Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The price action of Bitcoin in the past week has highlighted how reactive this market is to changes in positions and sentiments. BTC briefly missed the $90,000 handle before making an early rebound, driven by high volatility and low buying by short-term players. The move was quick, loud, and headline-focused — classic late-cycle behavior.

While the price has managed to stabilize for now, the overall flow picture remains mixed. The participants of the bottom of the Bitcoin point are still sitting on the side, and this caution can ultimately determine whether it continues or fades to another lower high.

Sponsored

Sponsored

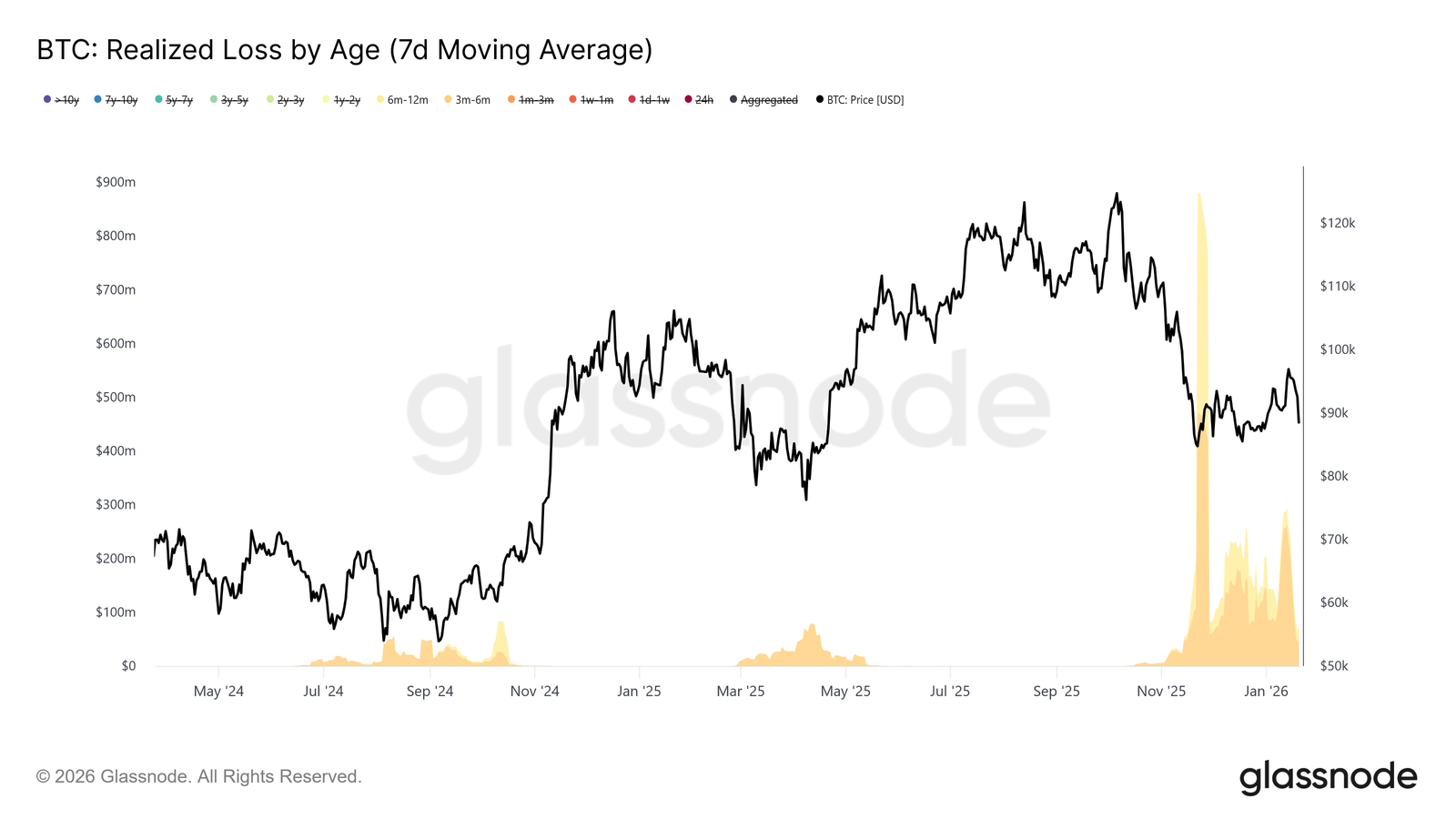

The data in the chain show that the losses realized are currently concentrated between the category of gestation of three to six months, with a secondary contribution from carriers of gestational in the range of six to twelve months. These are usually the participants who bought close to the cycles of the cycle, especially above the area of $110,000, and are now forced to counter the declines that the prices return to their cost base.

This type of loss realization is usually driven by a reduced risk rather than a new negative belief. These holders tend to sell strongly during early rebounds, creating a general supply near key recovery levels. As a result, they often stop Bitcoin attempts bullish Before the moment can rebuild completely.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

Historically, the increase in losses realized by these age groups have tended to indicate the later stages of corrective phases rather than the beginning of a prolonged distribution. In previous sessions, Bitcoin has often stabilized and risen after this group has finished capitulating, suggesting that the current behavior may be closer to the exhaustion of the escalation.

