Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Midnight continued to move in a steady uptrend, maintaining bullish momentum despite intermittent selling pressure. NIGHT continues to trade near its recent highs, inching closer to its all-time high.

Some investors show caution, while the general price action indicates that buyers are still in control of the prevailing trend.

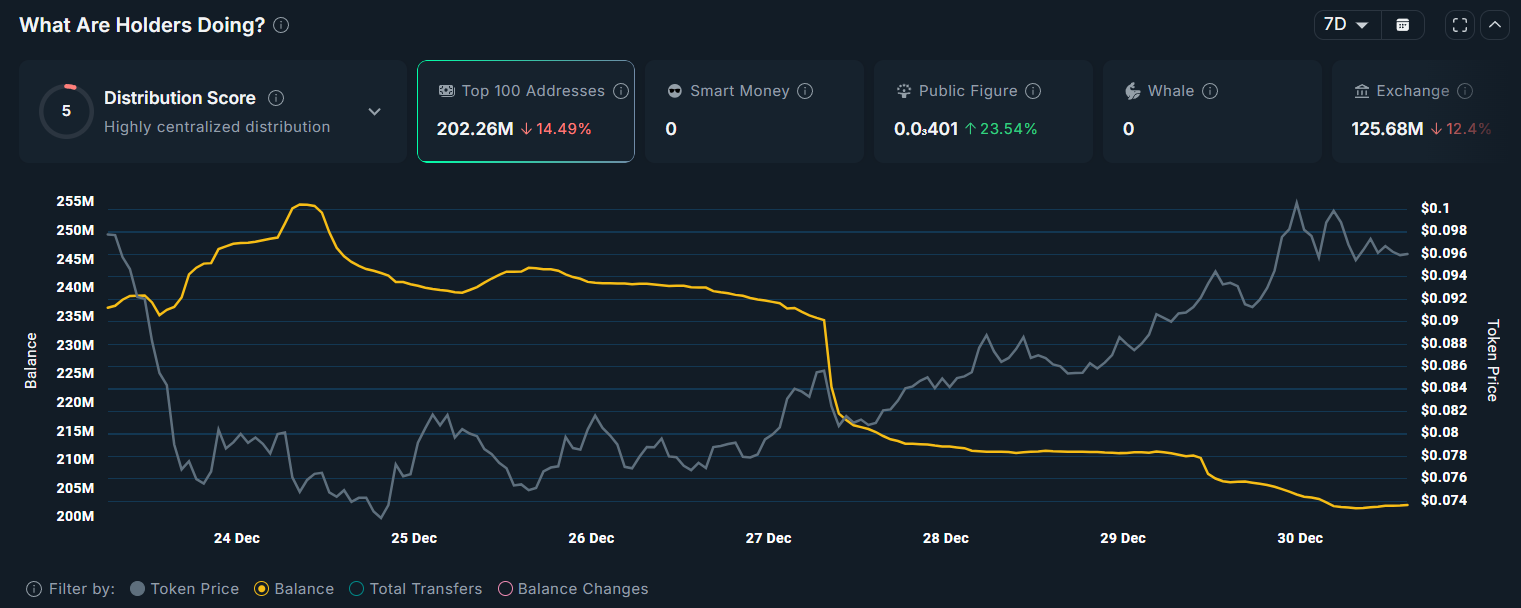

Recent data on the chain shows the first 100 holders of NIGHT Reduce their exposure. In the last seven days, their combined share has fallen by 14.5%, from 236 million NIGHT to 202 million NIGHT. This decrease indicates a calculated profit rather than panic selling.

Sponsored

Sponsored

The big holders are probably waiting for short-term saturation after the strong rally. Locking in profits during rising prices is a popular strategy among early adopters. Despite this distribution, the overall structure was not affected by the sale, indicating that liquidity is still sufficient to absorb the supply.

Want to get more token analysis like this? Subscribe to publisher Harsh Notariya’s cryptocurrency newsletter via Link here.

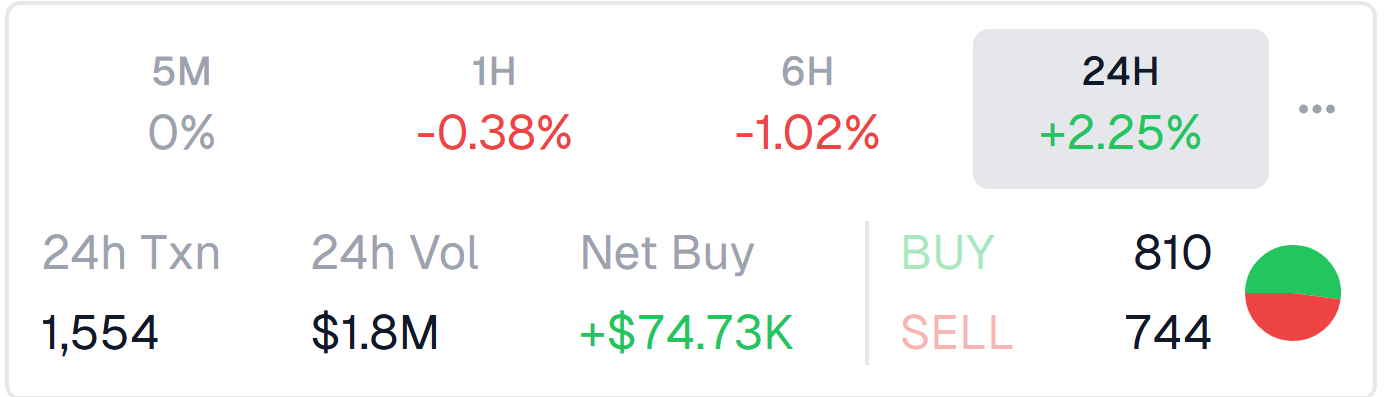

General indicators continue to support Bullish outlook for Midnight price. The buy to sell ratio shows that buyers account for 52% of the total transaction volume. This disparity confirms that demand remains stronger than supply, even when some profit emerges.

The continued dominance of buyers indicates confidence in Midnight’s long-term potential. Demand-driven volume often provides a basis for a trend to continue. While buying activity outpaces selling, NIGHT remains in a position to face higher resistance levels without outright structural weakness.

Knight is currently trading at $0.095, just below the major resistance level at $0.100. This psychological barrier prevents the final gains from being achieved. If a breach of this level is confirmed, it will allow Nite to accelerate towards its previous all-time high near $0.120.

Reaching this level requires a price increase of 25.7%. Given the current demand indicators and the dominance of buyers, this move remains achievable. If the momentum continues, Knight could come close From this purpose At the beginning of 2026, supported by continued accumulation.

There is downside risk if selling pressure increases. It can increase distribution To pay Knight Towards the support level at $0.075. If the price moves below that zone, the current uptrend will be broken and the bullish hypothesis will be invalidated, with momentum moving firmly to the sellers.