Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The price of Axi Infinity has dropped, but the bigger question is why the whales are buying now. Since January 21, AXS price has jumped about 41%, hitting a barrier near $3.00. The rise was rapid and largely uninterrupted. Now, the warning signs are starting to appear, with the price falling more than 17% day after day, even as the major shocks quietly add to their exposure.

This creates an obvious conflict. Whales are making a comeback, but several signals on the charts suggest that the risk of a near-term pullback is rising.

Sponsored

Sponsored

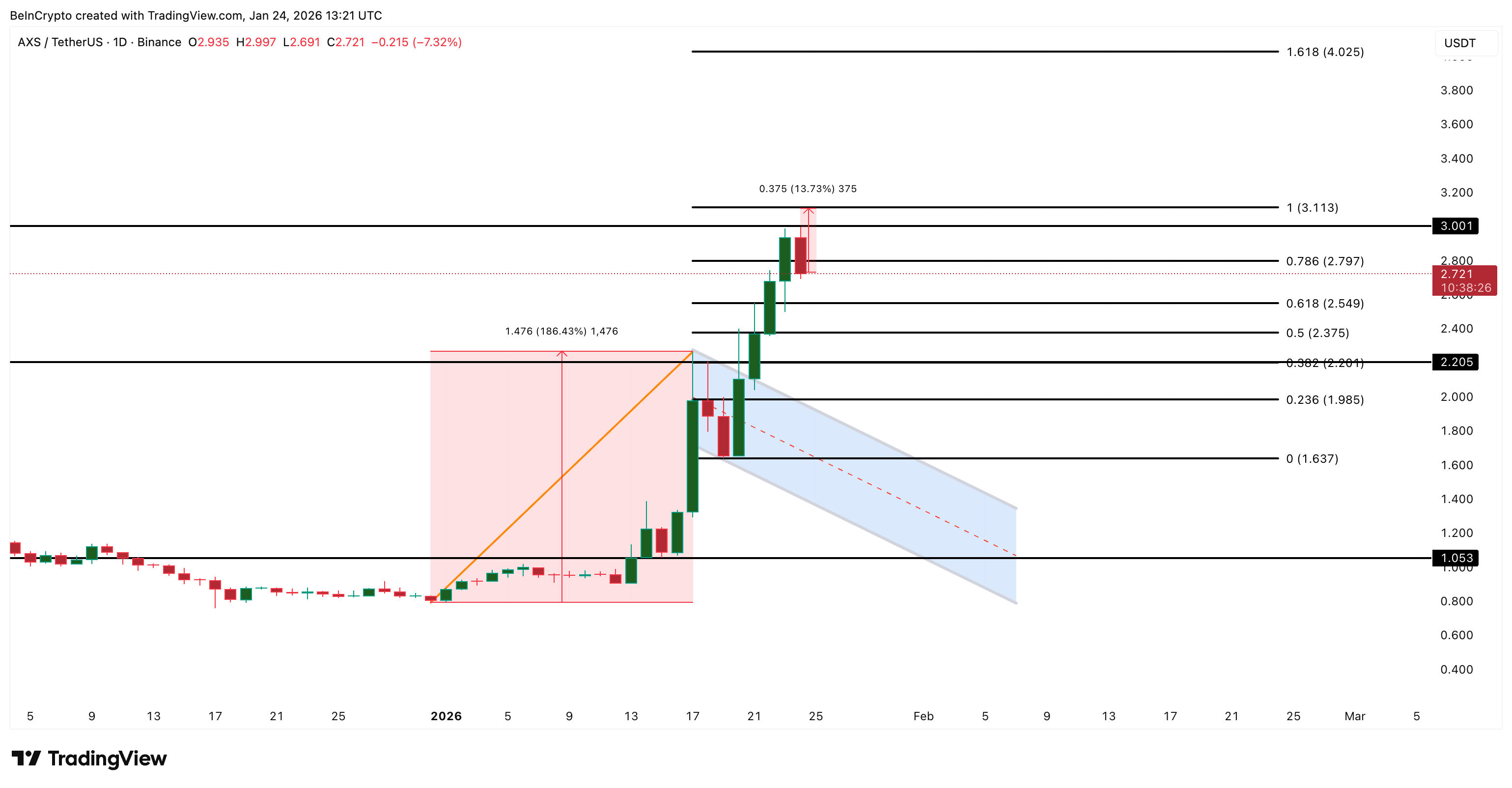

The first warning of the collapse came 24 hours earlier AXS candle structure Every day. A bearish harami pattern has formed near recent highs. A bearish harami occurs when a small red candle forms in the body of a previous strong green candle. This indicates that buyers are losing momentum and sellers are starting to resist.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

This model is important because Axi Infinity demonstrated this behavior at first. On January 18, a similar bearish harami appeared after a strong advance. In the following days, AXS corrected the assessment by about 26%. The move was driven by buyers pulling back as sellers used higher prices to exit.

This means a bigger collapse could be coming, especially since AXS is down 17% in the last 24 hours. After a growth of 41%, this indicates that the strength of the demonstration is no longer expanding. At least, not for a while.

