Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

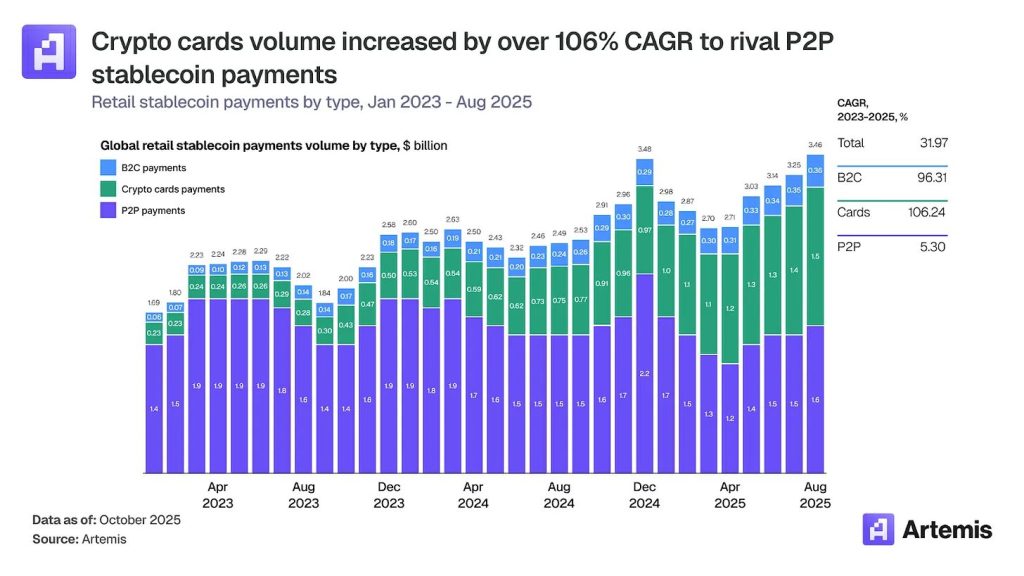

Cryptocurrency payments have changed significantly, and the amount of cryptocurrency cards will rise from about $100 million per month in early 2023 to $1.5 billion by the end of 2025, representing a compound annual growth rate (CAGR) of 106% that is now competing with peer-to-peer transfers, according to For a full report From Artemis Analytics.

The growth has seen and positioned cryptocurrency cards as a major bridge between the digital economy and everyday transactions, with annual books of more than $18 billion while traditional peer-to-peer (P2P) transfers grew 5% to $19 billion in the same period.

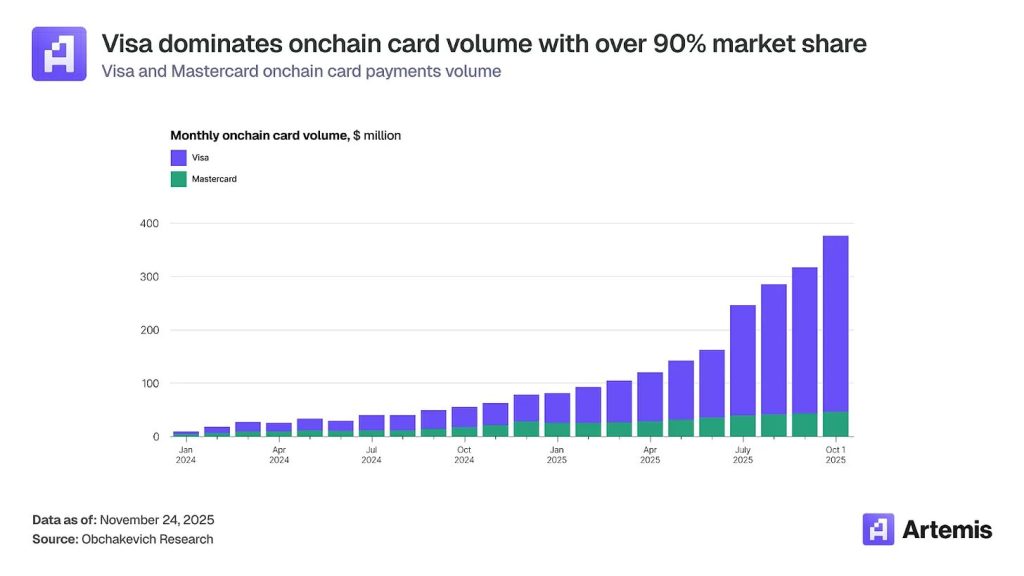

Visa has emerged as a major force in the cryptocurrency ecosystem, capturing more than 90% of card volume on the blockchain through early partnerships with emerging program managers and integrated providers.

