Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin’s recent fall towards $80,000 pushed most of the asset’s originally active capital into losses, signaling a change in market conditions for the world’s largest cryptocurrency.

Bitcoin has shed nearly 35% from its October peak of around $126,000 after falling to a seven-month low. As a result, it has now generated one of the biggest waves of unrealized losses this cycle.

Sponsored

Sponsored

According to data from the chain analysis company Checkonchain, the decrease in prices forced more than 70% of … Capital allocated to the underwater Bitcoin.

Bitcoin analyst James Cheek explains that 71.2% of the realized capital of the network carries a cost base of at least $86,500. This metric calculates the price of each coin in the circulating supply at the value that last moved on the chain.

This effectively represents the total entry price for active investors in the market.

So, with The latest fall of Bitcoin Below this critical line, a flow of buyers who entered during the demonstrations of the end of 2024 and the beginning of 2025 are facing increasing losses. Many of these investors are effectively locked into positions that no longer break even.

This extreme concentration of volume near the highs indicates that short holders are under severe pressure. Its unrealized profit and net loss indicators are forced to collapse to cycle lows.

Sponsored

Sponsored

At the same time, Glassnode data confirms this imbalance in the overall structure of the market.

The company’s Relative Unrealized Loss Index, which tracks the dollar value of tokens below their purchase price relative to the total market capitalization, rose to 8.5%. In a normal and healthy bull market, this measure typically stays below 5%.

Therefore, the current downturn indicates that the decline represents a significant “market reset” of the asset ownership base rather than… Standard volatility correction.

As prices recover At the level of $84,543 At press time, the psychological damage to the retail sector appears to be severe.

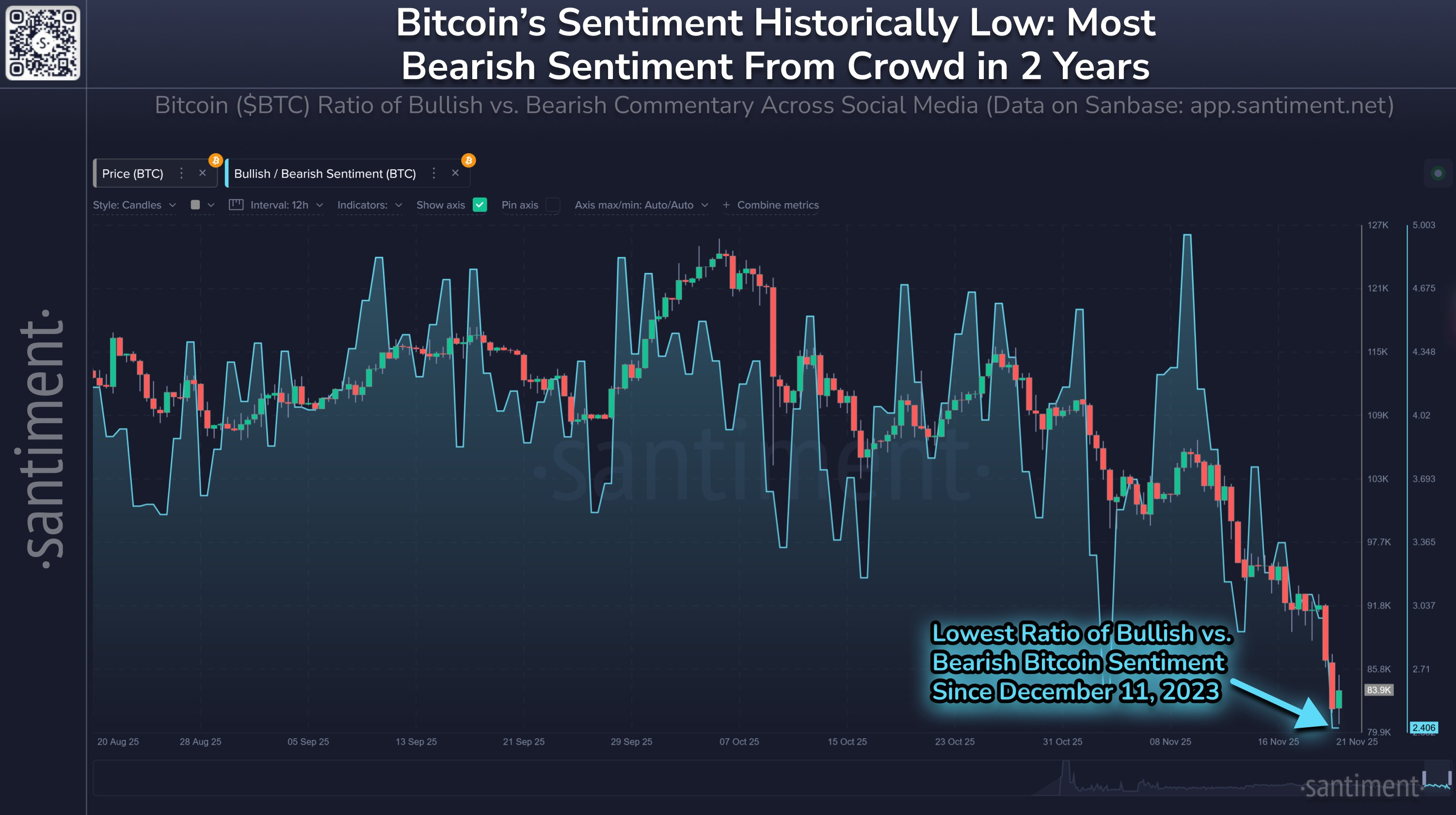

Social media sentiment has fallen to its lowest point since December 2023, according to data from blockchain analytics platform Santiment.

The company said its analysis of social media comments on X, Reddit and Telegram shows that Individual traders give up and sell in panic At levels not seen in two years.

Historical analysis suggests that such extreme levels of downtrend often act as a contrarian signal, suggesting that the market may be liquidating weak hands in preparation for a local bottom.