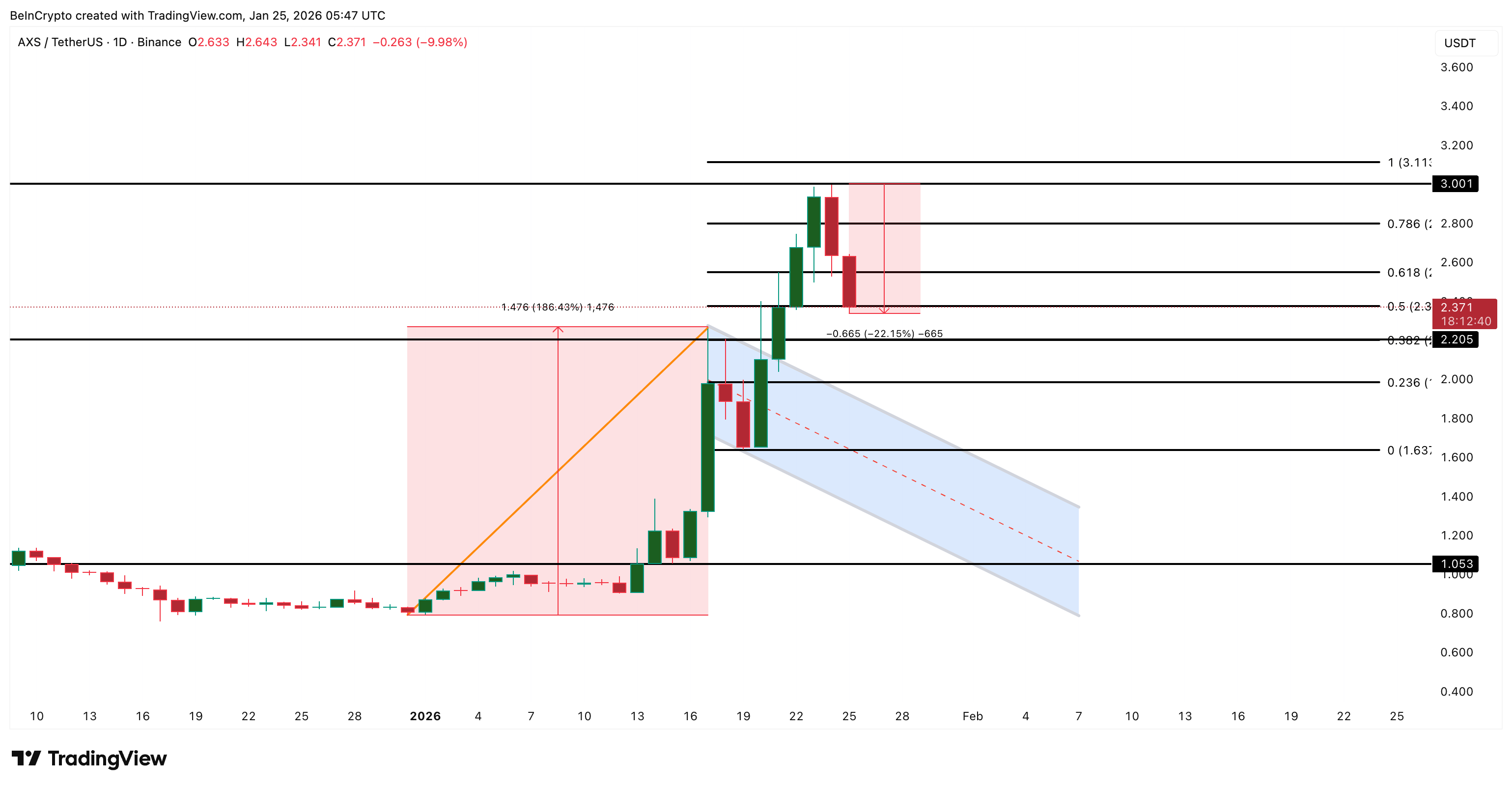

The chain data shows that something important has changed. Axi Infinity whales reduced exposure during the early stages of swarming. This marketing pressure was evident through Santiment’s data and coincided with a constant advance in prices. This confirms that AXS whales could use the 220% monthly price strength of AXS Infinity to bring back their losing positions.

This behavior has now changed.

Sponsored

Sponsored

Since January 22nd, whales holdings have increased from about 243.78 million AXS to about 243.94 million AXS. This is equivalent to adding about 160,000 tokens. At the current price, the purchase was worth about $430,000.

This suggests that the whales no longer use the demonstration to exit. Instead, they seem to be preparing for strength and conviction.

This adds today a layer of support, but does not remove the short-term risks posed by the bearish Harami candlestick pattern that has already begun the correction.

The exchange rate data confirms this mixed picture. On January 15, Axie Infinity saw a heavy exchange flow of around 4.07 million tokens, a clear indication of selling pressure. By January 18, flows turned very negative, with around 465,000 tokens leaving exchanges, indicating strong buying demand.

Sponsored

Sponsored

As of January 24, exchange flows had slowed to around 112,000 tokens. This means that buyers still dominate, but demand is weaker than before. Profits began to be made, even as the whales selectively increased. Are the whales making the right decision?

The impulse indicators have reinforced the warning. The money flow index, which tracks buying and selling pressure with price and volume, trended lower even as the price rose between January 17 and January 23, at $2.71.

It showed that the declines were not bought as strongly as before in the growth. The price of the AXS started to fall, and the immediate lower support below the lowest level.

From a price perspective, key levels are quickly starting to become clear. On the positive side, We need Axi Infinity To recover and hold the price above $3.00 (a key level that rejected the price earlier), then break above $3.11. A break above $3.11 would have brought it back to $4.02.

Sponsored

Sponsored

But this did not happen.

At the breakout, $2.54 emerged as decisive support. This level is in line with the 0.618 Fibonacci retracement and has acted as a strong reaction zone in the past. AXS lost $2.54, and the correction began.

The pullback may now deepen towards $2.20 and even $1.98, trapping more whales in the process.

The whales are buying, but the momentum is fading. Buyers are still in control, but they are no longer aggressive.

If Axi Infinity recovers above $2.54 and rebuilds momentum, the rally could continue. If not, the market may need a deeper correction before the next rally.