Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

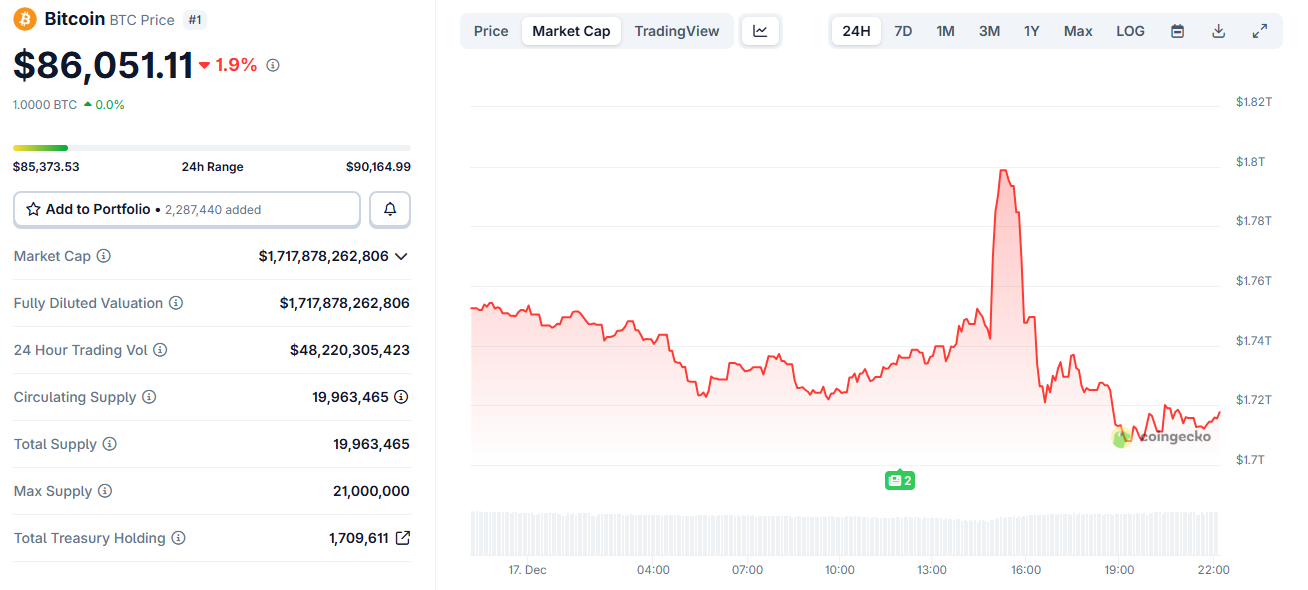

Bitcoin experienced a bout of extreme volatility on December 17th, rising more than $3,000 in less than an hour before abruptly pulling back and heading back towards $86,000.

No great news followed this violent incident. Instead, market data shows that the move was driven by leverage, concentration and fragile liquidity conditions.

The initial rally started when Bitcoin pushed towards a level $90,000 And he is A major area of psychological and technical resistance.

Sponsored

Sponsored

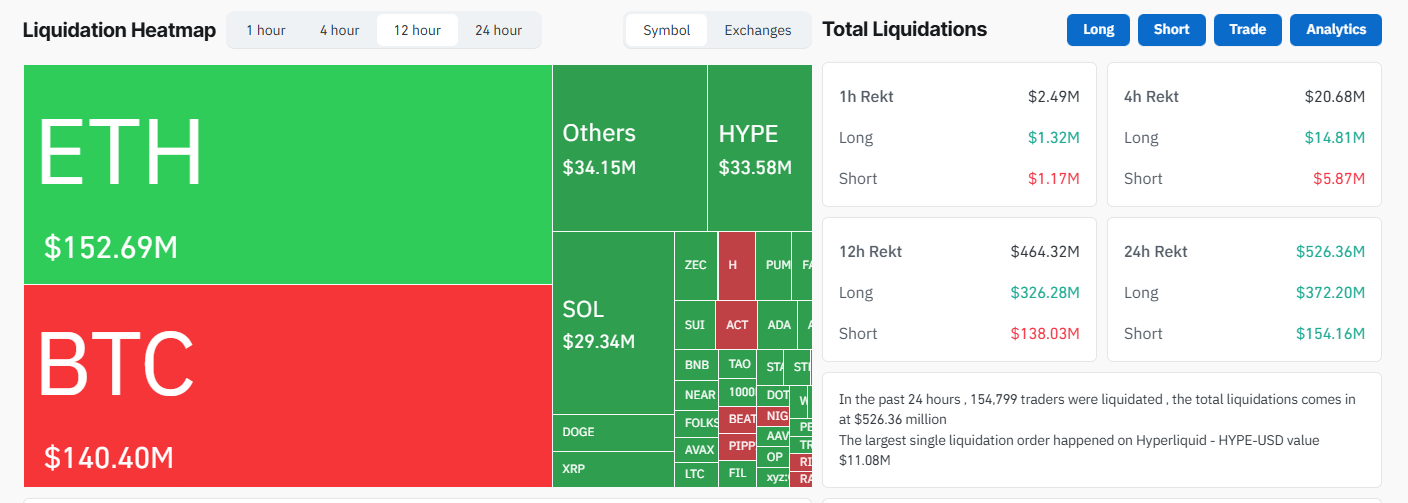

Filter data shows a dense collection of Leveraged modified short positions Finance is above this level. When the price rose, those short positions were forced to close. Request this The process of buying Bitcoinwhich pushed prices to rise faster.

