Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

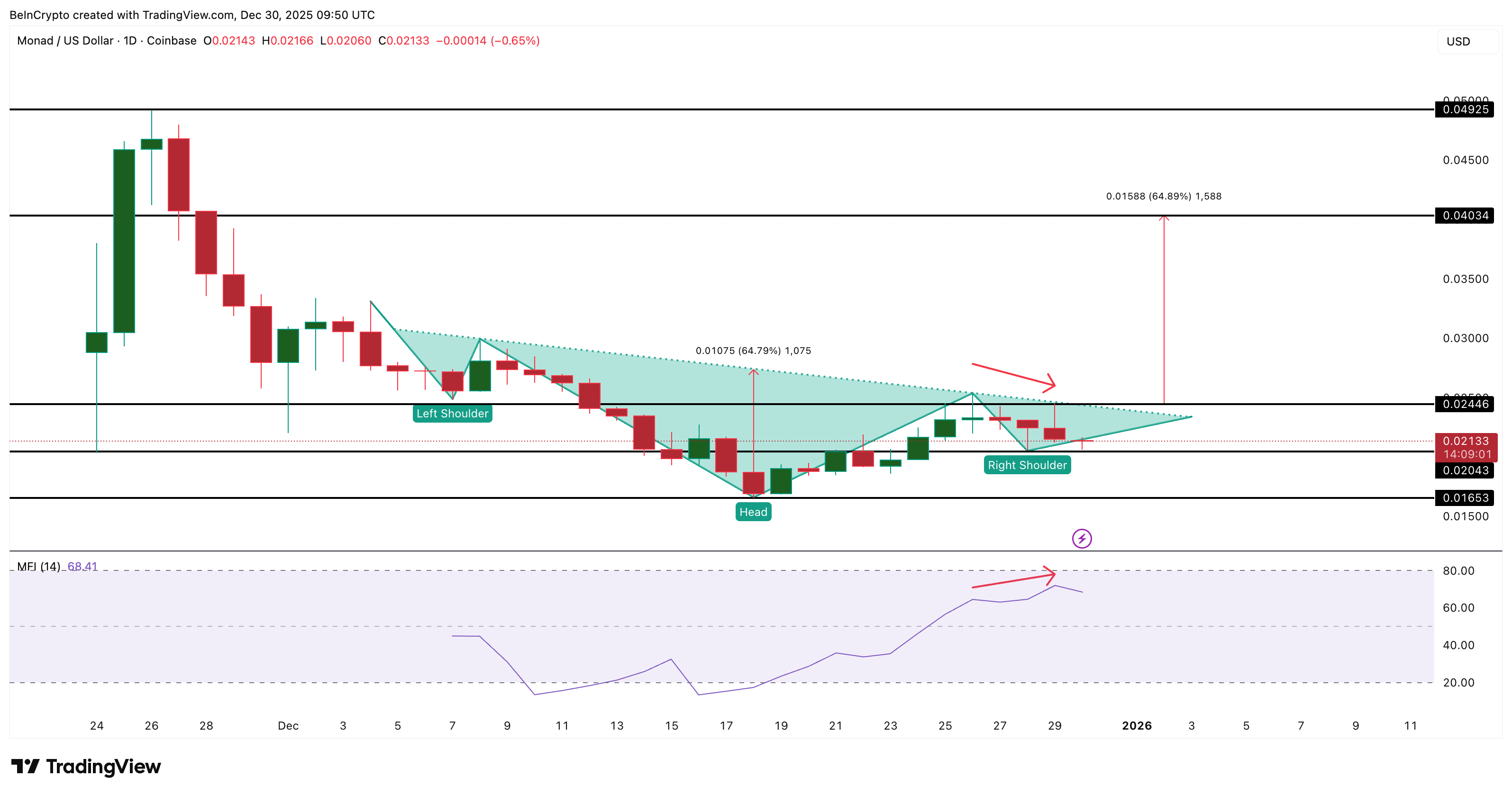

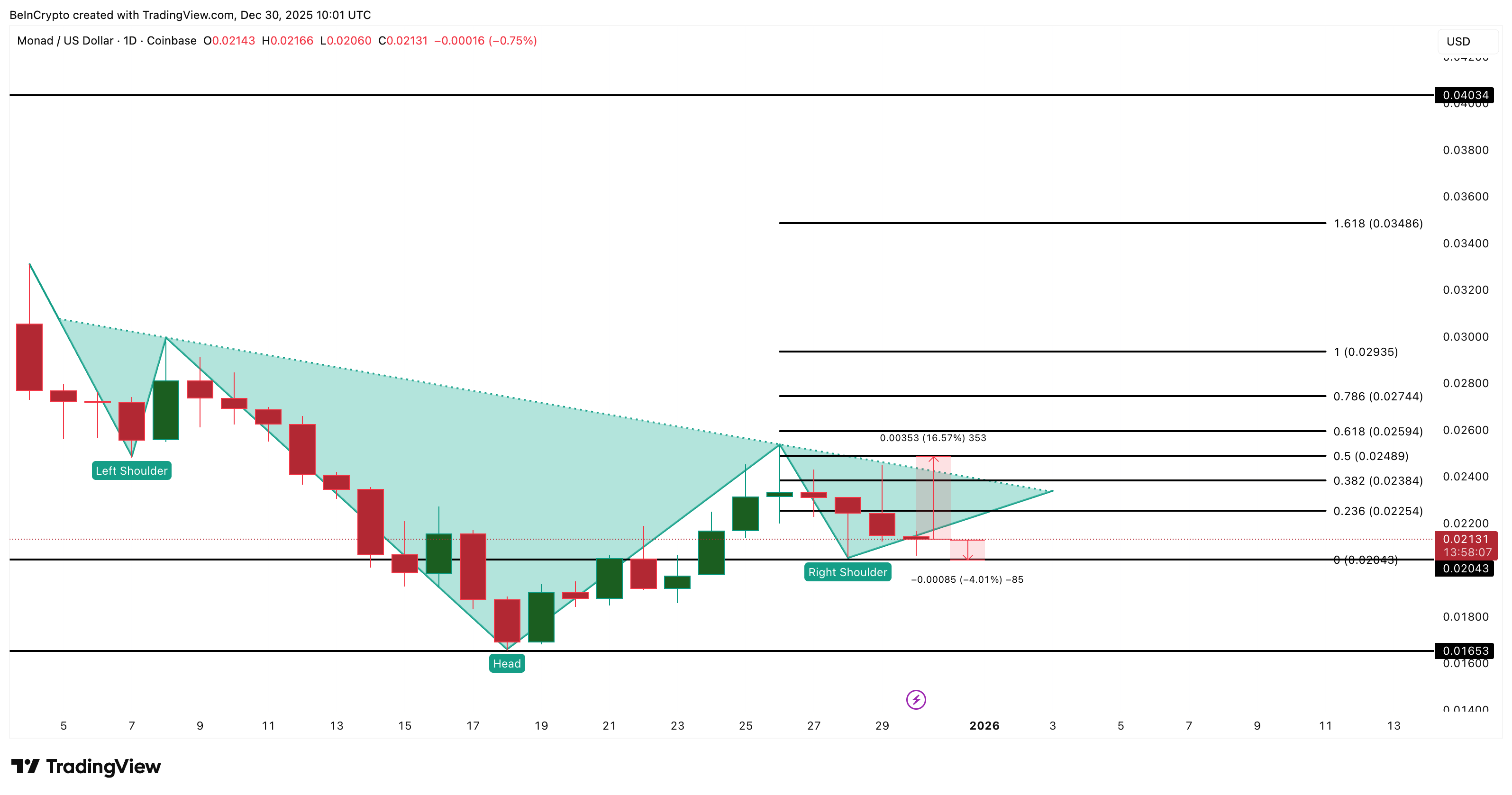

Monad (MON) is trading near $0.021, down 7% in the last 24 hours, but still up 4% on the week. The Monad price is also 56% below its post-listing high of $0.048.

Even with this decline, the chart is still bullish because the inverse head and back pattern keeps the structure intact. This pattern continues until the bulls hold a key level. However, the downside risks do not seem far away.

Sponsored

Sponsored

The monad continues to be respected Reverse arrangement of the head and shoulders. This pattern is known for its bullish reversal when the price crosses the rock. Support was formed at $0.020. The cut is about $0.024.

A daily close above $0.024 confirms the breakout. This breakout indicates a calculated move of 64% towards $0.040. While the price of the monad has corrected more than 7% in the last 24 hours, the low buying support keeps alive the hope of a breakout.

The Money Flow Index (MFI) tracks buying pressure with price and volume. Between December 26 and 29, the price trended lower while the IMF made new highs. This is an optimistic deviation. It shows the potential for reducing purchases and sales support.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

Sponsored

Sponsored

This behavior helps to defend the model. If the IMF falls below its recent swing low, support for the decline weakens. If MFI breaks recent highs, it strengthens the case for a price of $0.024. Currently, retail buyers are doing enough to keep $0.020 safe.

