Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin and the international markets turned into a defensive strategy following the great shocks of the Japanese market and the new geopolitical conflicts, which pushed BTC down by 6% in the last week, joining the US stocks falling by 2% at the lowest level, and the international credit markets are exposed to heavy selling.

According to Latest market analysis from QCP Asia The decline was driven by rising Japanese government yields and escalating trade tensions between the United States and Europe, which analysts say are exacerbating the financial crisis and eroding risk appetite across financial sectors.

Considering this trend, Bitcoin has struggled to regain strength, as it trades below $90,000 just after regaining the level of $97,000, it looks like a non-interest bearing tool instead of a hedging tool.

At the heart of this turmoil is the reversal of Japan’s interest rate history after decades of near-zero yields.

Ten-year Japanese government yields rose to around 2.29%, their highest level since 1999, as investors grew accustomed to Japan’s role as a stable pillar of the global economy.

The move revealed a serious financial crisis, with the government’s debt exceeding nearly 240% of GDP and total debt approaching 1,342 trillion yen.

Debt is expected to consume a quarter of Japan’s spending by 2026, adding to the long-term outlook as borrowing costs rise.

An expert at QCP Asia said: “As productivity increases, the stability of Japan’s economy is being publicly questioned, and the spread of international cooperation shows how Japan is creating instability.”

After decades of deflation, Japan is now facing price pressures that have made long-term bonds unattractive.

As investors sold at low prices, yields rose sharply, leading to a surge in mortgages, business loans and accounting across the markets.

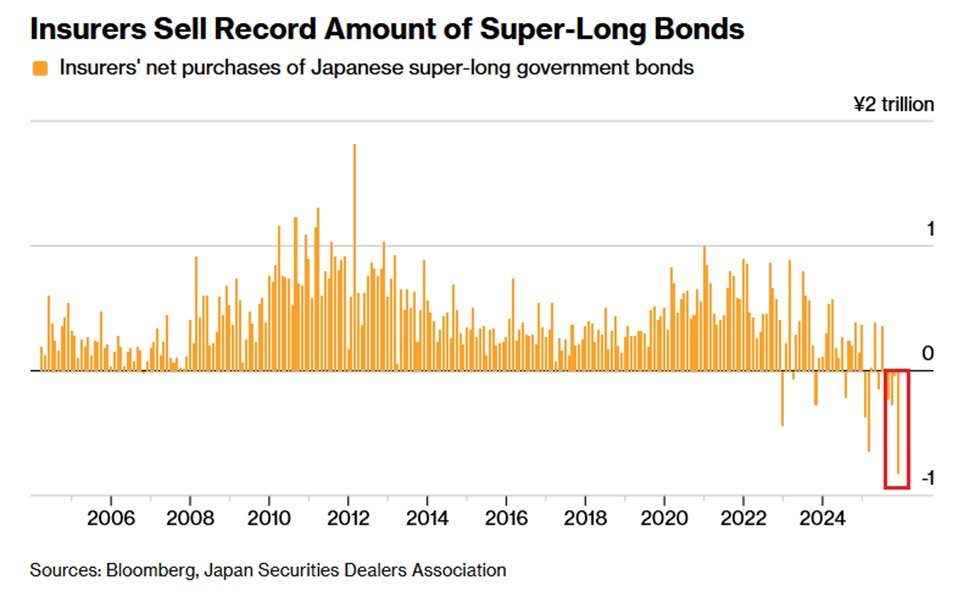

Organizational trends show pressure, such as Japanese insurance companies In the sale of bonds totaling $ 5.2 billion are mature Maturity passes ten years only in December.

This represents the fifth consecutive month of sales and the highest sales since data collection began in 2004, bringing total sales during the period to $8.7 billion.

Demand indicators also fell, with the lending ratio for Japan’s latest 20-year bond standing at 3.19, down from 4.1 previously and below the 12-month average.

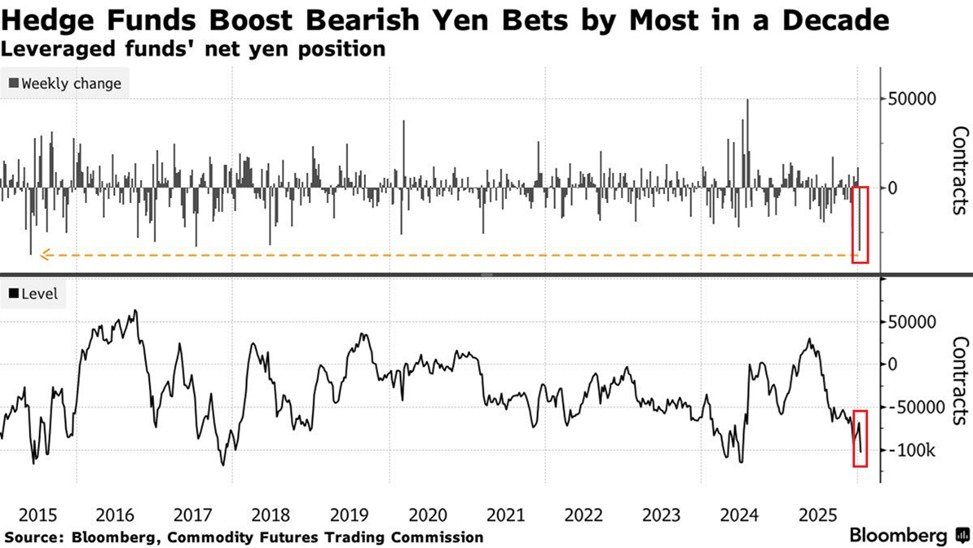

Meanwhile, hedge funds have increased their investment On the depreciation of the yen raising short positions by 35,624 contracts in the week ended January 13, the biggest weekly jump since May 2015.

Beyond Japan, political tensions have resurfaced as new challenges, while trade relations between the United States and Europe are entering a critical phase.

President Trump has imposed a 10% tariff on eight European countries that oppose US sovereignty over Greenland, and the duties are set to begin on February 1 and rise to 25% by June.

Europe has shown a swift response, jeopardizing the maritime trade relationship of between $650 billion and $700 billion in bilateral goods.

The European Parliament is now considering suspending approval of the US-EU trade deal agreed in July, a move that could mark a major escalation.

“With retaliatory measures on both sides, the question for markets is no longer whether the conflict will escalate, but to what extent,” said the QCP analyst. I wonder if this is “another round of TACO” or a strategic plan that the markets can’t ignore.

US Treasury Secretary Scott Besent added that the recent decline in the stock market was due to… “Six-step moves” in Japan’s bond market, describing it as “all about Japan’s defaulted yields.”

With the increasing lack of liquidity and high volatility, He said Crypto expert Mitch said that the price of Bitcoin may continue to fall until the situation is clear from Japan, warning that $ 86,000 is an important level that must be worked on to avoid a deep decline to $ 80,000.

A note Rising Japanese government yields and rising inflation are pushing Bitcoin into a defensive strategy, an analyst says. appeared for the first time Cryptonews Arabic.