Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin price has seen a steady recovery in recent sessions, extending gains that now place Bitcoin near a potential breakout zone. The continued rally has shifted the market tone towards cautious optimism.

However, with the development of bullish momentum, the increase in short-term umpire earnings present a familiar risk that could challenge the advance of Bitcoin.

Sponsored

Sponsored

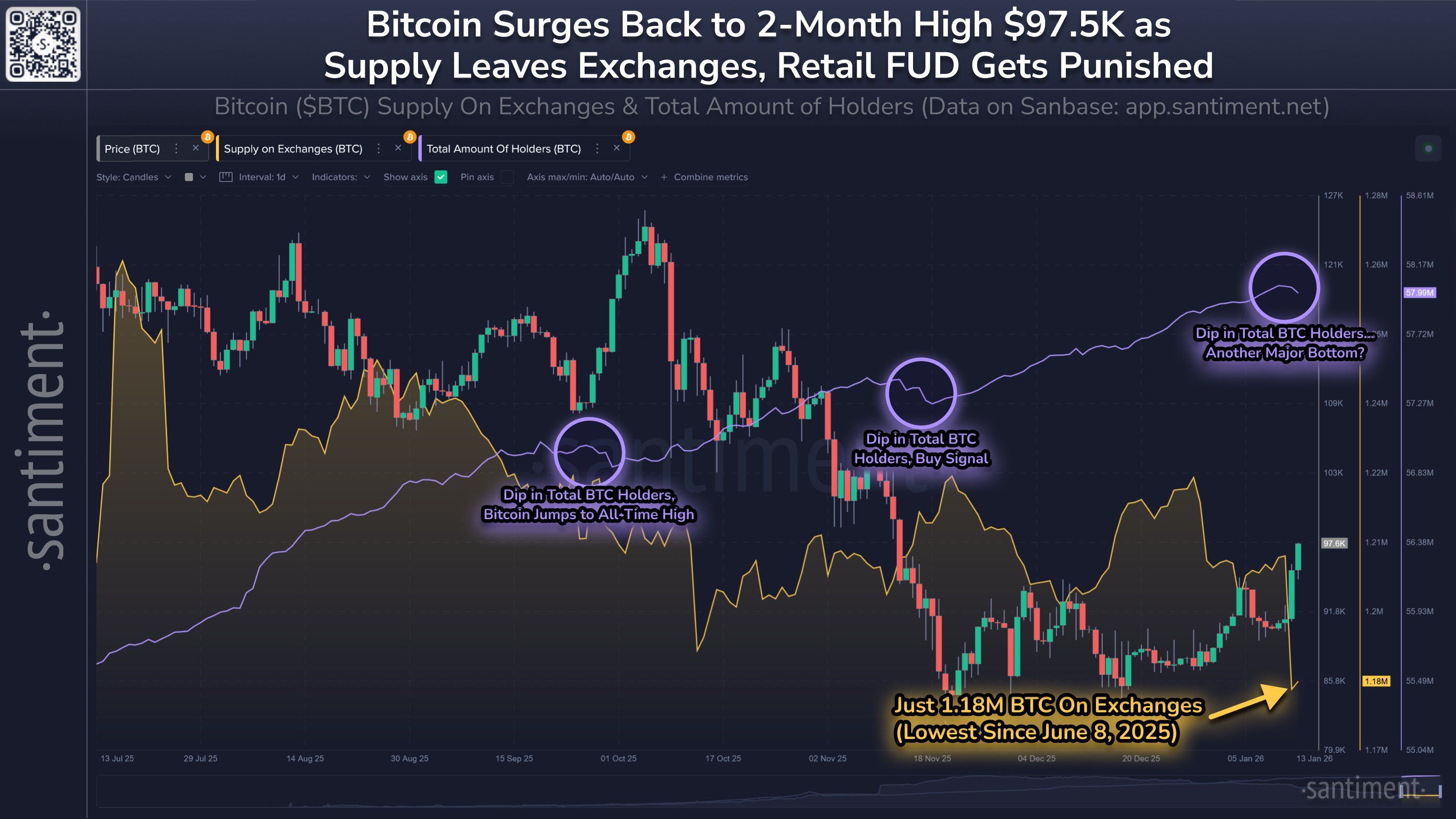

Bitcoin recently jumped to a two-month high near $97,500, marking its strongest level since early November. This recovery was achieved despite a notable contraction in the participation of the retail sector. Over the past three days, data on the chain shows a decrease in Bitcoin holders, indicating an exit from small investors.

“There was a net decline of -47.244%, indicating that retail was retreating due to anxiety and impatience.” Santiment highlights.

Meanwhile, exchange balances fell to a seven-month low of about 1.18 million bitcoins. A lower exchange offer often indicates lower spot selling pressure.

This is the third case in three months in which declining exchange balances coincide with stable prices. Together, these signals reinforce the confidence that… Bitcoin can Another local background.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

Sponsored

Sponsored

Macro indicators add complexity to the recovery narrative. The difference in market value versus realized value between the long and short distances shows that the term holders are regaining their dominance over long-term profitability. The recent rally, coupled with rising prices, pushed short-term holder earnings to their highest levels since January 2023.

Historically, high short-term profitability can be a double-edged signal. While this reflects improved demand and stronger prices, the short-term campaign is more sales-friendly. To date, there is no clear evidence of extensive distribution. However, sustained earnings may tempt these holders to close dividends, which may… Bitcoin recovery slows down.

Bitcoin is trading near $95,372 at the time of writing, and is moving in an expanding slide. This structure often leads to bullish consequences if the price breaks higher and continues. If the hack is confirmed, Bitcoin will be required Recovered $98,000 and successfully retested as support.

If current conditions persist, the apparent bottom formation may support another leg higher. Keeping the psychological level above $95,000 remains crucial. Successful defense of this area will encourage buyers to challenge $98,000 again. Converting this level into support will open the way to the psychological milestone of $100,000.

The negative alternative remains possible. If the bullish momentum fades and short-term holders start taking profits, Bitcoin could lose the $95,000 support. Such a move will likely push Bitcoin About $93,471 or less. A failure below that zone will invalidate the bullish hypothesis and delay any breakout attempts.