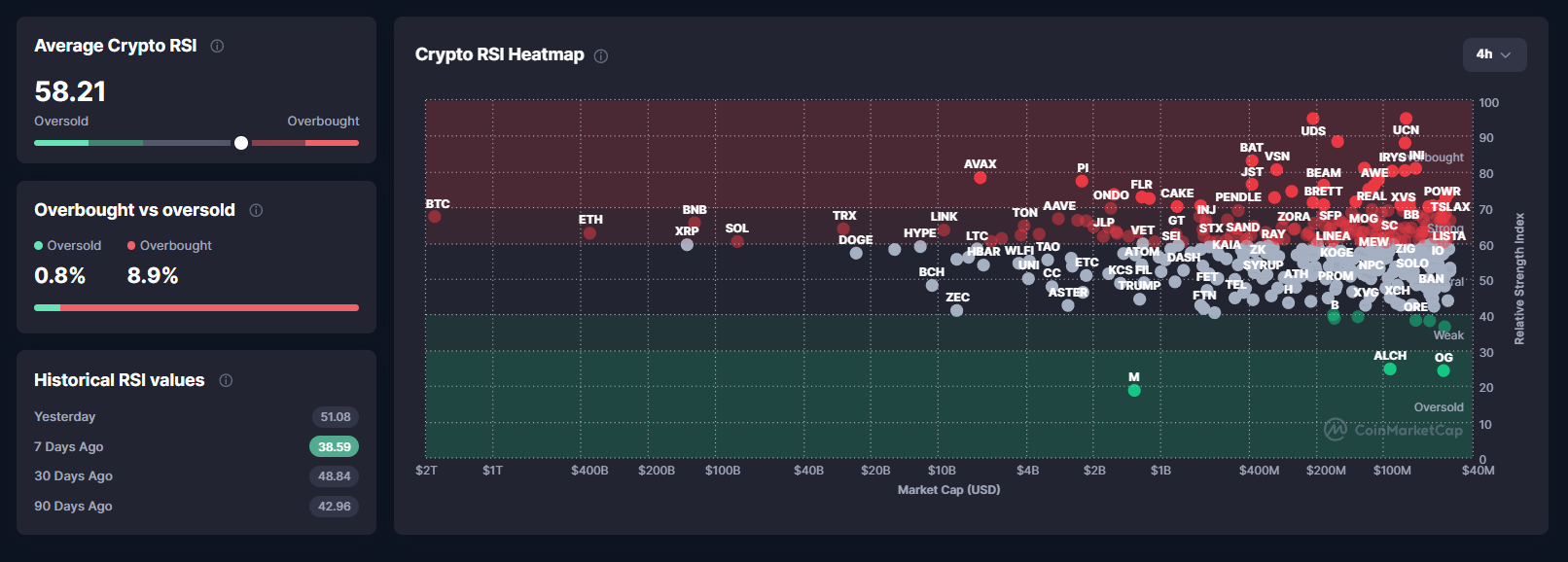

This change is consistent with a continued growth of… Average RSI for digital currencieswhich rose from 38.5 seven days ago to 58.3 today. The reading indicates increased strength after significantly oversold conditions earlier in the month.