Sponsored

Sponsored

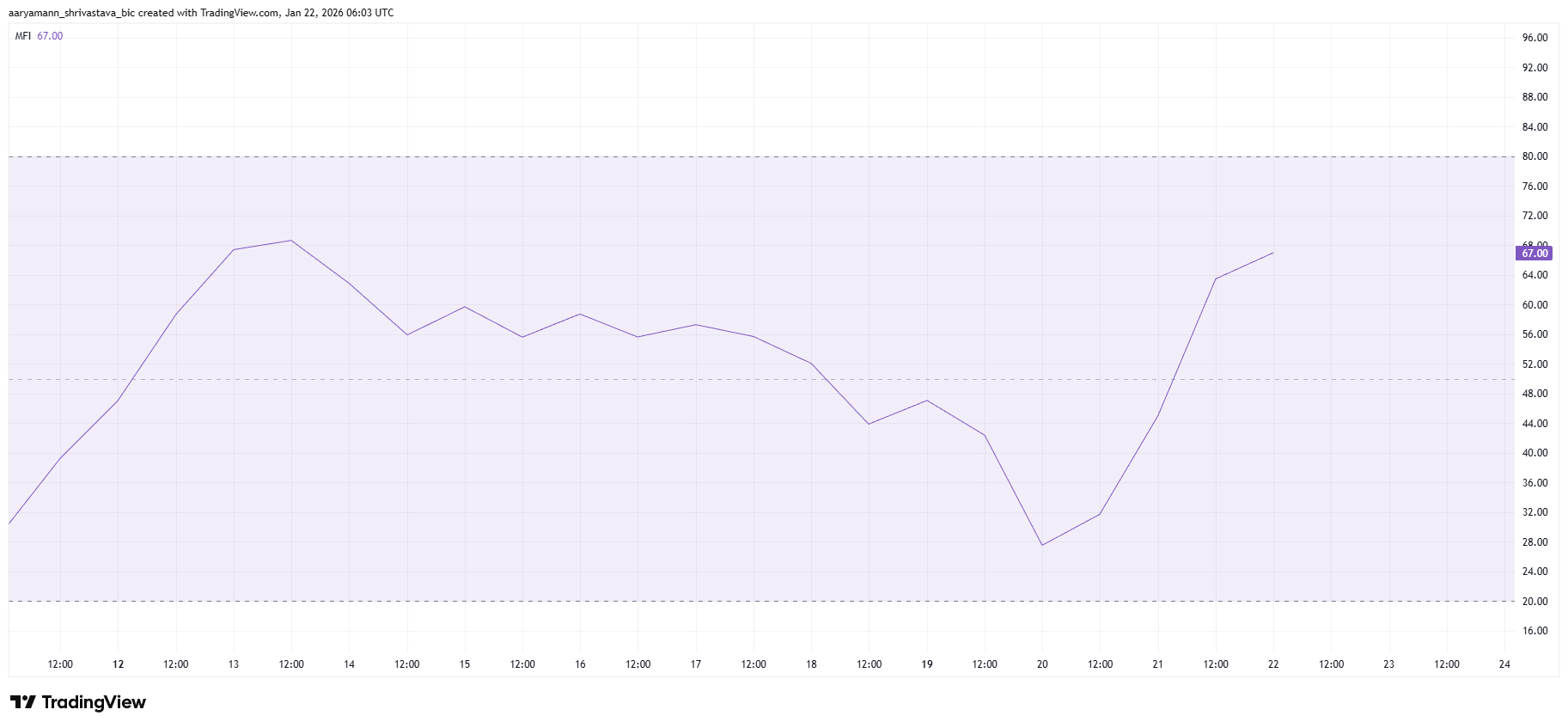

As for the momentum, conditions have improved faster than many expected. The Money Flow Index has seen a sharp rise in the last 48 hours, indicating renewed buying pressure. Since the IMF integrates price and volume together, it is a strong indicator of real demand during periods of volatility.

The jump in MFI appears to be linked to an easing of geopolitical tensions, including developments regarding the status of Greenland. Bitcoin’s reaction stands out Participants’ short-term sensitivity to major headlines. While this influx of buying supports near-term stability, it’s worth noting that headline-based optimism could quickly fade if the overall narrative turns to risk again.

In other words, momentum is better, but it remains fragile and reactive rather than structurally optimistic.

Sponsored

Sponsored

Although Bitcoin has bounced back over the past two sessions, ETF flows still paint a bearish picture. I saw Bitcoin spot funds The flow continued this week, with the total reaching about $1.6 billion in three trading days. Wednesday alone recorded $708 million in redemptions — the largest single-day flow since November 2025.

This disparity between price flows and ETFs is remarkable. It suggests that institutional participants and long-term researchers are still unconvinced by the recovery narrative. Instead, they seem to be waiting for clearer macroeconomic stability before reallocating risks.

As long as ETF flows remain negative, the upward momentum is likely to face headwinds. Continuous flows tend to overshadow rallies and make it difficult for Bitcoin to recover and maintain key resistance levels.

Sponsored

Sponsored

Technically, Bitcoin has been trading in an expanding bullish bracket since mid-November 2025. This pattern generally indicates an expansion of volatility rather than a clean trend continuation. Recently, Bitcoin narrowly avoided a complete collapse to the lower trend line as short-term buyers intervened aggressively.

This response pushed the price above $90,000, while… Bitcoin is currently still nearby From $90,054. A confirmed breakout from this structure would indicate a long-term growth target of more than $98,000, although this scenario remains overblown as of now.

In short, focus on $91,298. A clean recovery and hold above this level opens the door for a move towards $93,471. However, downside risks are still linked to the behavior of ETFs. The continuation of the flow may cause the price to stop below the resistance And withdraw Bitcoin at Under $90,000.

If that happens, the next downside targets will be at $87,210, or perhaps a retest of the lower boundary of the rising wedge. Until flows turn decidedly positive, Bitcoin remains in a volatile, range-based environment where patience is key.