Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

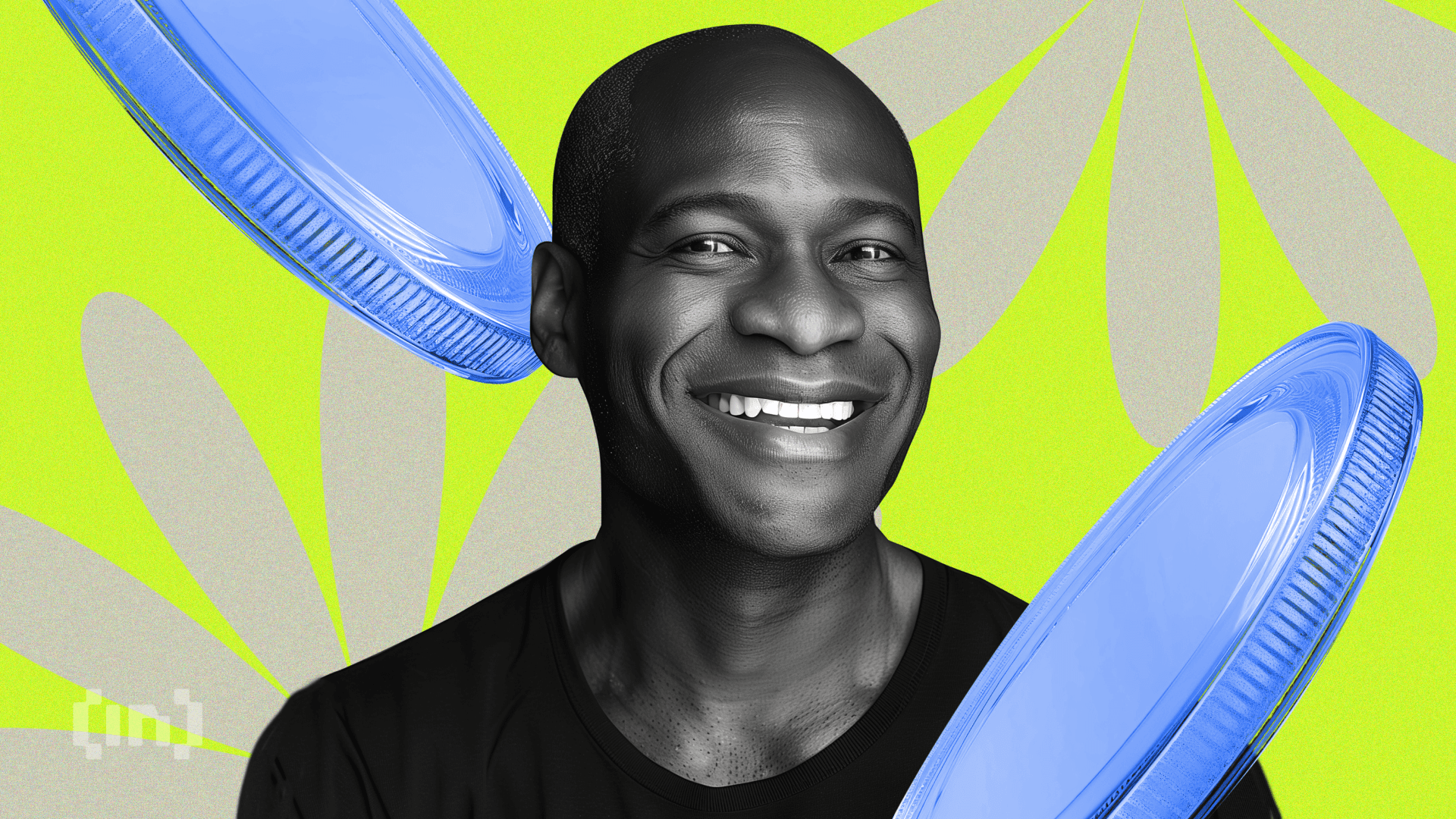

Arthur Hayes turned Monad (MON) into the most chaotic battlefield this week. Just 48 hours after boldly promoting the “MON at $10” token, the BitMix co-founder has completely reversed course.

Meanwhile, other whales continue to accumulate the token that appeared on the mainnet recently, but they continue to ride the wave of fraudulent token movements.

The former CEO of BitMex slammed the token, calling on traders to send it to zero, just two days after the price of MON hit a record. Strong increase after launch.

Sponsored

Sponsored

Hayes initiated the change on November 25, when he joked that the bull market needed “the last of the float-type, high-cap, useless tokens.” Infrastructure Layer 1 (L1),” before admitting he joined anyway.

However, on November 27, he declared that he was “out”, ruling out MON completely and telling the market to ignore it.

But blockchain data suggests that MON’s biggest players don’t share his pessimism.

On-chain tracking by Lookonchain showed that whale address 0x9294 withdrew 73.36 million MON (about $3 million) from Gate.io in 24 hours, indicating one of the largest collections of unique titles recorded this week.

Sponsored

Sponsored

BeInCrypto also reported that the giant whales (which hold the first addresses) Boosted its MON holdings by 10.67%bringing his total to 176.44 million MON after adding 17.08 million tokens worth about $717,000.

Meanwhile, fin whales added 4.80 million MON during the same period, increasing their activities by 9.51% to 55.42 million MON.

In total, the whales now control more than 300 million MON, a stark contrast to Hayes’ public rejection of the project.

While Hayes publicly attacked MON, he quietly shifted capital to other tokens. Reports Lookonchain reports that over the past two days, Hayes has compiled:

Sponsored

Sponsored

On November 26 only, spend Another $536,000 on the 218,000 PENDLE. ENA trades are more prominent. Just nine hours before Lookonchain’s latest reports, Hayes once again bought 873,671 ENA for $245,000, although he had sold 5.02 million ENA two weeks ago at a lower price.

Lookonchain reported that “(Hayes again) sells low, buys high,” suggesting either emotional trading or a deliberate strategy to expand into positions worth more than their initial entry.

Combined movements indicate… Broader business strategy. Hayes seems to be breaking out of the limited mega-cap narratives built on memes like MON while upping the ante on the “real returns” and liquid stakes represented by PENDLE, ENA and ETHFI.

This will be in line with the behavior of the broader market, where stable prices mean that spot flows, particularly from whales, now matter more than short-term hype cycles.

The contradiction between Hayes’ aggressive public promotion of MON and his heavy collection of whales at the same time also raises uncomfortable questions for the market.

Sponsored

Sponsored

Is his comment just an emotional reaction, or is it… It deliberately plays with volatility What do professional traders benefit from? The dynamic is reviving debates about whether crypto-influential voices could distort sentiment while others gather in the shadows.

However, investors should do their own research, as Hayes’ dramatic exit from the Moon has not deterred those with deep pockets. On the contrary, the whales seem to be more interested than ever, quietly absorbing the supply while individual traders absorb the noise.

As of this writing, Luna’s price has fallen by more than 13%, currently trading at $0.0412. This decline may stem from concerns following counterfeit token transfer attacks, where bad actors exploited the ERC-20 standard to trick users into fake wallet activities.

In one case, a fraudulent contract created false exchanges and disrupted business models around the Moon ecosystem. The transfers aimed to exploit the hype in the first hours after the launch of the Monad main network, when users opened wallets, staking tokens, and monitoring liquidity.