Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin is currently trading at $93,000, down about 2% over the past 24 hours, with a market cap of $1.85 trillion and a daily turnover of over $38 billion. Although the price has been moving almost horizontally within a narrow range since January 16, blockchain data suggests that the decisive moment may be approaching.

The goal is “kimchi premium,” a token that measures the price difference between Bitcoin on South Korean exchanges and international markets. When Korean businessmen pay premiums, it shows domestic demand. Historically, this indicator has been preceded by large price increases. In October 2023, the price turned positive, causing the price of Bitcoin to rise by 370%.

The reports show Updates from XWIN Finance show that the price is rising again, approaching the levels that brought in the biggest profits. If this indicator is confirmed, it may indicate the beginning of a new cycle, which can lead to an increase of more than 300%.

Moving on to the blockchain signals, the Bitcoin price trend seems to be positive as Bitcoin continues to respect the rising line from $86,700, creating an intermediate structure at the support level at $91,885 and the resistance level at $95,483.

The movements of the 50- and 200-period Exponential Moving Averages (EMA) indicate a possible golden cross, a historical event with bullish connotations. At the same time, the RSI is approaching 47, showing a slight bullish divergence from the recent price decline. Japanese candlesticks, including the Spinning Top and Doji, indicate volatility, but also indicate consolidation potential.

A breakout of the $95,500 level and a strong trading volume could push the price of Bitcoin to $97,700 and $99,500, fulfilling the expected trend of the mill. On the other hand, a price drop below $91,885 leads to a repeat of the $90,000 and $88,342 psychological levels.

The compatibility of signals on the blockchain and technical signals is very important for traders. The rising price of Kimchi Premium is showing an increase in demand, while the charts are showing an end.

For entrepreneurs, the implementation is simple:

If history repeats itself, Bitcoin could be on its way to hundreds of units, similar to those seen in October 2023. Although the macroeconomic and institutional management will affect the growth of this meeting, current signs cannot be ignored.

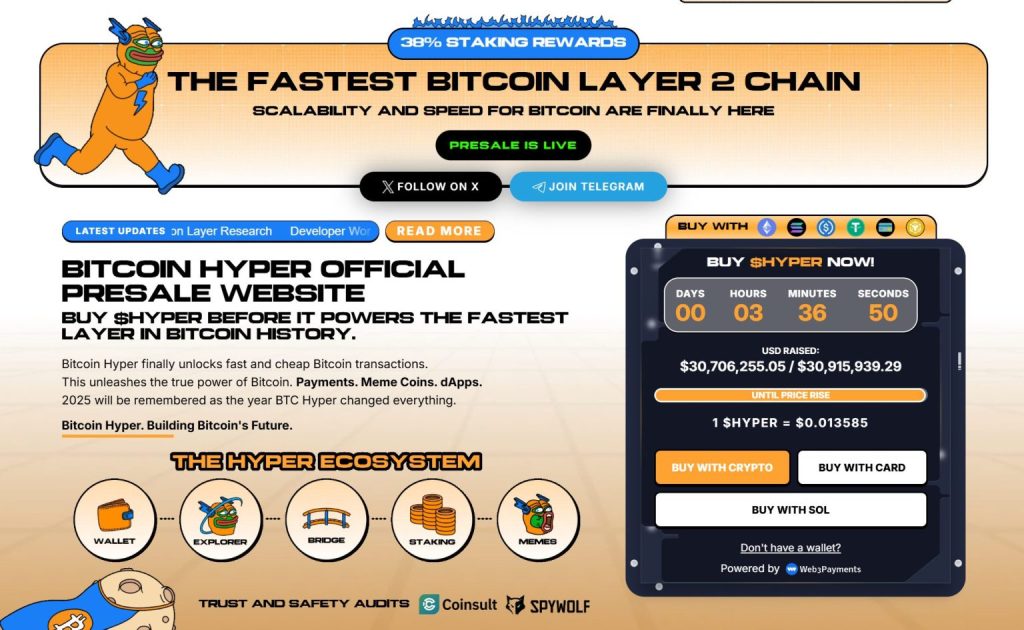

Bitcoin Hyper ($HYPER) brings a new dimension to the Bitcoin ecosystem. Although Bitcoin is still the gold standard for security, Bitcoin Hyper adds something it has always lacked: Solana’s speed. The result: high-speed, low-cost smart contracts, embedded software, and the creation of meme-specific cryptocurrencies, all secured by Bitcoin.

This project, which has been reviewed, focuses on… Company Application for reliability and scalability as demand increases. The project has already gained momentum, with the pre-sale price exceeding $30.7 million, and the token price standing at only $0.013585 before the next increase.

With the rise of Bitcoin services and the high demand for powerful software based on this, Bitcoin Hyper is seen as a bridge between two of the biggest cryptocurrency brands. If Bitcoin has set the foundation, then… Bitcoin Hyper Being able to make it fast, flexible and fun again.

Click here to participate in the pre-sale

A note Bitcoin Price Prediction: The Real Signal That Led To The 370% Operation Reappears – Are You Ready? appeared for the first time Cryptonews Arabic.