Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

CoinGecko CEO Bobby Ong confirms that he is evaluating a “good opportunity” amid reports that the cryptocurrency data platform is eyeing an investment worth around $500 million.

CoinGecko CEO Bobby Ong admitted on Thursday that the company is investigating ” Opportunity wise “Following media reports indicating that the company is seeking an investment of approximately $500 million.

“After nearly 12 years of building CoinGecko as a self-funding company, the most frequently asked question is: Where do we go next?”

“What I can reveal today is that CoinGecko is growing and maintaining profitability, and I am seeing the interest of financial institutions as financial institutions are increasingly embracing cryptocurrencies,” he said. Said Ong On LinkedIn .

Media reports, made by sources familiar with the situation, revealed that CoinGecko is considering a potential sale of $500 million.

Sources have revealed that the company has hired Moelis to advise on the matter, although another source insisted that it was too early to know the price as negotiations did not start until the end of 2024.

Moelis is a Wall Street-based bank that specializes in financial management of mergers, acquisitions and public sector startups, and has supported more than $5 trillion in investments involving various sectors.

In a post on X, Ong admitted that he received many questions after the recent news, and appreciated the interest.

He said that after leading CoinGecko alongside co-founder and President TM Lee for over a decade, “Like any growing, profitable company, we are always looking for the best opportunities to strengthen our business and accelerate our work.”

This statement shows that CoinGecko is seriously considering its options, which are aimed at Wall Street buyers rather than investment funds.

While Ong declined to go into detail about the negotiations, he explained on “His love” A capability that enables us to better serve our users and manage businesses based on cryptocurrencies “.

It is worth noting that CoinMarketCap, another cryptocurrency market platform, was bought by Binance cryptocurrency exchange in 2020 for $400 million.

when Announcement of availability Binance explained that although all trading platforms and its token BNB are offered on the platform, ” CoinMarketCap and Binance remain separate entities that adhere to independent principles “.

More than five years later, cryptocurrency industry observers believe that CoinGecko’s price of $500 million is reasonable, because cryptocurrency data has become very important and Wall Street intelligence companies command high valuations.

For example, Bloomberg LP, although a private company, is valued in the billions Current accounts over $120 billion based on contract value in 2008, with annual revenues of over $13 billion from early 2025.

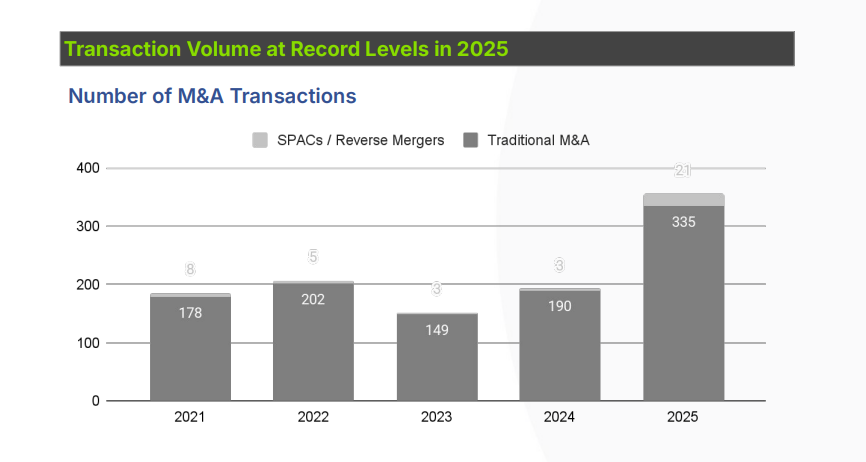

The volume and value of cryptocurrency M&A and IPOs increased in 2025, with a transaction value that reached $8.6 billion, thanks to the loose practices in the US that encouraged investors and financial institutions to re-enter the sector.

And according to A report published by the Financial Times 267 related to cryptocurrency were completed in 2025, which represents an increase of 18% from 2024.

The total revenue of the partnership increased by almost 300% compared to $2.17 billion last year.

Market participants expect the growth to continue until 2026 as regulatory clarity improves in all major jurisdictions.

Polygon Labs recently revealed its plans to acquire cryptocurrency trading platform Coinme and cryptocurrency wallet provider Sequence for $250 million in 2026.

In addition, FireBlocks, a blockchain infrastructure company, announced on Wednesday that it has acquired Trace Finance, a cryptocurrency accounting and financial reporting system, for more than $130 million to complete the volume of financial statements. Prepared and tax-compliant positions “For companies adopting blockchain technology.

On January 12, Bakkt Holdings, Inc. revealed it announced its agreement to buy Distributed Technologies Research Ltd. (DTR), advancing its strategy to create a stablecoin payment capability with the ability to be paid through a joint venture including shares representing 31.5% of the “Bakkt Share Number”.

A note CoinGecko CEO Responds to Reports of $500M Earnings appeared for the first time Cryptonews Arabic.