Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

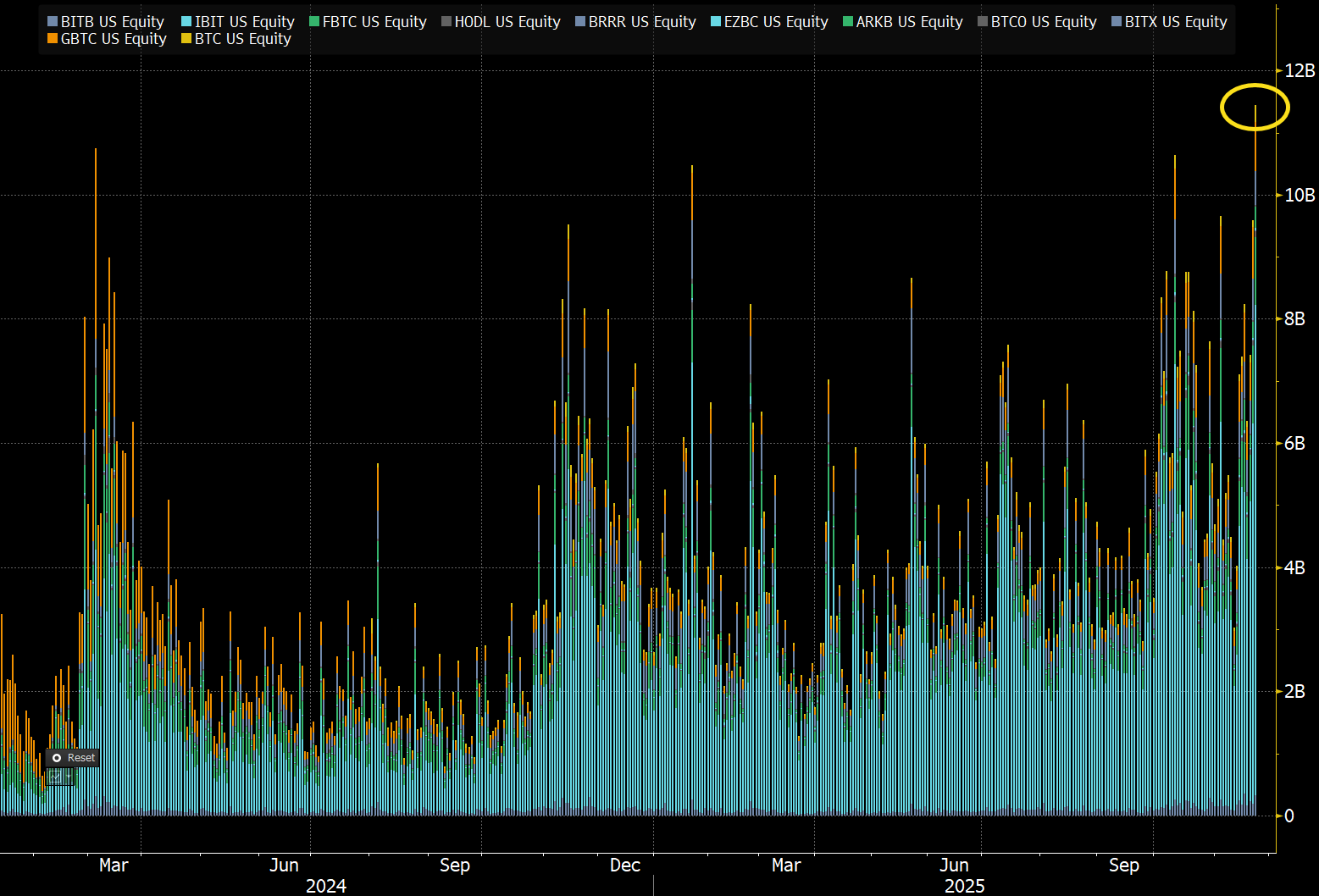

US Bitcoin exchange-traded funds have had the most active moments in their history, even when the price of the digital currency has recently decreased, resulting in losses for the average investor in these funds.

This increase in activity constituted a new stage in the adjustment of the market to the decline of the sector of the month.

Sponsored

Sponsored

On November 21, Bloomberg ETF analyst Eric Balkunas said that 12 Bitcoin Spot ETFs It recorded a combined trading volume of $11.5 billion.

Balkunas called the increase in volume “crazy but normal,” noting that exchange-traded funds and other asset classes tend to record high turnover during periods of market stress.

Such spikes in activity often indicate a release of liquidity as investors reallocate their positions, he said.

The high trading was reflected in active participation on both sides, with some investors reducing exposure while others took advantage of lower prices to add more assets to their positions.

He drove BlackRock’s IBIT This increased, as it achieved a turnover of $ 8 billion, which constituted more than 69% of all the businesses of the Bitcoin spot fund on that day. It was the highest IBIT session volume since its launch, although the fund ended the day with flows of $122 million.

Sponsored

Sponsored

At the same time, the boxes are published Other Bitcoins, led by Fidelity’s FBTC, Net inflows of more than $238 million.

Despite these flows, 12 Bitcoin investment vehicles are on track for their worst trading month ever, with net flows of more than $3.5 billion.

This huge entry and record session came as Bitcoin Cash ETF holders hit the red.

Data from Bianco Research indicates that the weighted average purchase price of ETF flows in… Bitcoin cash It reached $91,725 as of November 20.

I paid Bitcoin falls below that level This week most holders, including those who entered the market in January 2024, have unrealized losses.

Bitcoin fell nearly 12% this week to a low of $80,000 before recovering to $84,431 at press time. This price performance extends the current month’s decline and reinforces the sense of risk around the digital asset.