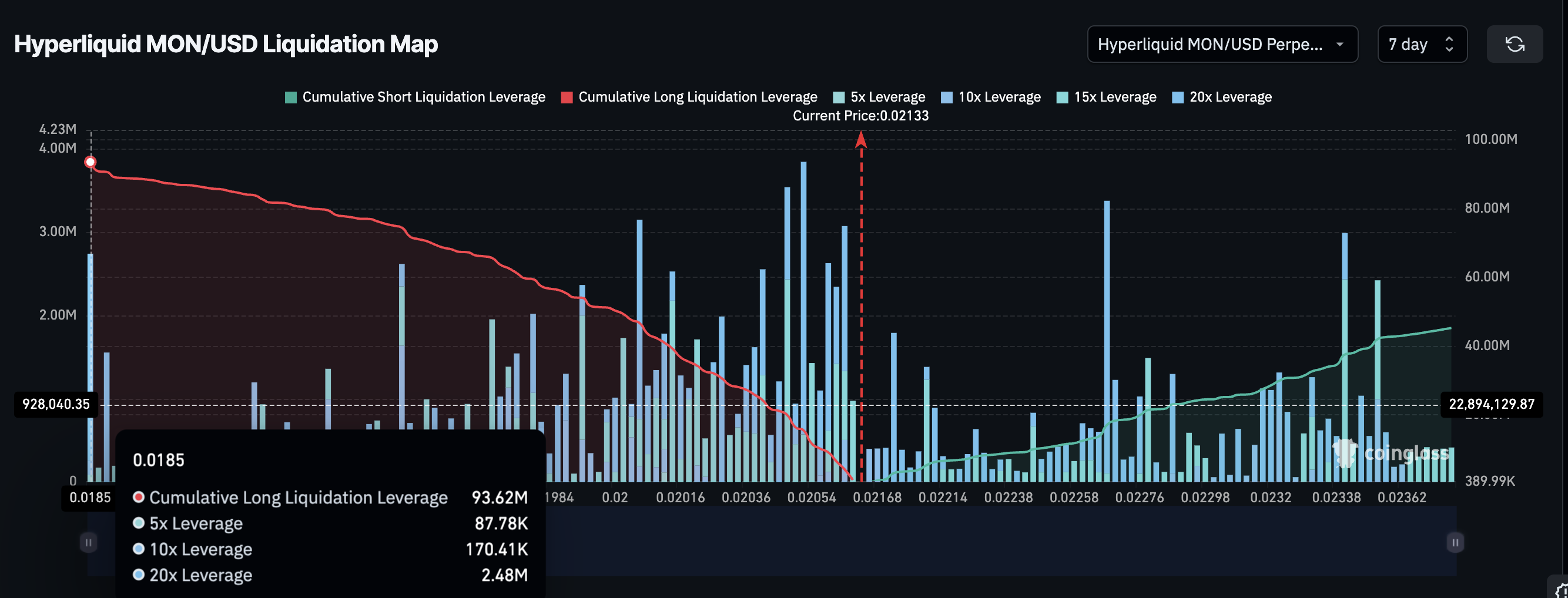

The derived positioning explains why the setup feels unstable. On the 7-day Hyperliquid chart for the Monday and USD binaries, the liquidation shows a clear buy-sell bias. Long-term qualifiers accumulate about $93.62 million. The short qualifier is close to $45.26 million.

The long filter pressure is more than 100% higher than the short filter pressure. Traders are in a bullish position.

Sponsored

Sponsored

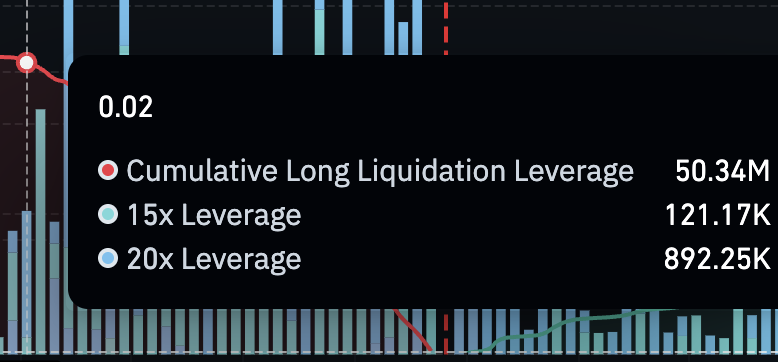

This creates risk. A close below $0.020 triggers a filtering range where more than 50% of the long block remains. This level includes $50.34 million of cumulative long leverage. A breakout can impose a tight squeeze and drag the price down.

Sellers may be waiting for this catalyst. If $0.020 fails, the liquidation cycle accelerates the move.

On the other hand, a clear close above $0.024 eliminates the majority The main groups of the monad. This will confirm the breakout and open higher levels.

Sponsored

Sponsored

Exchange Monad Between two levels that determine the trend. Above $0.024, the breakout is active. The $0.029 area confirms the momentum and could lead a move towards $0.040.

Below $0.020, the structure weakens. This exposes $0.016 and invalidates the pattern, breaking the head of the reversal pattern. This makes the chart bearish again. Even then, the pattern tends to go up, but just barely.

Currently, the market is waiting for the neck or trap long squeeze. A crash opens up a 64% move. A bear-led crash causes pressure and brings the asking price to $0.016.