About $120 million was liquidated in close positions during the rally. This created a kind of… Press sells Short, where forced buying accelerates movement beyond what is justified by normal immediate demand.

At this point, the transition seemed solid. But the underlying structure was weak.

with Bitcoin temporarily returned its value to $90,000new traders entered the market chasing the momentum.

Many of these Traders opened leveraged buy positionsThey bet that progress will be made. However, the rally lacked sustained temporary buying and quickly stalled.

When the price started to fall, those long positions became vulnerable. Once key support levels were broken, exchanges automatically liquidated those positions. More to follow Of the $200 million long rating which flooded the market.

Sponsored

Sponsored

This second wave explains why the decline is faster and deeper than the initial growth.

Within hours, Bitcoin fell towards $86,000, erasing most of the gains.

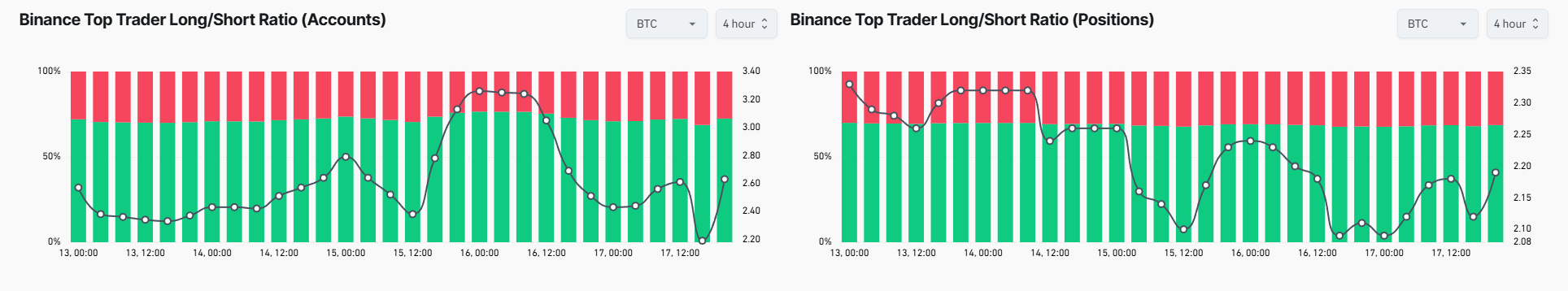

Data on traders’ positions helps… Binance and OakEx In explaining the reason for the violence of this step.

On Binance, the number of large trading accounts that tend to buy has grown significantly before the rally. However, the position size data showed less conviction, suggesting that many traders were long but not too big.

Sponsored

Sponsored

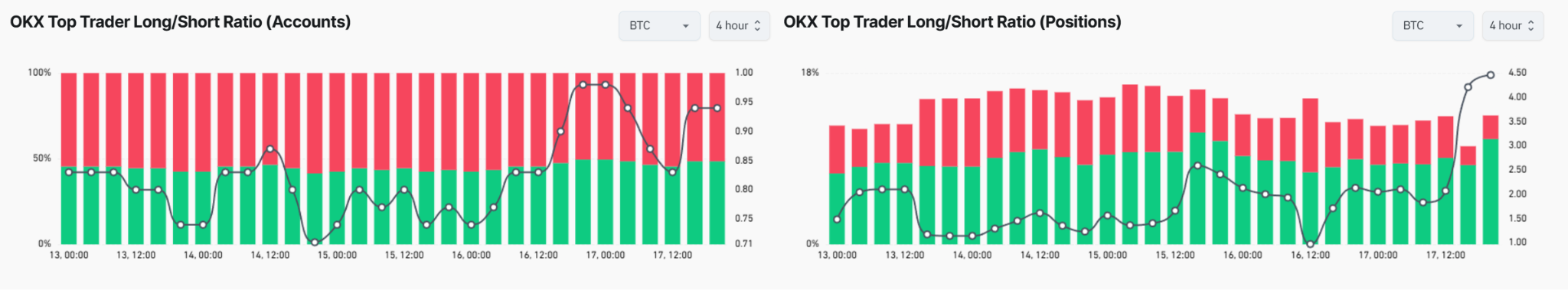

In OKX, the position ratios changed sharply after the volatility. This indicates that Larger traders quickly repositioned themselvesor buy the dip or adjust the hedge during the liquidation.

