Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

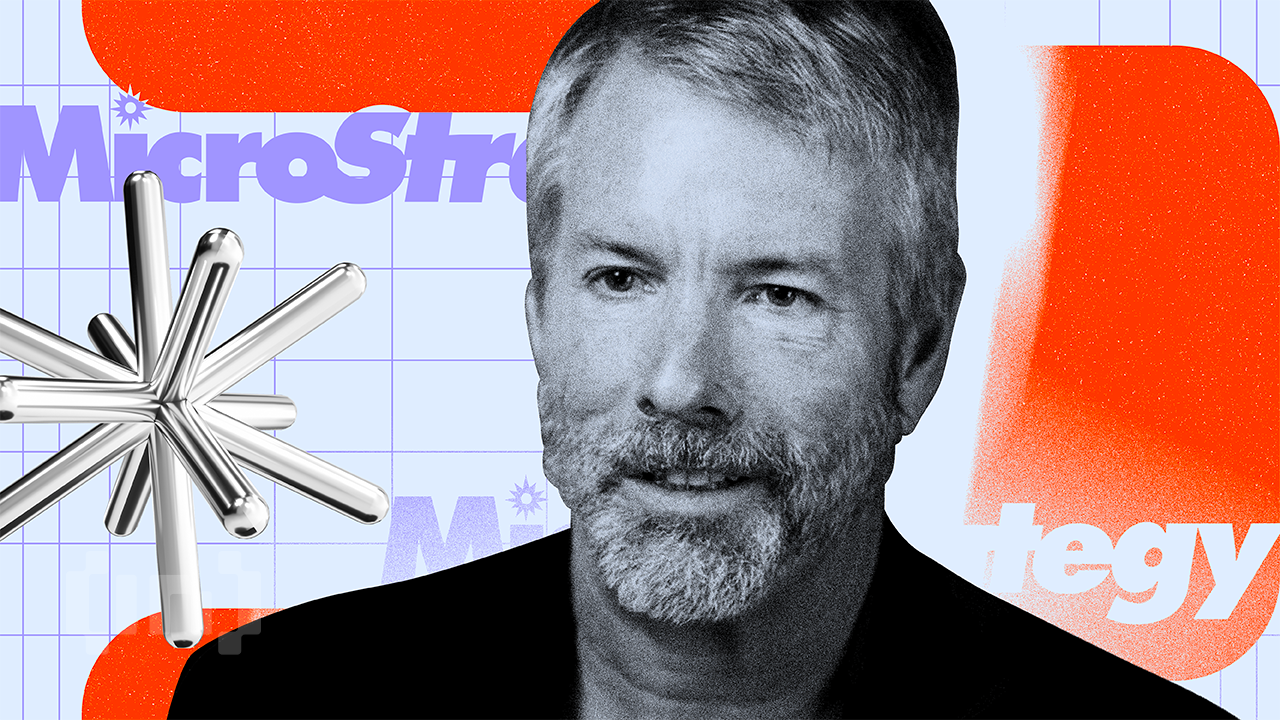

MicroStrategy CEO Michael Saylor has responded to MSCI’s review of the company’s ranking, incriminating his company as a hybrid business rather than a venture fund.

The clarification comes amid a formal consultation on how digital treasurers (DAT) will be treated in the main stock indices, a decision that could have major market consequences for MSTR.

Sponsored

Sponsored

In a detailed post on X (Twitter), Saylor stressed that MicroStrategy is not a fund, not a trust, and not a holding company.

“We are a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital,” Saylor said. a description.

The statement defines MicroStrategy as more than just… Bitcoin holderwith Saylor noting that trusts and trusts hold assets passively.

“Holding companies sit on investments. We create, build, export and operate,” he added, emphasizing the company’s active role in digital finance.

This year, MicroStrategy completed five public offerings of digital credit securities: STRK, STRF, STRD, STRC and STRE. This total has a face value of more than $7.7 billion.

Sponsored

Sponsored

In particular, Stretch (STRC) is a Bitcoin-backed treasury instrument that offers variable monthly returns in USD to institutional and retail investors.

Saylor describes MicroStrategy as a structured finance company, backed by Bitcoin, that operates at the intersection of capital markets and software innovation.

“No passive vehicle or holding company can do what we do,” said Saylor, emphasizing that ranking in the index does not define a company.

can drive Consultation MSCI reclassified companies like MicroStrategy as mutual funds, making them ineligible for major indexes like MSCI USA and MSCI World.

Exceptions may result Negative flows amounting to billions It increases volatility in $MSTR, which is already down about 70% from its all-time high.

Overcome bets on MicroStrategy. Saylor’s defense makes standards Traditional Finance (TradFi)asking whether Bitcoin-led operating companies can maintain access to passive capital without being classified as funds.

MicroStrategy holds 649,870 Bitcoins, at an average cost of $74,430 per coin. The company is valued at $66 billion, and the company relies on the offering of equity and structured debt to finance its strategy to collect Bitcoin.

It is expected that a decision by MSCI, from January 15, 2026, could test the viability of such hybrid treasury models in the public markets.