Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The price of Ethereum has risen more than 13% since December 1, supported by a broader market recovery and growing optimism ahead of today’s Fusaka update, which will improve the network’s efficiency of processing transactions. ETH is still up 17% over the past month, but the recent recovery and many technical signals are similar to what happened before the Pectra update in May 2025, when Ethereum increased 56% in seven days.

The question now is simple: Can Fusaka galvanize such a movement again?

Sponsored

Sponsored

During the Pectra phase (6-13 May), Ethereum rose From 56% after showing a record upward deviation. This pattern occurs when the price makes lower lows, but the Relative Strength Index (RSI, a measure of momentum from 0-100) makes lower lows. This often indicates that sellers are losing control even when the chart still looks weak, indicating a further trend reversal.

Note: The Pectra update took place on May 7, 2025.

The same setup is now taking shape.

Between November 4th and December 1st, ETH made new lows, but the RSI made new lows. This reflects the same structure that existed before the Pectra movement.

Want more ideas about tokens like these? Subscribe to editor-in-chief Harsh Notariya’s cryptocurrency newsletter here.

Sponsored

Sponsored

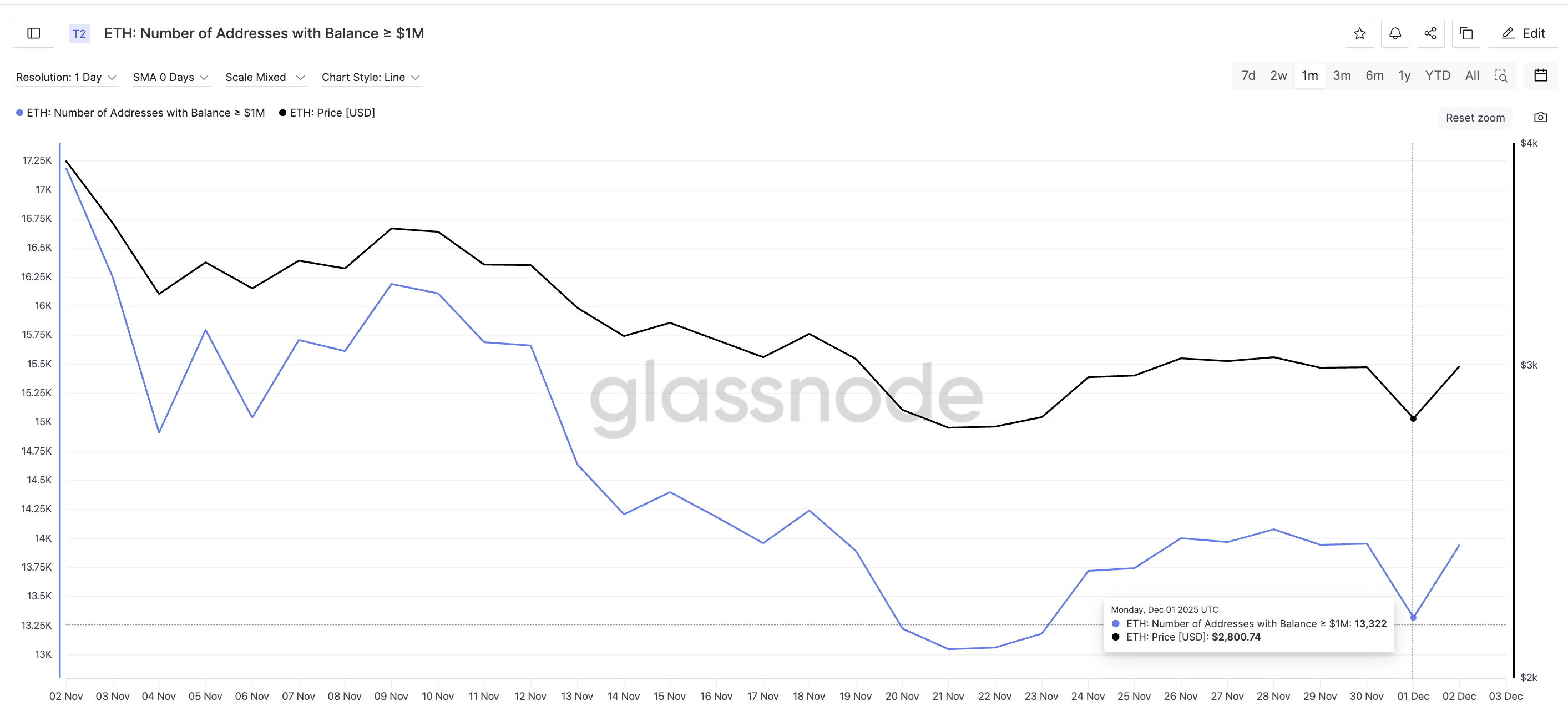

Big investors also show early accumulation.

