Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

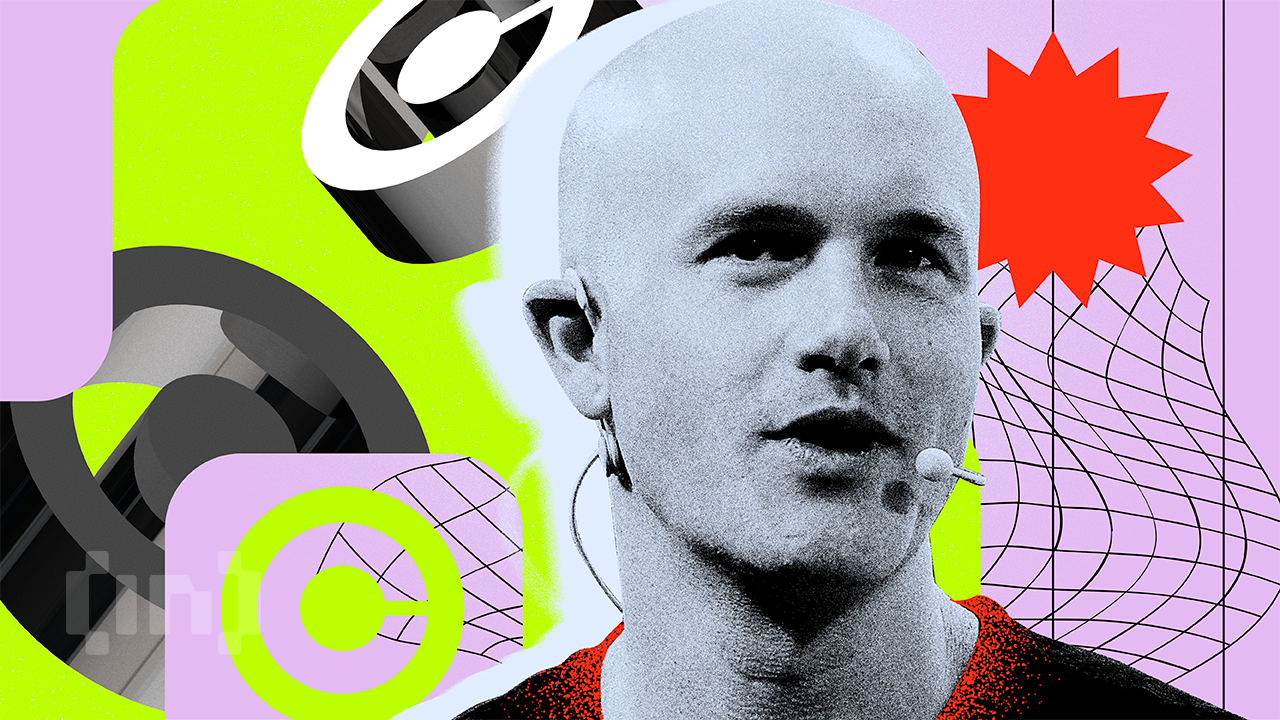

The CEO of Coinbase, Brian Armstrong, expects that the banks of the United States will announce their position on the regulation of stablecoins and eventually pressure the Congress to allow interest payments on these digital assets.

Armstrong’s prediction, published Dec. 27 on X, contradicts the banking industry’s current effort to remove yield-generating functions from the GENIUS Act.

Sponsored

Sponsored

He argued that lenders currently protect low-cost deposits, but will be forced to adopt this technique to compete for capital.

“My prediction is that banks will actually catch up and start pushing for the ability to pay interest and returns on stablecoins in a few years,” Armstrong wrote.

This prediction recasts the current legislative battle over the GENIUS Act as more than just a regulatory dispute. It presents the battle as a clash between the protection of ancient profit and the inevitable evolution of the market.

The GENIUS Act, signed in July 2025, Stablecoin issuers such as Circle and Tether are prohibited from paying interest directly to their holders.

However, intermediaries – such as exchanges – are allowed to pass the yield from the underlying treasury reserves to users.

Therefore, Bank lobbyists are asking lawmakers Reopen the legislation and close this loophole.

Sponsored

Sponsored

They argue that non-bank platforms can now offer nearly risk-free Treasury yields of between 4% to 5% on their cash equivalents. In this context, commercial banks are fighting to compete without raising deposit rates and compressing net interest margins.

However, Armstrong described the attempts to modify the issued law as a “red line” for the cryptocurrency industry.

He criticized the banking lobby’s approach as “mental preliminaries”. He pointed out the inconsistency citing security concerns while defending a business model based on paying depositors at below-market rates.

As described CEO of Coinbase Current spending on lobbying by banking trade groups has been described as “100% wasted effort”.

It should be noted that A coalition of 125 companies in the field of digital currencies, Including Coinbase, it recently submitted a letter to the Senate Banking Committee opposing any changes. The group argued that reopening the project would undermine regulatory certainty.

Armstrong’s position suggests that banks will eventually lose the ability to hold deposits at near-zero interest rates. In contrast, They issue their own premium money To capture the return spread directly.

Until this change, Coinbase and its counterparts intend to defend the current framework that allows them to act as a high-performance interface for dollar holders.