Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

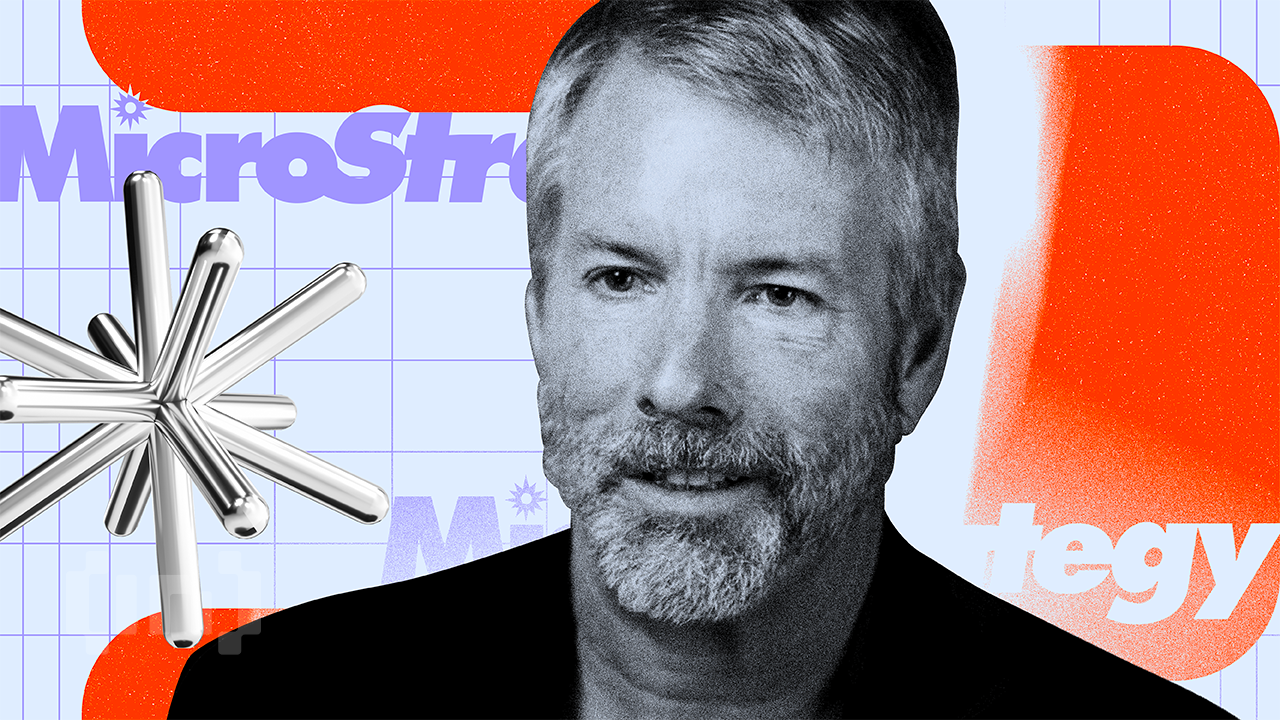

MicroStrategy CEO Michael Saylor’s mysterious post raised, “What if we start adding green dots?” On the well-known Bitcoin accumulation card, there is widespread speculation in cryptocurrency circles.

The signal seemed to coincide with CEO Feng Li publicly admitting, for the first time, that the company may sell Bitcoin under certain conditions of pressure. This dual narrative may mark a turning point for a more aggressive corporate treasury strategy in the Bitcoin world.

Sponsored

Sponsored

In Saylor’s post Sunday X A diagram of the company’s Bitcoin wallet was shown. It showed 87 purchase events including 649,870 Bitcoin units, valued at $59.45 billion, with an average cost of $74,433 per Bitcoin. The orange dots mark each purchase since August 2020, while the green dashed line indicates the average purchase price.

I quickly learned about the cryptocurrency community Green dots As an accelerated Bitcoin buy signal. where The analyst summed up the situation optimistically Noting that MicroStrategy has the capital, conviction, significant net worth and cash flow to support ongoing purchases. However, some have proposed alternative theories, including a possible stock buyback or asset restructuring.

These ambiguities reflect Saylor’s history of obscure letters. His supporters see his posts as deliberate strategic gestures, while skeptics wonder if they are merely reactive. However, the timing of this signal, coupled with the financial disclosures, suggests more than just a comment.

In a major shift from MicroStrategy’s “no selling” philosophy, CEO Feng Li has publicly admitted that the company may sell Bitcoin if certain crisis conditions arise. MicroStrategy will consider the sale Only if two drivers are found: stock trading below 1x adjusted net value (mNAV) and the company’s inability to raise new capital through equity or debt.

Sponsored

Sponsored

Net worth measures a company’s institutional value divided by its Bitcoin holdings. On November 30, 2025, mNAV was close to 0.95, close to the limit. If it falls below 0.9, MicroStrategy may have to liquidate its Bitcoin to meet the… Annual preferred stock dividend obligations from $750 million to $800 million.

The company issued perpetual preferred stock throughout 2025 to finance the purchase of Bitcoin. According to Official press releasesPerpetual Series A preferred stock with an interest rate of 8.00% requires a quarterly dividend beginning on March 31, 2025. These continuous obligations add new pressure on liquidity, especially since the stock markets react less to new issues.

This policy change provides a measure of the level of risk. Analysts now consider MicroStrategy as Bitcoin ETF: Benefit from appreciation in rising markets, but are exposed to double the risk when liquidity is tight.

He adds Recent Bitcoin price action An important context for Saylor’s letter and Lee’s confession.

MicroStrategy’s portfolio showed an upside of 22.91% ($11.08 billion) until November 30, 2025, raising its valuation to $59.45 billion. However, its shares have fallen more than 60% from recent highs, exposing a gap between Bitcoin earnings and shareholder returns. This gap affects the NAV calculation and raises questions about the sustainability of the strategy.

Some members of the community recognize this tension. One observer commented To X The green dots may suggest more Bitcoin holdings, but the key issue is whether MicroStrategy can survive the steep declines without a forced liquidation. This highlights the challenge of the strategy: strong in bull markets, but unproven in declines.

Second For the company’s financial results in the third quarter of 2025, I lost He held approximately 640,808 BTC as of October 26, 2025, at an original cost of $47.4 billion. The subsequent rise to 649,870 BTC since November 30 highlights the continued accumulation despite the volatility.