Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The price of Bitcoin has returned to a major reversal near $90,000, as technical weakness coincides with changes in economic and institutional growth indicators. The plan to raise 150 million dollars to buy Bitcoin, to reduce trade disputes between the United States and the European Union, and to establish a new investment fund focused on recovery is helping to restore the market.

With current support broken and neutral stability, traders are wondering if this pullback represents a consolidation phase or a deeper correction.

Try to dive deeper into his Bitcoin strategies. The company plans to raise 150 million dollars through an additional Class A preferred offering (SATA), with a clear list of priorities: debt payments, fund operations, and buying more bitcoins.

Part of the money will go to buy or redeem 4.25% senior notes issued by his company, Semler Scientific, which will mature in 2030. Strife is also evaluating the possibility of debt swaps with selected candidates, and the aim is to reduce the risk of debt related to Coinbase’s debt. Any capital left over after this can be invested directly into Bitcoin.

The company SATA pays a dividend of 12.25 %. Administrators confirm that the system provides flexibility without a significant reduction in the value of the asset, making Bitcoin accumulation a long-term investment strategy rather than a short-term speculation.

Markets also saw positives after President Donald Trump suspended tariffs in several European countries, including Germany, France, Denmark, and the United Kingdom. Following the announcement, the Standard & Poor’s 500 index rose 1.16%, reflecting a recovery in the stock market’s high risk.

Cryptocurrencies responded with a few benefits:

The suspension of the tariffs followed talks with NATO Secretary General Mark Rutte, during which Mr. Trump spoke about a number of negotiations related to cooperation in Greenland and the Arctic. Despite the improving sentiment, market participants remain cautious, with signs of panic continuing to rise after recent volatility.

Institutional interest in Bitcoin is also focused on monetization. Laser Digital, a subsidiary of Nomura, has launched a Bitcoin Diversified Yield Fund, designed to generate returns beyond the rising price of Bitcoin.

Instead of the traditional buy-and-hold method, the fund uses non-market and diversified strategies to generate profits while still holding Bitcoin. This builds on Laser Digital’s 2023 Bitcoin Adoption Fund, and will add funds that target organizations facing challenges.

The loan is managed by Kaio, secured by Komainu, and is only available to authorized and registered investors.

The opinion of the price of Bitcoin seems to be neutral, because it is currently trading near $ 89,700, it continues to decrease after the clear closure of the two-hour candle under the rising line that has been guiding the price since the end of December. Rejection near the level of $92,000-92,200 corresponds to the 50 and 100 EMAs, confirming that this is a short-term delivery area.

Recent bearish candles show long bodies with narrower bars, indicating controlled selling rather than panic.

The price has now fallen below the 0.382 Fibonacci retracement level of the previous one, while the whole system is showing the appearance of a broken upward trend. This move also disrupted the short form of combining triangles, moving downwards. Immediate support is at $89,300, followed by $87,400 which was the key level in the past. On the downside, $91,800 and $94,200 remain major resistance levels.

BTC/USD trading opinion: Sell below $89,300, target is $87,400, stop loss above $91,000.

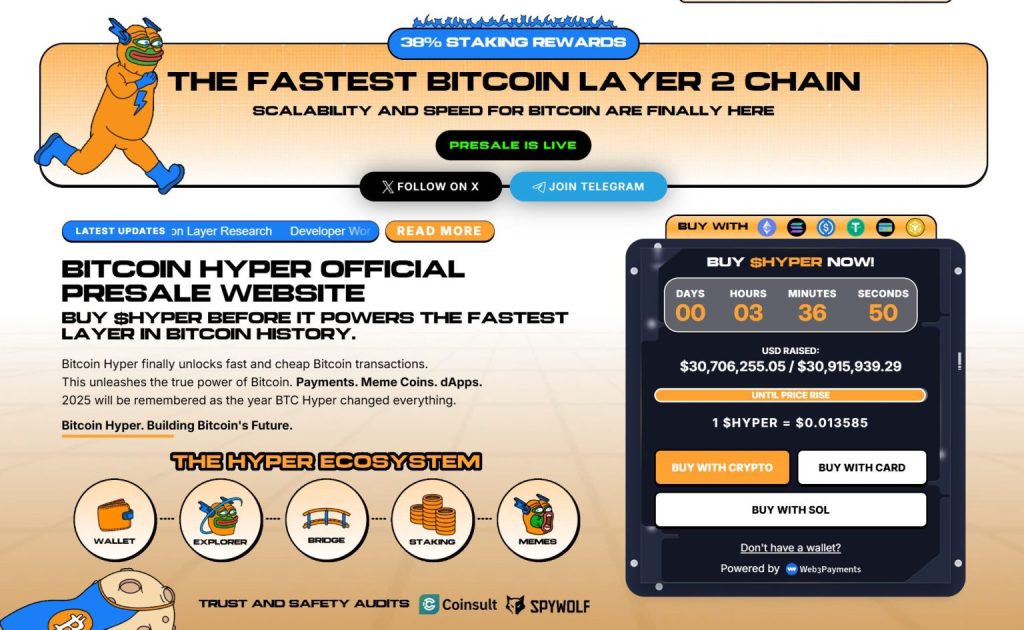

Launches Bitcoin Hyper ($HYPER) A new phase in the Bitcoin system. Although Bitcoin is still the gold standard for security, Bitcoin Hyper adds what has been missing: Solana-like speed. The result: high-speed, low-cost smart contracts, embedded software, and the creation of meme-specific cryptocurrencies, all secured by Bitcoin.

After the previous search Company Application The project focuses on reliability and scalability as demand increases. The project has already gained momentum, with the pre-sale amount exceeding $30.8 million, and the token price standing at only $0.013605 before the increase.

With the rise of Bitcoin services and the high demand for powerful software based on this, Bitcoin Hyper is seen as a bridge between two of the biggest cryptocurrency brands. If Bitcoin has set the foundation, then… Bitcoin Hyper Being able to make it fast, flexible and fun again.

Click here to participate in the pre-sale

A note Bitcoin price prediction: $90,000 at the discount point and $150 million Bitcoin buying plan to support the next move appeared for the first time Cryptonews Arabic.