Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

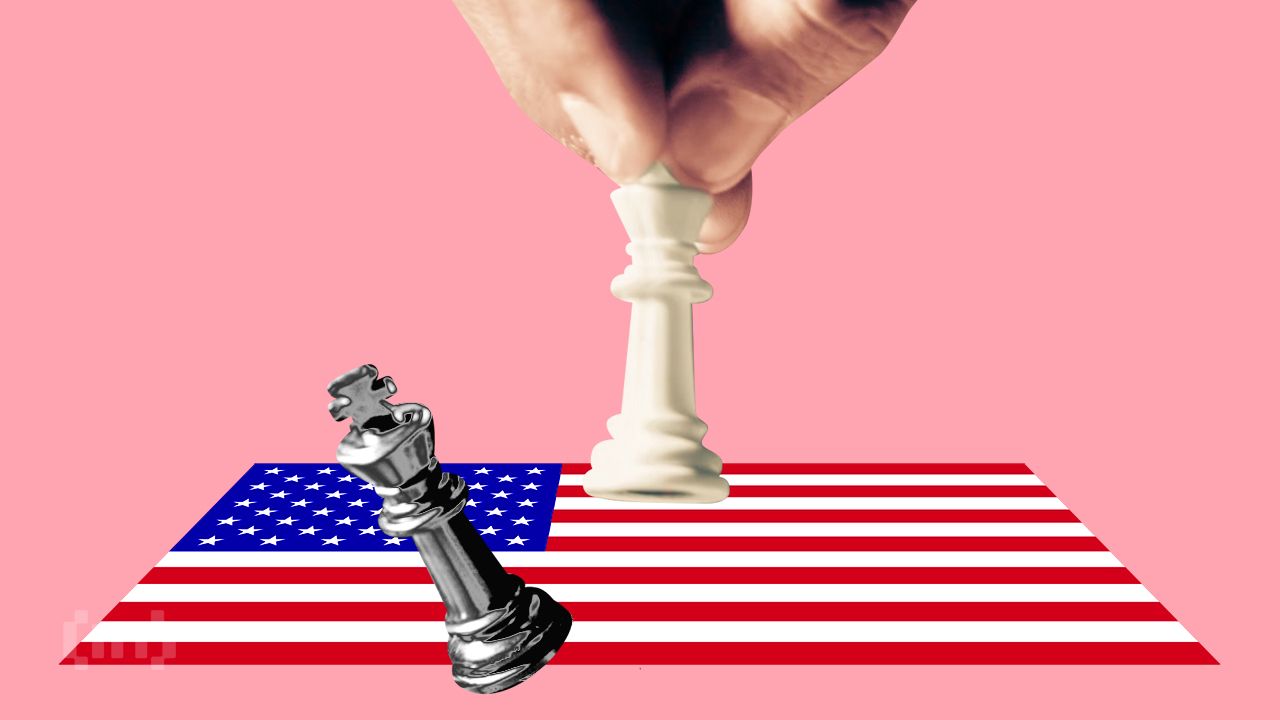

The state of Connecticut has ordered Kalshi, Robinhood, and Crypto.com to immediately stop event-based contracts, deepening its hostile stance toward digital assets.

The decision reveals a widening of the regulatory gap between state gambling laws and federal oversight of derivatives.

Sponsored

Sponsored

Connecticut issued cease and desist orders against Kalshi andRobinhood Derivatives and Crypto.com, accusing them of operating unlicensed online sports betting through event-based prediction contracts.

The Department of Consumer Protection (DCP) claims that these platforms have violated state gaming laws and are putting consumers at risk.

The move comes five months after Gov. Ned Lamont signed a bill into law All Bitcoin investments are prohibited at the state levelcementing Connecticut’s position as one of the least cryptocurrency-friendly states in the United States.

As states like Texas, Arizona and New Hampshire explore Bitcoin reserves and tolerant digital frameworks, Connecticut continues to tighten restrictions.

In a press release issued on December 3, the DCP said that none of the three platforms has a license to offer betting in the state.

“Their contracts violate numerous laws and other government policies, including the offering of bets to individuals under the age of 21,” a statement said in the press release. Read on.

Sponsored

Sponsored

Regulators accuse the platforms of:

“Betting on the predictive market is not an investment,” said DCP Gaming director Chris Gilman.

In this context, DCP urges the platforms to stop all contracts of sports events and allow Connecticut residents to withdraw funds.

While Robinhood and Kalshi objected, citing federal oversight, only the latter filed a federal lawsuit challenging the Connecticut authorities.

Sponsored

Sponsored

However, this clash highlights a growing legal divide between state gambling laws and federal derivatives regulation.

One Twitter user commented: “Unfortunate drama. The conflict between state gaming laws and federal derivatives oversight proves regulatory inconsistency.” .

Connecticut is not alone. New York is involved Legal dispute Special with tea. At the same time, he stressed Nevada ruling The latest is that state regulators can control contracts for sporting events, weakening the industry’s case for calling for exclusive federal oversight.

At the same time, the regulatory environment changed: I had Polymarket has CFTC approval It has expanded to more than 20 states, marking a stark contrast to Connecticut’s blocking order.

Sponsored

Sponsored

The campaign highlights the difference between Connecticut andNational Cryptocurrency Trends It increases uncertainty about the legal status of event-based contracts.

With many states asserting their authority, prediction markets make for a complex and fragmented US regulatory market.

Legal issues are likely to increase, and the results could determine whether… Forecast markets They grow into financial products under federal supervision or are treated like state-regulated gambling.

The next event will be the federal challenge to tea and if more states will be part of Connecticut or follow the Polymarket model and CFTC +.