Artemis noted that the payment giant’s way of connecting with healthcare providers like Rain and Reap is more reliable than Mastercard’s way of connecting directly.

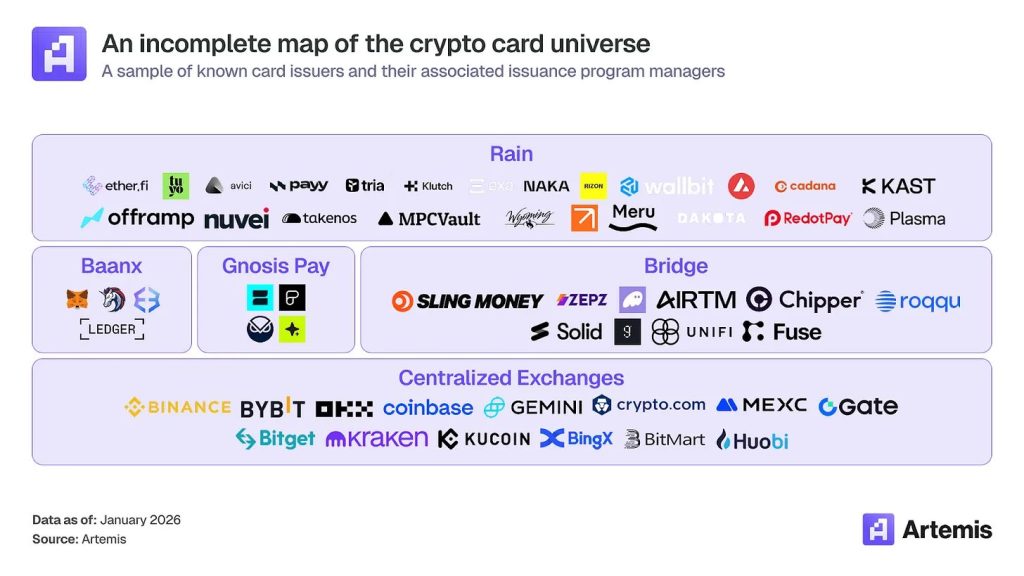

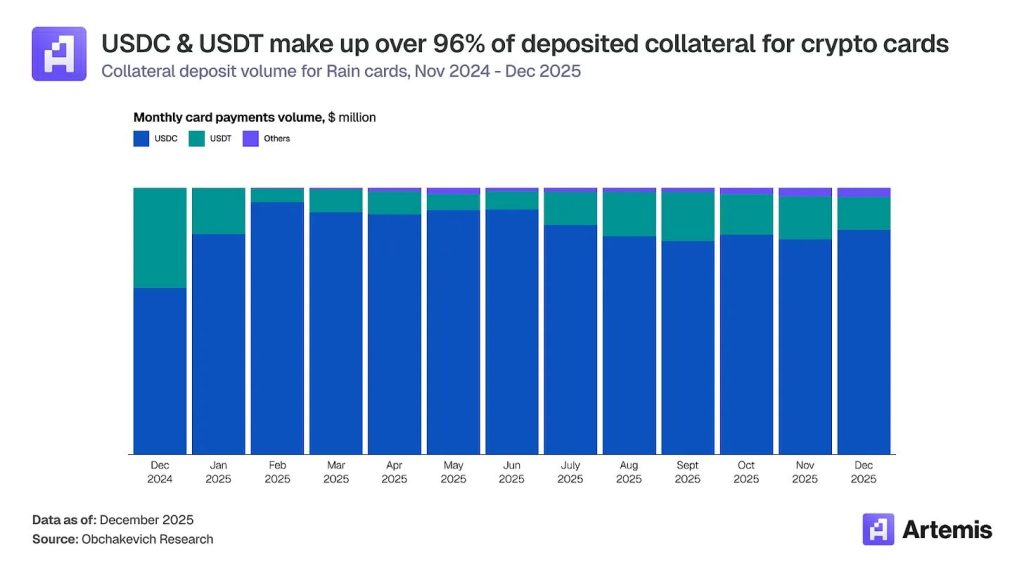

The development of cryptocurrency cards consists of three critical areas (payment networks, card issuing platforms, and consumer-facing products), the most important development is the emergence of integrated providers with direct membership to Visa.

Companies such as Rain and Reap have successfully combined card payments by combining BIN support, a profile of registered borrowers, and directly establishing the Visa network into a single platform, enabling them to access financial returns spread across multiple locations.

The use of Visa cards linked to stablecoin reached $ 3.5 billion in Q4 FY2025, registering 460% year-on-year growth, although it still represents about 19% of the total cryptocurrency card settlement volume.

Central exchanges use credit cards as a way to acquire users, with platforms like Gemini taking on losses from credit card programs to drive platform users.

