Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

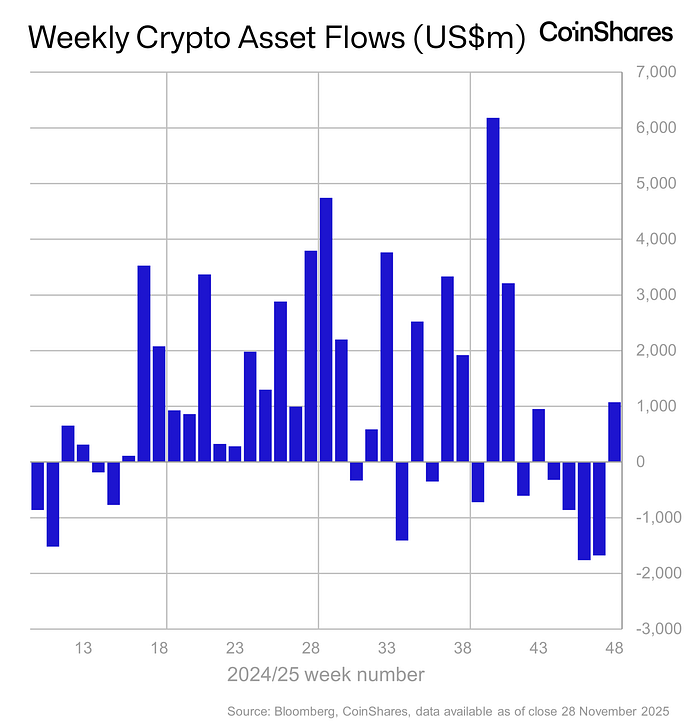

Digital asset investment inflows reached $1.07 billion after four weeks of withdrawals, as hopes for an interest rate cut by the US Federal Reserve revived investor confidence.

Market sentiment changed following comments from FOMC member John Williams, who indicated that monetary policy remains tight. This fueled expectations of a possible rate cut in December and spurred new investment.

Sponsored

Sponsored

The $1.07 billion inflow comes after digital asset exchange products (ETPs) saw $5.7 billion in outflows over the previous four weeks. last week, Cryptocurrency flows reached $1.94 billion.

Attribute CoinShares latest weekly report Last week’s inflows led to John Williams’ comments on US monetary policy, leading to speculation of a possible easing.

Business volumes fell to $24 billion during the week of Thanksgiving, compared to $56 billion the previous week. Even with slow trading, investors moved capital into products Encryption At a rate not seen since early November.

Interest rates greatly influence digital markets. Low rates reduce the opportunity cost of holding unprofitable assets, for example Bitcoin.

Sponsored

Sponsored

This change makes risky assets more attractive to institutional investors looking for higher returns. Traditionally, easier monetary conditions have been associated with the manifestation of digital assets.

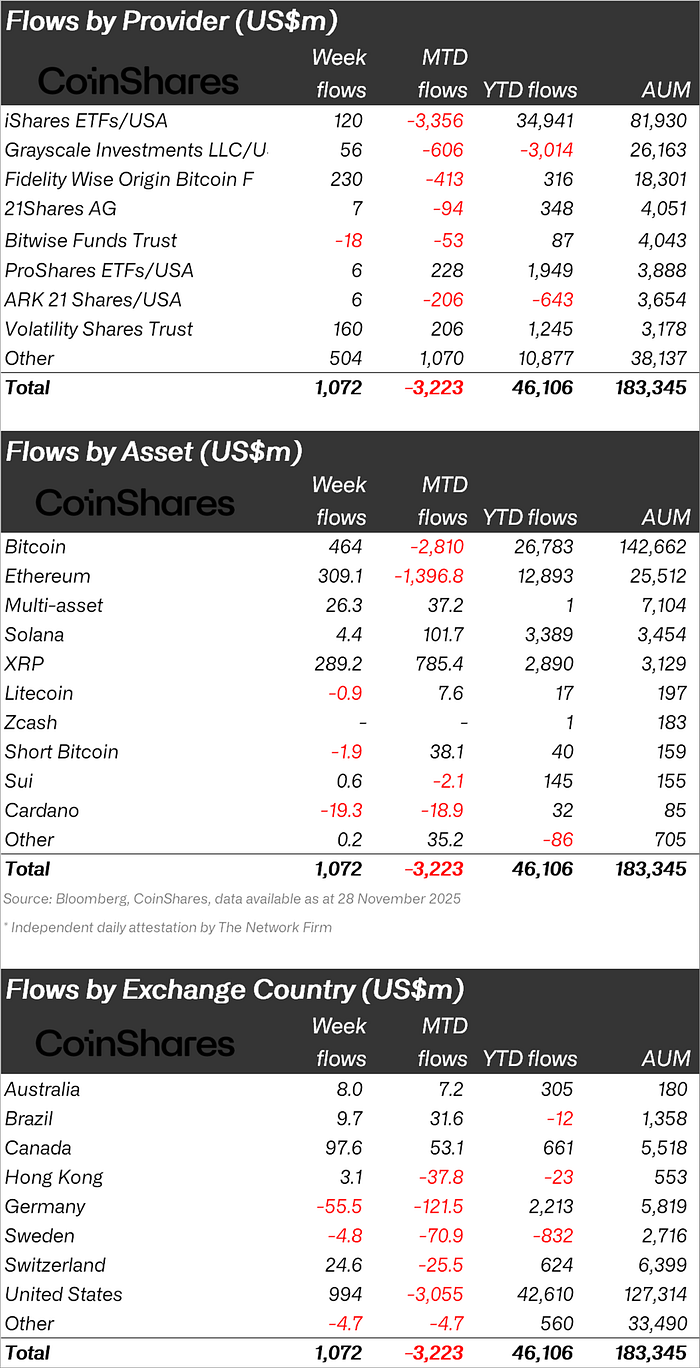

The United States accounted for 93% of total cryptocurrency inflows, while Canada saw $97.6 million in flows and Switzerland $24.6 million, reflecting strong demand in regions that support traditional cryptocurrencies.

In contrast, Germany saw $55.5 million in outflows, indicating mixed investor confidence and a possible portfolio adjustment at the end of the year.

Sponsored

Sponsored

Bitcoin raised $464 million, confirming its position as the highest institutional holding. Ethereum came next with $309 million, driven by expectations of network upgrades and increased deposits.

In particular, “XRP” was reported by CoinShares to be the most prominent with a record flow of $289 million.

“Short-Bitcoin ETPs” saw outflows of $1.9 million, showing that traders are moving away from bearish bets. This ongoing change is consistent with widespread optimism and reduced coverage among participants.

Cardano saw inflows of $19.3 million, shedding 23% of its assets under management. This suggests a selective institutional interest, with capital flowing towards prominent leaders and emerging narratives rather than being distributed equally among all. Alternative currencies.

Sponsored

Sponsored

Data on the chain highlights notable supply movements that support bullish sentiment. A market watcher on

This model suggests that investors move assets into long-term storage, reducing the supply for immediate sale. As the new institutional demand via ETP converges with a decrease in supply, the result can be a tightening of prices and upward momentum.

The intersection of positive macroeconomic signals, regulatory developments and new investment vehicles opened the door to continued flows.

In December and beyond, the interaction between the policy of the Federal Reserve, institutional demand, andCryptocurrency markets It will determine whether this reversal will lead to a sustained rally or just a pause in the recent weakness.