Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Cathie Wood’s Ark Invest is heading towards big expectations for cryptocurrencies at the end of the decade.

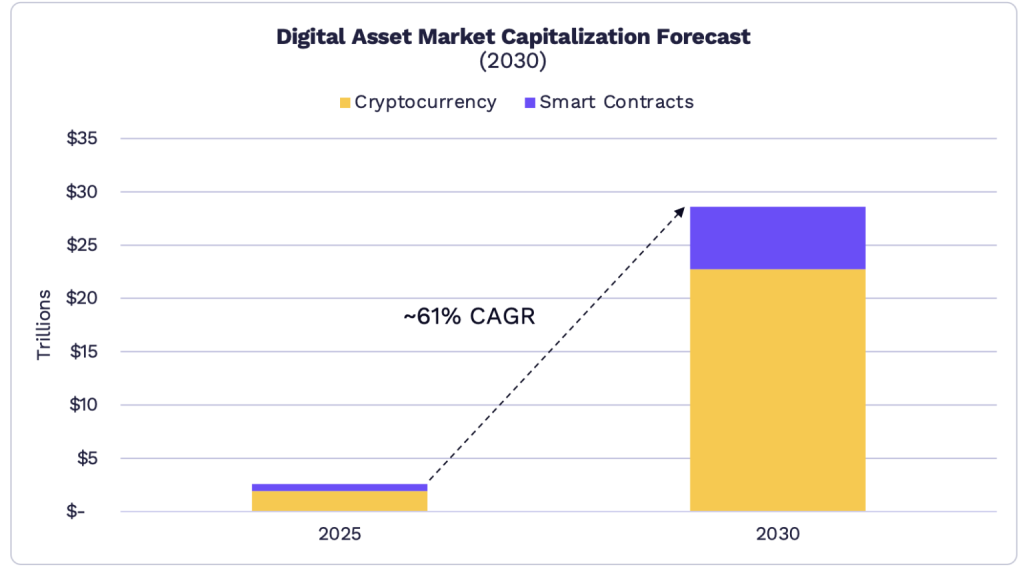

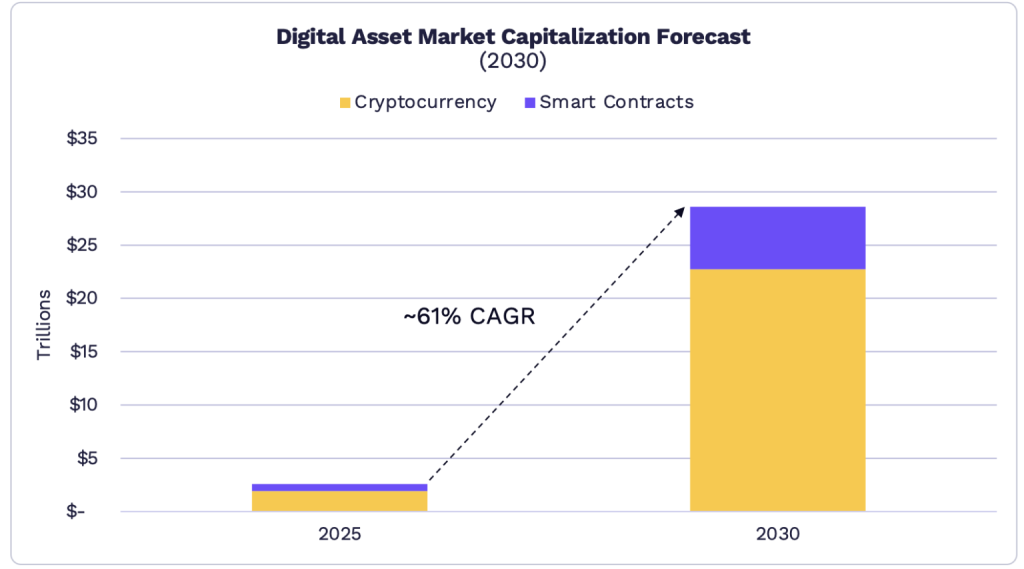

in His report “Big Ideas 2026” Published on Wednesday, the company says that the digital economy can reach a value of $ 28 trillion by 2030. This is from about $ 3.13 trillion today, an increase of about 9.

The company has organized the report around two categories, smart networks of cooperation and “cryptocurrencies,” which it describes as stores of value, means of exchange, and shares of account on public blockchains.

Arc said the market “could grow by about 61% annually to reach $28 trillion in 2030.”

Arc also expects Bitcoin to dominate the market. He said : “We think Bitcoin can take 70% of the market,” while smart contract networks like Ethereum and Solana will drive the rest.

According to Arkasa’s predictions, the Bitcoin market capitalization can double at an annual growth rate of about 63% over the next five years, rising from about $2 trillion to $16 trillion by 2030.

The report also stated that Bitcoin is behaving like a safe haven, noting a steady decline and a decline in 2025 that looks small compared to its history in 5 years, 3 years, and 1 year and 3 months.

Corporate ownership is a big part of the story. Ark reported that US bitcoin ETFs and public companies own about 12% of the total amount of bitcoin, from 8.7%, after bitcoin ETF measures rose 19.7% in 2025 from about 1.12 million to about 1.29 million, and holdings of public companies jumped 73% from about 598,000 million to 1.000 million.

In terms of smart contracts, Ark expects this sector to reach around $6 trillion by 2030, with an annual growth rate of 54%, with the network generating annual revenue of around $192 billion at a cut rate of 0.75%.

The report also expects that the top two or three platforms will account for the largest share, and that the calculation will be driven more by the cost of capital rather than DCF.

The ARC report kept Ethereum at the forefront of blockchain assets, noting that the value of Ethereum assets now exceeds $400 billion. The report also stated that the top 50 stablecoins and tokens account for nearly 90% of the market capitalization across seven of the eight most popular blockchains.

Ark said memes are still a small part of most blockchains, making up about 3% or less of capital outside of Solana.

Solana is the exception, with meme-inspired cryptocurrencies representing about 21% of assets. The company also said that the real estate token could be one of the fastest growing areas, as assets outside the blockchain offer the greatest opportunity for growth within it.

In this article, Arc came up with another important figure, saying that the tokenized assets could grow from $19 billion to $11 trillion by 2030, which would only represent about 1.38% of the total financial assets, showing that there is a lot of room to grow even under favorable conditions.

Credit is dominating tokenization today, and global bank deposits and government stocks are expected to move a large portion of the blockchain over the next five years, Ark said.

The research linked the implementation of the system with the clarity of the management system.

A note Cathie Wood’s Arc Invest expects the digital economy to grow nearly 9-fold to $28 trillion by 2030. appeared for the first time Cryptonews Arabic.