Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

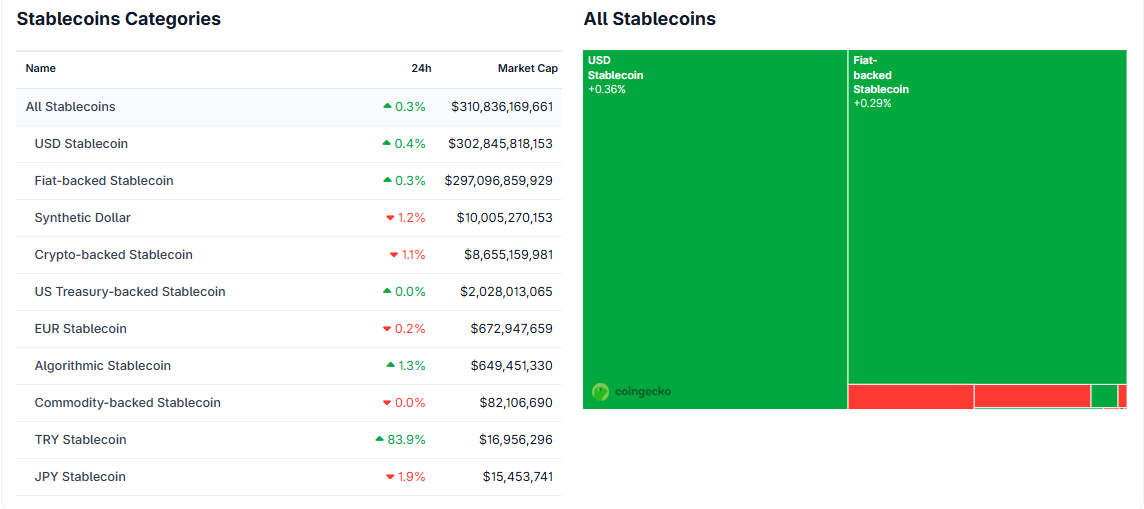

American stablecoins control 99% of the global market. China is moving forward with e-CNY. Europe, supported by MiCA and the first euro stablecoin EURAU regulated by BaFin, wants to fill the gap. But can you move fast enough?

BeInCrypto spoke with Gracie Chen, CEO of Bitget, about Europe’s strengths, its regulatory challenges, and whether the EU can continue to play a leadership role in digital finance.

Sponsored

Sponsored

BeInCrypto: How would you rate the position of Europe compared to the United States and Asia?

Gracie Chen: Europe is based on MiCAwhich provides a uniform legal framework but requires a high compliance burden. Issuers must maintain full reserves, maintain significant capital, and obtain an EMI license. This protects users, but raises barriers to entry and slows growth.

On the contrary, she said: US GENIUS Act It takes a lean approach focused on innovation. It has allowed private issuerslike Circle and Tether to expand rapidly, integrating USDC and USDT into the Visa and Mastercard networks.

Meanwhile, Asia is focusing on CBDCs, where private stablecoins still have a limited role.

BeInCrypto: Does MiCA encourage innovation, or does Europe need more flexibility?

Chen: MiCA forms a strong foundation, but Europe needs three tweaks: faster authorization for CASPs and issuers, stronger support for multi-bank reserve models like EURAU, and uniform application in all member states.

Sponsored

Sponsored

Without these adjustments, Europe risks regulatory fragmentation and slower adoption.

BeInCrypto: What will the launch of EURAU mean for Europe?

Chen: EURAU is a crucial step. As the first euro-backed crypto asset regulated by BaFin in Germany, it provides a US dollar stablecoins Strengthens Europe’s monetary sovereignty. Regulatory clarity is the trigger for business adoption and cross-border payment use cases, he said.

BeInCrypto: What are the most urgent steps for the EU?

Chen: Europe must move from policy clarity to operational preparedness. The priority is to accelerate MiCA-compliant Euro stablecoins with native SEPA Instant or TIPS integration, enabling fast, low-cost routes.

Sponsored

Sponsored

Europe must also establish Tier 2 standards, EU-wide licensing, and clear rules for performance products such as tokenized T-bills – an area where the EU could stand out from the US.

Europe also worries about infrastructure. Europe needs uniform FIAT directives, dealer acceptance programs, compliance bars and a common supervision booklet.

A pilot fund dedicated to stablecoins and new development tools could attract new issuers and reduce the innovation gap.

BeInCrypto: What creates trust in European stablecoins?

Chen: Transparency and audited reserves. MiCA’s quarterly requirements help prevent the uncertainty that led to the TerraUSD collapse.

Sponsored

Sponsored

Integration is considered AML/KYC compliance Secure and verified smart contracts provide additional assurance for organizations and individual users.

BeInCrypto: Can Europe compete in the next 3-5 years?

Chen: Europe could become a respectable player, but it is unlikely to overtake the United States, which already controls almost the entire market through the mature private ecosystem. Europe’s advantage is clarity in regulation – but it must accelerate innovation to turn this framework into a real adoption.

Europe has what other regions lack: a comprehensive and unified regulatory framework. But rules alone will not close the 99% market gap.

As Grassi Chen says, the EU must combine MiCA with speed, infrastructure and incentives. Whether it is enough to challenge American hegemony remains a test for Europe – the answer will come soon.