The number of Ethereum addresses holding at least $1 million increased from 13,322 to 13,945, an increase of 4.68%. Since each wallet contains a minimum of $1 million, this reflects at least $623 million of added capital entering the first tier of network holders. Entrance of large buyers before the event Great technology upgrade It is considered a historically constructive sign.

Together, the divergence model and new large portfolio flows make for a situation that could make… Fusaka acts as a catalyst -If the base explosion level is exceeded.

Sponsored

Sponsored

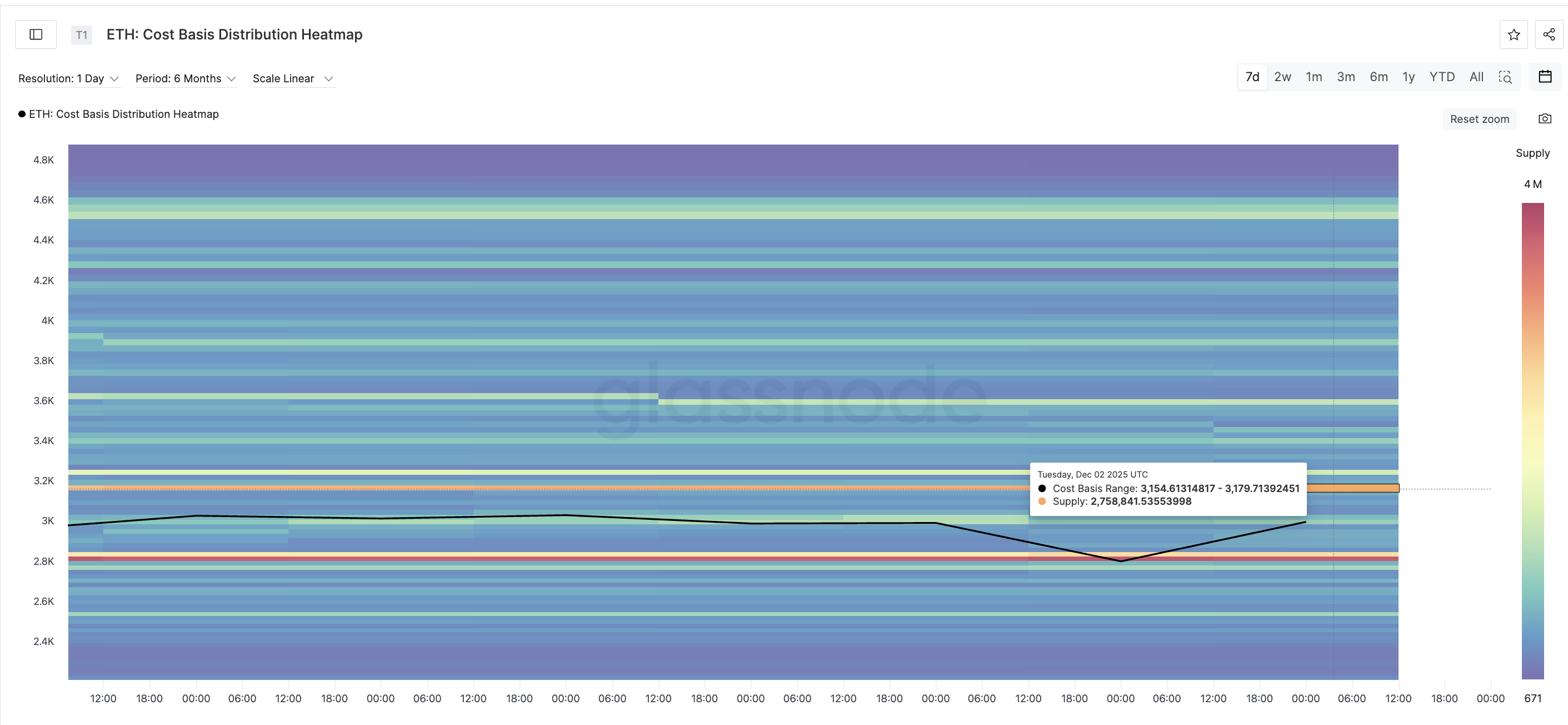

Ethereum showing a Pectra-style extension is based across a single supply wall. The cost breakdown for Glassnode reveals the largest pool of supply at a low price between $3,154 and $3,179, where approximately 2.76 million ETH are located. This is in line with paper resistance at $3,166 (strong resistance and support line).

Clean Ethereum Daily Wax demonstrates Above $3,166:

Sponsored

Sponsored

• Buyers have almost consumed the largest supply space

• Open the way to pay about $3,653

If the momentum reverses the structure of BECTRA, an extension of 56% from the lows of December would seek to target $4,262, which also corresponds to a strong historical ceiling.

On the upside, the ETH structure is weakening below $2,996. Losing this range exposes $2,873, and if the selling pressure expands, $2,618 becomes the deepest support to watch the price of Ethereum.