Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

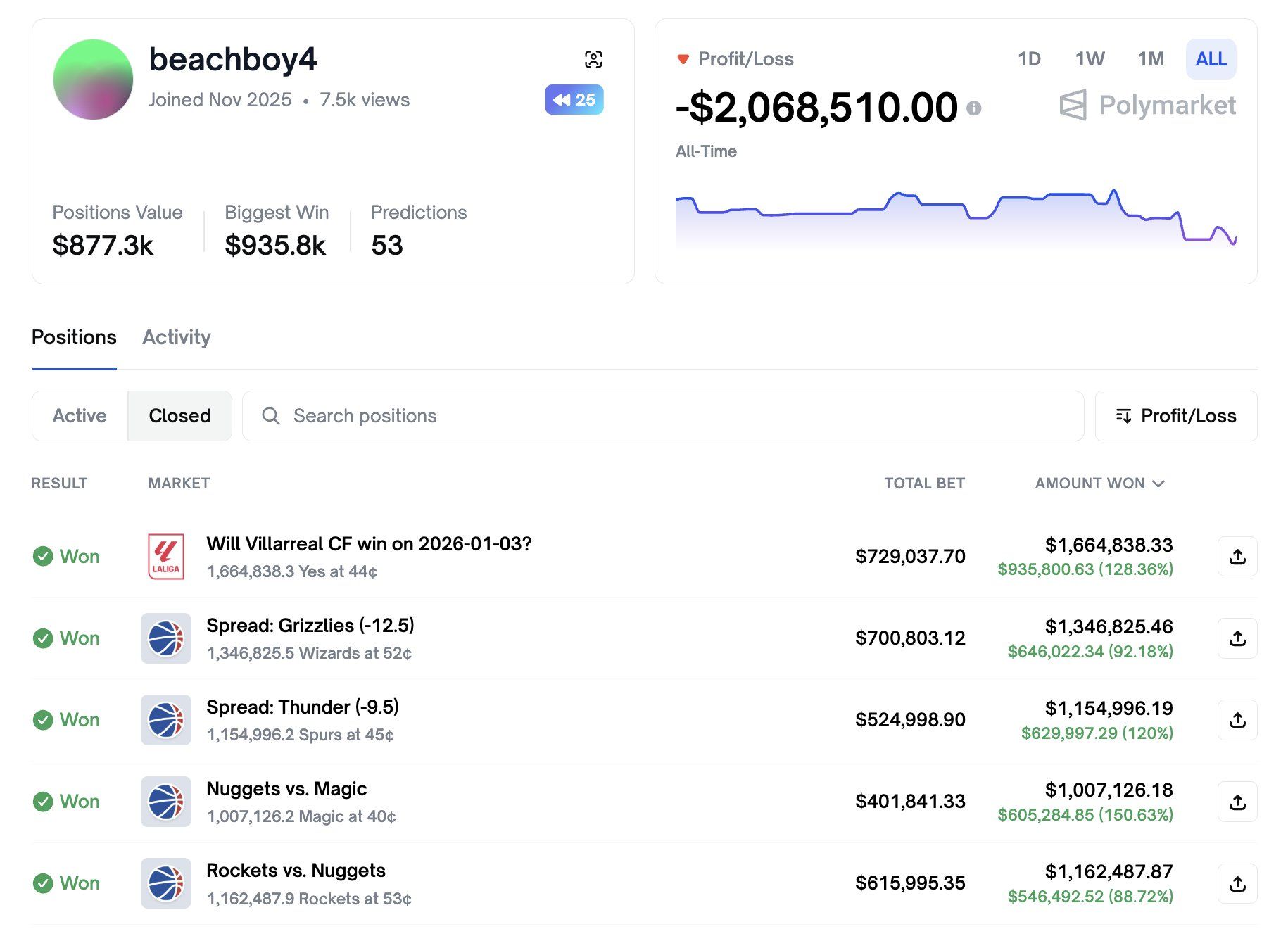

One trader lost more than $2 million on PolyMarket in just over a month, with one position accounting for nearly 79% of the total loss.

As prediction markets gain momentum in the cryptocurrency sector, more traders are turning to outcome-based platforms in search of new opportunities. However, this growing trend also raises concerns about whether participants fully understand the distinct risks associated with betting on real-world events, rather than price movements.

Sponsored

Sponsored

In a detailed thread on X (formerly known as Twitter), the blockchain analytics platform Lookonchain highlighted a trader named beachboy4, whose losses on Polymarket exceeded $2 million. The publication reviewed the trader’s activity and risk exposure for a period of 35 days.

According to the data, the trader placed 53 predictions during that period, recording 27 winning positions with a winning percentage of about 51%. However, Overall performance was greatly affected Many high risk transactions.

Lookonchain noted that the average trader’s bet size was around $400,000. The trader’s biggest profit was $935,800. Meanwhile, the biggest loss was $1.58 million, the result of a single bet on Liverpool to win, bought at $0.66.

“Buying ‘Yes’ at $0.66 does not mean: ‘Liverpool is likely to win’, but rather: ‘I think the real probability is higher than 66%.’ Polymarket is an odds market, not a bookmaker. This trader was always treating PolyMarket as binary sports betting, not trading odds. This one mistake is enough to explain most of the losses,” said Leconchine.

As the report highlighted A recurring pattern in traders’ losses Entry prices in the main losing positions range between $0.51 and $0.67. These trades usually offer limited upside ranging from 50% to 90%.

However, it had a 100% downside chance. Lookonchain described this as the “worst return structure” in Polymarket, as it combines limited earnings with total loss risk.

Sponsored

Sponsored

In addition, the trader did not use basic risk management strategies, such as identifying an early exit, creating a hedge, or applying probability-based stop-loss mechanisms. Instead, the missing positions were set to zero, which increased the impact of any wrong prediction.

This model has been repeated in many markets, including NBA franchises and major league football. LeConchine noted that the loss came from fundamental flaws, not just bad luck.

“The trader was not unlucky. This was not bad luck. This portfolio had: negative return asymmetry, no maximum loss set per position, no advantage in efficient markets, no probability discipline, loss was inevitable.”

This case reflects how losses can accumulate in prediction markets though Positive win rate. Lookonchain has shared several practical rules to avoid similar results.

The lessons learned by beachboy4 reflect a broader pattern seen in recent cryptocurrency trading losses. At first, BeInCrypto highlighted how Exploited traders like James Wynn, Coateau, et al From huge declines after taking huge risks in highly efficient markets.

These cases highlight recurring behavioral risks in the cryptocurrency trading and prediction markets. Overconfidence after the first wins, poor position sizing and lack of clear exit strategies often lead to significant losses.

Although disciplined traders can make profits with proper risk controls, most individual participants are not prepared for these structural risks. As traders turn to… Markets based on resultsThe need for education about probability and risk management is greater than ever.