DeFi protocols such as Ether.fi offer the highest returns through mechanical rewards, offering returns of around 4.08% and driving the entire value of the protocol through the lending process.

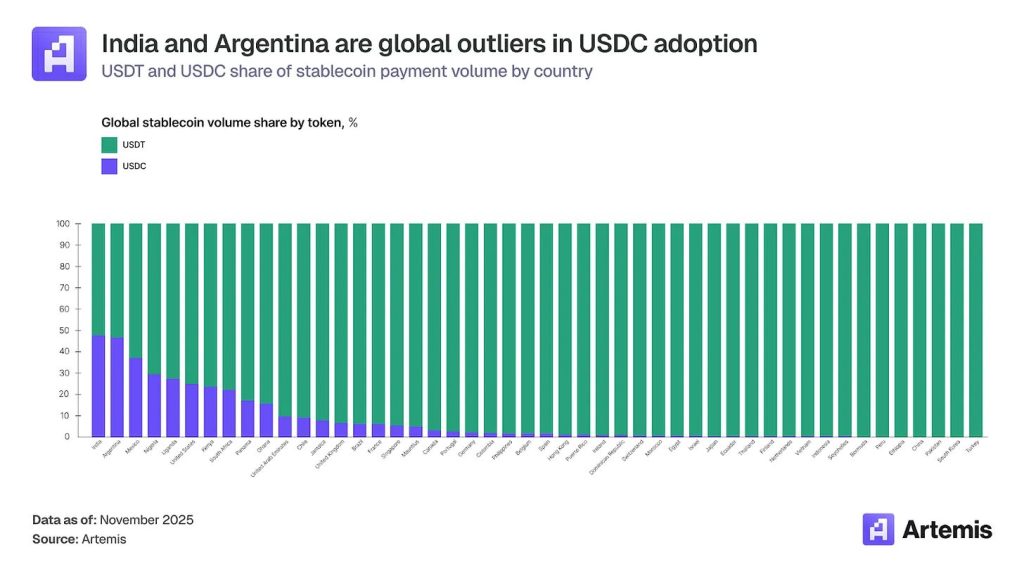

It is worth noting that India and Argentina are the leading countries in the world where USDC is approaching parity with USDT in the market, which offers a very different opportunity for adoption of crypto cards.

India recorded $338 billion worth of crypto in the 12 months ending June 2025, but strict tax laws have pushed many jobs offshore, leading to a latent demand for legitimate crypto products, hampered by regulatory disputes rather than user interest.

Argentina has the opportunity to run stablecoin debit cards that fence with inflation, because there is no competition in the digital infrastructure, while the possibility of India is lying cryptocurrency-backed credit cards, considering that the Unified Payment System (UPI) has made the debit service available everywhere.

