Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the US Morning Crypto News Report – your essential summary of the most important developments in crypto for the day ahead.

Grab a coffee to read how the Bitcoin mining sector is changing. Rising costs, falling fees and the rise of artificial intelligence are forcing miners to rethink their strategies, turning previously stable operations into a battleground for next-generation computing power.

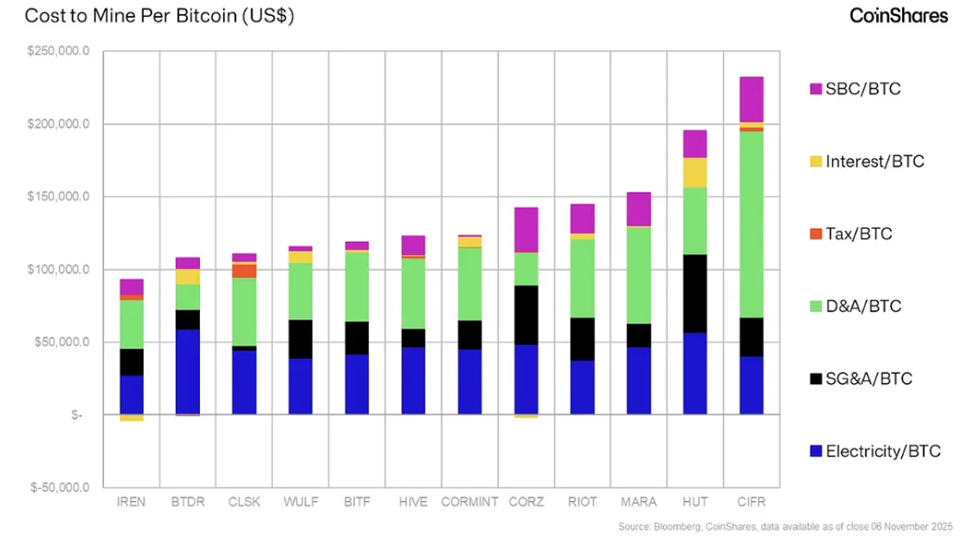

a report CoinShares for Bitcoin mining in Q4 2025 He said the sector had reached breaking point. Production costs have reached all-time highs, the price of hash has collapsed, and artificial intelligence (AI) is now outwitting miners for their infrastructure, creating the most dramatic structural change the sector has ever faced.

Sponsored

Sponsored

The industry entered the second quarter of 2025 with a new harsh reality:

Despite the collapse in margins, the Bitcoin network continued to grow, passing 1 zeta hash/s for the first time in August.

Public miners have contributed only about 80 EH/s of the year-to-date growth rate, meaning that most of the expansion now comes from private operators, sovereign miners, and well-funded power units with much cheaper power.

Result: Miners are diluted due to the growth of hash power that they no longer drive.

Much greater disruption is unfolding at the infrastructure level. Industrial-scale mining campuses, ranging from 100 MW to 1 GW, share almost identical power, cooling and rack density requirements with modern AI data centers.

Those interactions are transformed Mining facilities At the main targets for the technology giants.

Offered by Google-TeraWulf And Google-Cipher isMulti-site agreements with Fluidstack All point in the same direction of the great technology that moves towards the mining power integrated in its capacity at the premiums of the price.

The math explains why. Bitcoin mining produces about $1 million per megawatt, while AI computing produces $10 to $20 million per megawatt.

Sponsored

Sponsored

No miner can ignore this difference.

The sector is now divided into two clear models:

These allow the facilities to optimize the electrical topology and operational time standards to meet the needs of the company. They sign long-term contracts of up to a full decade and switch from volatile block rewards to fixed income based on capacity.

2. Cheap, mobile miners → transition to finite energy

Miners unable to compete with AI are moving off the grid: flared gas, remote hydropower and surplus renewable energy. Portable drilling rigs are deployed wherever there is economic power, reflecting the decentralized roots of mining in its infancy.

This transition signals a long-term reshaping of the industry, not a temporary cycle.

Sponsored

Sponsored

According to a report from CoinShares:

Analysts expect the hash rate to remain in a range of $37-55 per PH/s/day until 2028, unless BTC grows much faster than the growth of the hash rate.

For the first time in Bitcoin history, miners are excluded from their own infrastructure.

The superior economics of artificial intelligence, massive transaction processes and the rising costs of industrial mining are driving the industry into a permanent transformation.

The Bitcoin network remains strong, as the hash rate is still increasing, but the work of mining is quickly being rewritten.

This puts miners in a dilemma, either investing heavily in AI or switching to finite energy.

Sponsored

Sponsored

Here’s a roundup of the top US cryptocurrency news to follow today:

| Company | At the end of December 2 | Overview of the market before the opening |

| Strategy (MSTR) | $181.33 | $185.83 (+2.48%) |

| Coinbase (COIN) | $263.26 | $269.39 (+2.33%) |

| Galaxy Digital Holdings (GLXY) | $25.36 | $25.90 (+2.13%) |

| MARA centers | $11.91 | $12.27 (+3.02%) |

| RIOT Platforms | $15.22 | $15.55 (+2.17%) |

| Core Scientific (CORZ) | $15.82 | $16.03 (+1.33%) |