Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the US Cryptocurrency News Morning Briefing – your essential summary of the most important developments in the cryptocurrency world for the day ahead.

Grab a coffee and settle down because what’s happening with Bitcoin, micro-strategy and retirement funds is not the usual market story. From quiet institutional moves to complex capital strategies, the latest filings reveal a mix of opportunity, risk and debate.

Sponsored

Sponsored

Louisiana State Employees Retirement System (LSERS) disclosed a $3.2 million position in MicroStrategy (MSTR). This move indicates a growing desire by institutions for indirect exposure to Bitcoin.

Bitcoin Treasury cited a recent 13F filing, which indicates that the retirement fund owns 17,900 shares of Strategy.

This represents just 0.2% of its $1.56 billion portfolio. This reflects the growing interest For public pension funds With assets linked to digital currencies.

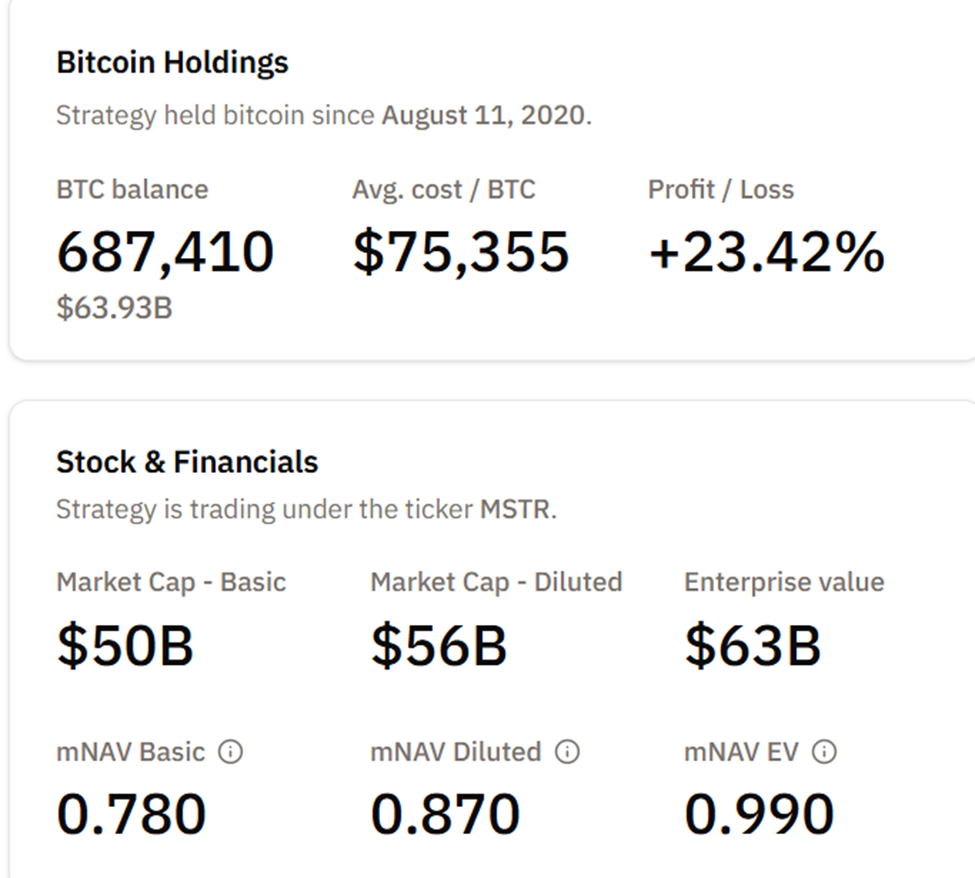

MicroStrategy, led by CEO Michael Saylor, now owns more than 687,000 bitcoins, making MSTR an alternative bet to bitcoin itself.

Supporters argue that Saylor’s approach is about more than accumulation basics By issuing both equity and debt instruments, the company is effectively converting demand for capital into massive purchases of Bitcoin. This restricts the circulating supply and strengthens the balance sheet.

“The real innovation is that the market treats these STRC-style machines almost like sonic money. There was no forced liquidation, no structural failure. The framework has been stable. They behave like a battle tank – volatility does not destroy them because there is no short-term debt pressure,” he said. books Gus, the popular user of X.

Sponsored

Sponsored

Recent activity at MSTR reflects this strategy in action. BeInCrypto has announced a strategic plan To acquire 13,627 additional Bitcoins for $1.25 billion. Such a move would push the company’s total holding to more than 700,000 BTC, about 3.3% of the total BTC supply.

Traders point to technical breakouts in the MSTR indicator and continue to buy as evidence that Saylor’s Bitcoin engine is gaining momentum.

However, not all investors are convinced. Critics note that favored tools such as STRC, Despite its usefulness for raising capitaldiluting the remaining exposure of MSTR’s common stockholders.

Sponsored

Sponsored

Each new preferential issue reduces the claim of existing shareholders on Bitcoin (BTC). At the same time, this requires more issuance of MSTR to cover the dividend, which could erode shareholder value over time.

“The more STRC is issued, the less BTC MSTR holders actually have rights,” He said Pledditor, a popular user in X.

Sponsored

Sponsored

Here’s a roundup of more US cryptocurrency news to follow today:

| Company | Closed until January 16th | Early market overview |

| Strategy (MSTR) | $173.71 | $174.27 (+0.32%) |

| Coinbase (COIN) | $241.15 | $241.15 (+0.00%) |

| Galaxy Digital Holdings (GLXY) | $34.31 | $34.45 (+0.41%) |

| Mara Holdings (MARA) | $11.36 | $11.45 (+0.79%) |

| RIOT Platforms | $19.23 | $19.31 (+0.44%) |

| Basic Sciences (CORZ) | $18.89 | $18.98 (+0.48% |