Sponsored

Sponsored

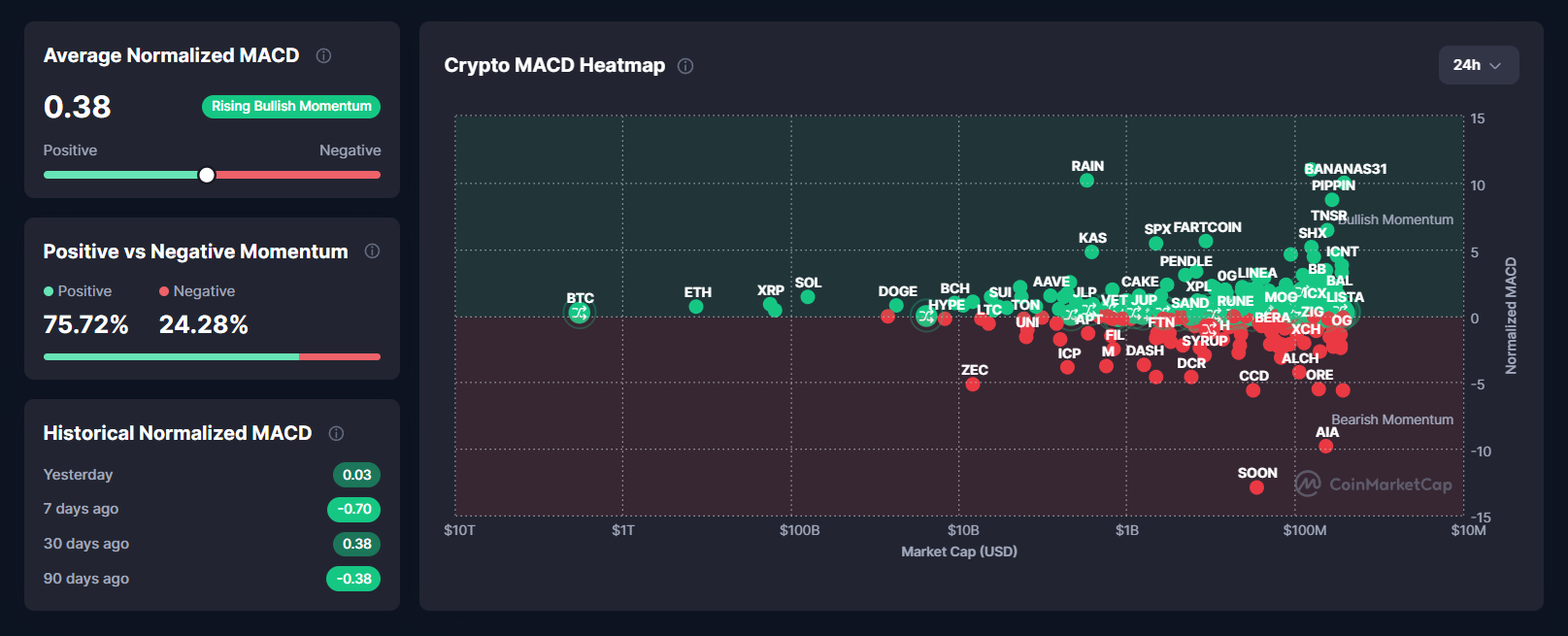

The momentum is also reversed. The MACD index printed on the major axis turned positive for the first time since the beginning of November.

Now about 82% of monitored cryptocurrencies show positive trend momentum. Bitcoin, Ethereum and Solana appear in a bullish zone on CoinMarketCap’s MACD heat map.

Price action supports this change. Bitcoin rose 6% during the week. Earn Ethereum About 8%. Solana has increased about 8% in the same period.

The market capitalization rose to $3.21 trillion, up 1.1% in the last 24 hours.

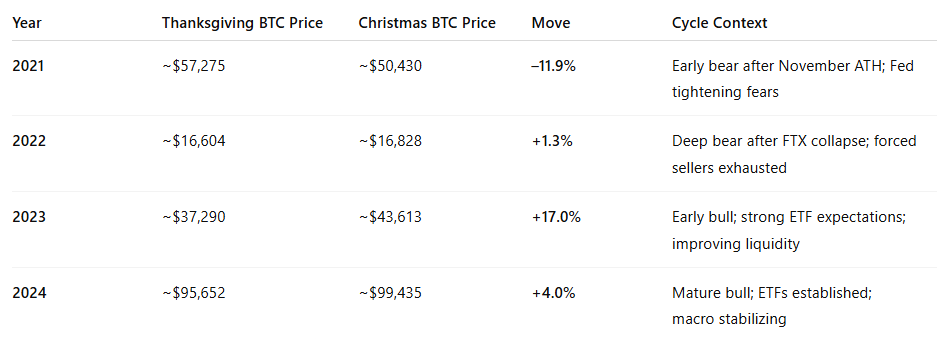

The current recovery replicates a structure seen twice before. In 2022 and 2023, the market entered Thanksgiving after a sharp decline and then stabilized in December.

In 2022, Bitcoin fell to almost $16,000 after that I would have FTX. By Thanksgiving, the selling pressure was exhausted, and the market cooperated without going into Christmas.

This was a consolidation phase of a deep market low rather than a rally.

Sponsored

Sponsored

In 2023, Bitcoin started Thanksgiving at $37,000 after a strong correction in September-October. A strong outlook for ETFs and improving liquidity conditions pushed BTC to $43,600 by Christmas. December was a classic early bull market.

This year, the pattern repeats itself again with a familiar element: The November crash happened earlier, and by Thanksgiving, the sales momentum was down.

Bitcoin’s 90-day CVD has shifted from sell dominance to neutral, indicating that aggressive sellers have retreated. The funding and leverage data support the same interpretation.

The president said BitMine Company Tom Lee That the market is “reeling” after the liquidation shock of October 10.

Market makers were forced to reduce their budgets, which weakened the depth of the market in the exchanges, said Lee. This is amazing The fragility continued until November.

Sponsored

Sponsored

However, Lee argued that Bitcoin tends to make its biggest moves in short periods when liquidity recovers. Strong growth is expected in December then The Fed noted Allen’s position.

The data on the chain is consistent with this view. The escrow numbers from Nexo show that users still prefer to borrow against Bitcoin instead of selling.

BTC makes up more than 53% of all collateral on the platform. This behavior suppresses spot selling pressure, which helps stabilize spot markets. But it also adds hidden leverage that can compound future volatility.

Three factors are now similar to the post-Thanksgiving conditions of 2022 and 2023:

If this pattern continues, December could lead to one of two outcomes based on the past two years:

Sponsored

Sponsored

The decisive factor will probably be the tone of the Fed in early December and the behavior of Bitcoin ETF flows. Low liquidity means that even moderate flows can move prices quickly.

The market has entered a transition phase instead of a clear trend. Fear is still high, but price and momentum indicators are showing a recovery.

Bitcoin position above $91,000 It indicates that buyers are willing to defend key levels, but the depth of the order book remains weak.

With selling pressure fading and technical momentum building, the environment now resembles the same post-Thanksgiving parameters that characterized the previous two year-end sessions.

If the pattern holds, December will not be flat. It is likely to bring decisive movement as liquidity conditions change.

However, the direction will depend on major economic signals and demand for ETFs in the coming weeks rather than crypto narratives.