This combination – crowded positions, mixed conviction and heavy leverage – creates a market that can move violently in both directions without adequate warning.

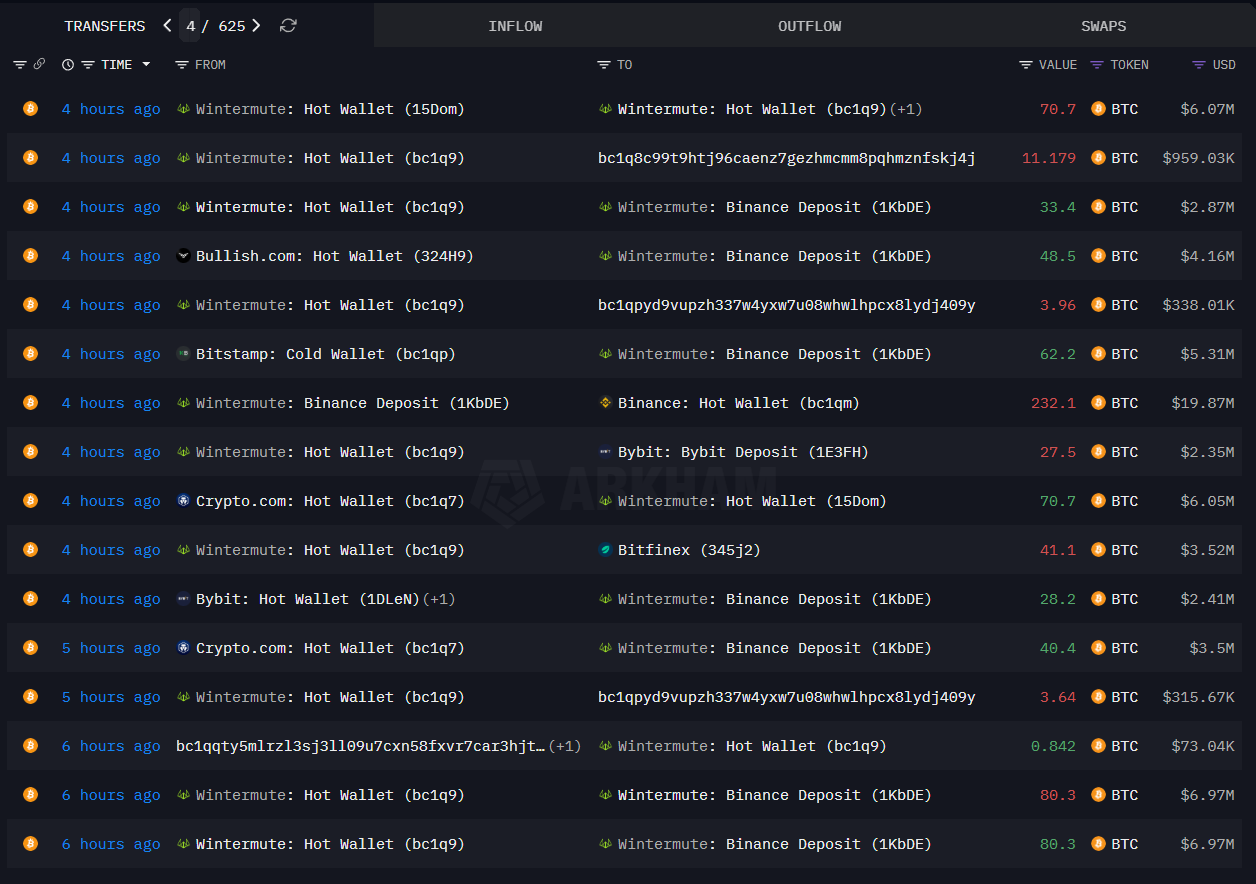

Series data shown That market producers like Wintermute They transfer Bitcoin between exchanges during a period of volatility. These transfers coincide with price fluctuations, but do not prove fraud.

Market makers regularly rebalance stocks during periods of stress. Deposits on exchanges can refer to hedging, margin management or providing liquidity, not necessarily selling at declining prices.

It is important that all this transition can be explained by mechanisms Well known market: Liquidation pools, leverage, and limited order books. There is no clear evidence of coordinated manipulation.

Sponsored

Sponsored

This episode highlights that A major risk in the Bitcoin market today.

Leverage remains high. Fluidity decreases rapidly during rapid movements. When the price approaches key levels, forced liquidations can dominate the price action.

The fundamentals of Bitcoin have not changed during these hours. Reverse this transformation Fragility of the market structurenot a long-term change in value.

Until the lever is reset and the positioning becomes more correct, similar strong movements remain possible. In this case, Bitcoin did not rise and fall because of the news.

It moved because leverage turned the price against itself.