Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

SanDisk Corp. will join. On the S&P 500 on Friday, November 28, 2024, it will replace Interpublic Group of Companies Inc., according to the S&P Dow Jones Index. After Monday’s announcement, shares of the computer storage maker rose more than 9% in after-hours trading.

This marks a rapid rise for SanDisk, while Strategy (formerly known as MicroStrategy) faces another setback, as it is still excluded from the S&P 500 despite holding more than 640,000 units of Bitcoin.

Sponsored

Sponsored

SanDisk’s move from the S&P SmallCap 600 to the S&P 500 reflects its strong market performance in recent months. Driven by demand for AI applications, the company’s market capitalization has reached nearly $33 billion. Getting out of the usual small indexes makes switching to the S&P 500 a logical move.

The announcement came just before the holiday trading session Thanksgiving DayThis highlights the urgent need to restore balance. The replacement is outside the usual quarterly balance sheet, which indicates strong market momentum. The stock closed up 13.33% on the day of the announcement before rising after hours.

Joining the S&P 500 typically attracts large flows of passive investment, as index-tracking funds buy stocks to maintain their weighting. This change increases the appeal and flexibility of SanDisk institutional investments. It also increases the profile of the company among investors who focus on large stocks in the index.

SanDisk’s rally is underpinned by optimism around its AI infrastructure. As companies use more advanced machine learning models, storage solutions become more important, driving investor enthusiasm and increasing SanDisk’s valuation over the past year.

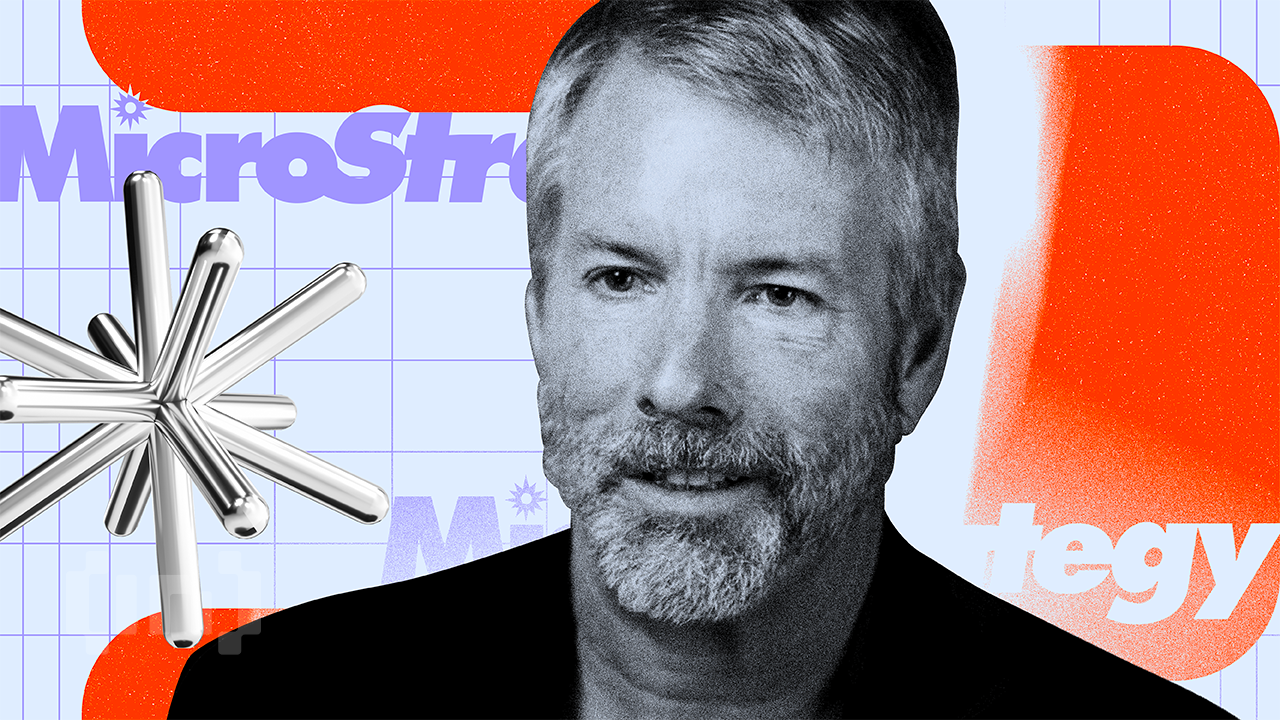

While SanDisk celebrates, the Strategy remains out of the loop, even after meeting many technical requirements. The company is led by CEO Michael Saylor, He owns 640,808 BTC, Its value is appreciated With approximately $72.3 billion, making it the largest institutional holder of Bitcoin in the world. However, this concentration of assets is considered a disadvantage by index decision makers.

Sponsored

Sponsored

Strategy is not included September remodeling For the index, he chose Robinhood, AppLovin and Emcor. Analysts put the possibility of the company joining in December at 70% after strong results in the third quarter. The company reported profits of $3.8 billion in the third quarter, which shows profitability linked to Bitcoin price movements.

Earnings volatility remains the main obstacle. Strategy results fluctuate every quarter with Bitcoin pricewhich creates a discrepancy with the requirements of the S & P 500. For example, in the second quarter of 2024, $ 10 billion in revenue was generated and $ 14 billion in unrealized gains, while the first quarter saw a loss of $ 4.2 billion. The indicator requires four consecutive quarters of positive earnings – a limit that the strategy has not been able to overcome due to its Bitcoin-heavy approach.

S&P Dow Jones Indices gave the strategy a “B-” credit rating, citing high exposure to Bitcoin, low US dollar liquidity and a tight business model. These factors contribute to traditional financial skepticism about digital treasury companies. The assessment shows that the committee sees the volatility of Bitcoin as inconsistent with the stability expected in the S&P 500 members.

If the strategy meets the market capitalization and liquidity criteria, the committee also takes into account the diversification of the business model, financial stability and sector representation. While some call for evolving index methodologies to include innovative treasury approaches, traditionalists insist on consistent and proven returns, particularly for benchmarks like the S&P 500.

SanDisk’s approach and strategy highlights a wider gap between the traditional business models of finance and digital assets. Some companies with exposure to cryptocurrencies like Robinhood have entered the S&P 500, but the strategy’s Bitcoin-focused position poses unique challenges. The company’s shares have fallen 35% from a July high of $434, reflecting disappointment over the foreclosure and credit rating issues.

Nasdaq’s audit of digital asset treasury companies adds further hurdles to the strategy. As you point out Industry analyticsthe skepticism of traditional finance extends beyond earnings volatility to include concerns about long-term business models and regulatory compliance. This concern persists, although the strategy has occasionally outperformed Bitcoin and the S&P 500, as Saylor highlighted.

On the other hand, Recent MSCI advice That the strategy could be removed from the main stock indices has raised the interest of investors to know if a similar squeeze could eventually extend to the S & P 500. While the company’s listing on MSCI USA and MSCI World has directed billions of dollars of passive capital in the shares, analysts now know that its more Bitcoin-centric profile cannot comply with traditional index methodologies.

That has raised questions in the broader market about whether the valuation premium associated with the index’s expected stability is at risk — and whether its future eligibility for the index, including unlikely hopes of entering the S&P 500, may be further complicated by increased scrutiny.