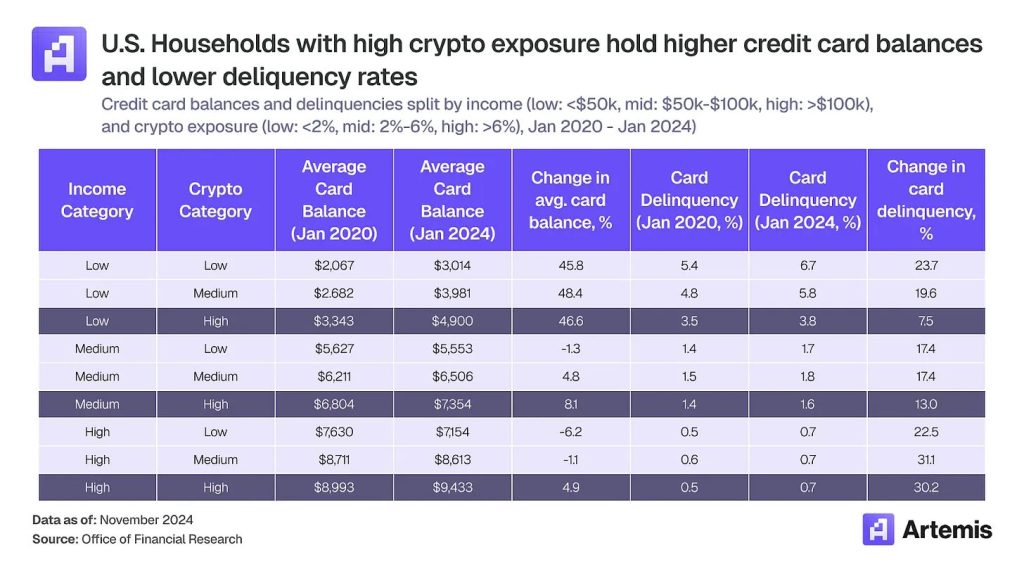

However, Artemis saw that in developed markets, the opportunity lies in attracting a high-value, high-value segment of users with advanced financial skills and a growing digital economy, rather than addressing insufficient payment needs.

For example, the mature US credit card market. Despite the large growth of credit card payments among all issuers, a new phase is emerging.

Consumers now have large amounts of stablecoins and expect more and more to spend money without restrictions, creating opportunities for traditional providers who combine the advantages of scale and the power of stablecoins in front of their crypto-native competitors to strengthen their relationship with users.

As the major networks, including Visa, Mastercard, PayPal, and Stripe, build merchant acceptance centers built around stablecoins, three facts indicate that cryptocurrency cards will retain their importance.

Artemis noted that a network that covers 150 million retail locations around the world remains difficult to replicate, requiring years of collaborative infrastructure that stablecoin systems must rebuild from the near-disappearance of existing transactions.

Social cards bring together the services that consumers expect, such as fraud protection, dispute resolution, unsecured credit, rewards programs, and purchase protection, which stablecoins cannot easily match.

In particular, earlier this month, Anthony Yim, co-founder of Artemis, said that DeFi investors like USDC because ” They often move in and out of places “, while raising many children shows” Unsettled geopolitical environment “Driving demand for the digital dollar.

The total value of global stablecoin transactions will reach $33 trillion in 2025, a 72% year-over-year increase, and Bloomberg Intelligence predicts it will reach $56 trillion by 2030.

Revolut’s stablecoin payment volume alone rose 156% to about $10.5 billion, and the outgoing day between $100 and $500 accounts for 30% to 40% of the platform’s activity.

Despite their growing demand, major banks are refusing to reject stablecoins that pay dividends, warning that they could drain trillions of dollars from traditional deposits.

Bank of America CEO Brian Moynihan warned that as much as $6 trillion could move to stablecoins, while JPMorgan’s Jeremy Barnum warned of “creating parallel banking systems” without prudential safeguards.

This opposition helped the Senate Banking Committee to delay the negotiation of a bill designed to create a cryptocurrency market after Coinbase withdrew its support, with the chairman of the committee, Tim Scott, citing bipartisan discussions on factors that could prevent stablecoin payments.

A note Cryptocurrency Card Market Jumps 15-fold As Stablecoin Expenditure Grows 106% Year Over Year: Report appeared for the first time Cryptonews Arabic.