Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The price of Ethereum has rebounded almost 10% from this week’s lows near $2,600, and the price is up 1% today. The movement seems to be positive, but the recovery may not last.

Two main signs of the bear market appeared at the same time. Together, you threaten to end the repayment before it grows.

Sponsored

Sponsored

Two related signals now point to deeper weakness.

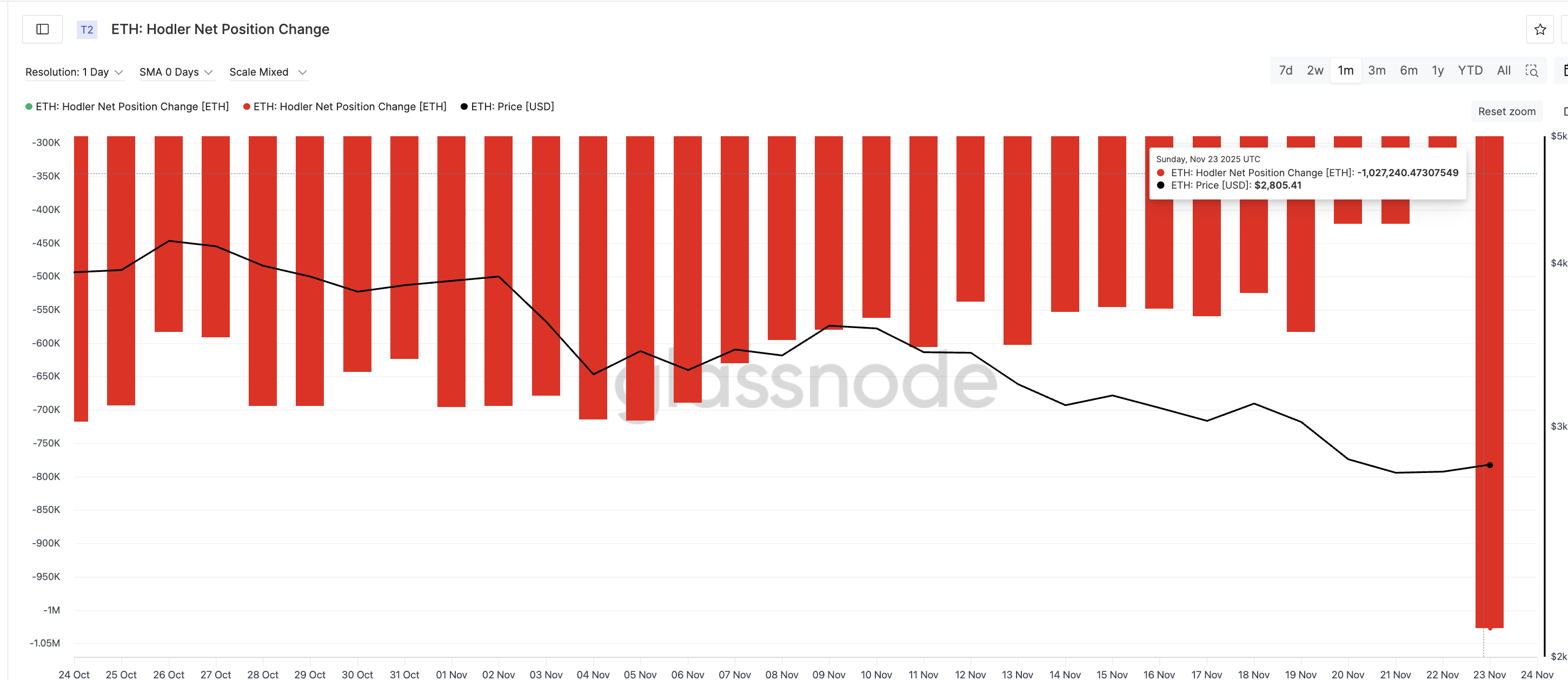

The first comes from long-term investors, often called huddlers. These are the wallets I usually use Hold ETH For more than 155 days. When hudders sell higher, it usually shows fear or a change in long-term belief.

On November 22, the net sale of these wallets was about 334,600 ETH. On November 23, it jumped to 1,027,240 ETH – a 300% increase in one day. This is a significant exit from long-term holders and adds significant supply at a time when ETH is already trading in a broader trend.

Want more icon ideas like these? Subscribe to Harsh Naturia’s daily cryptocurrency newsletter here.

Sponsored

Sponsored

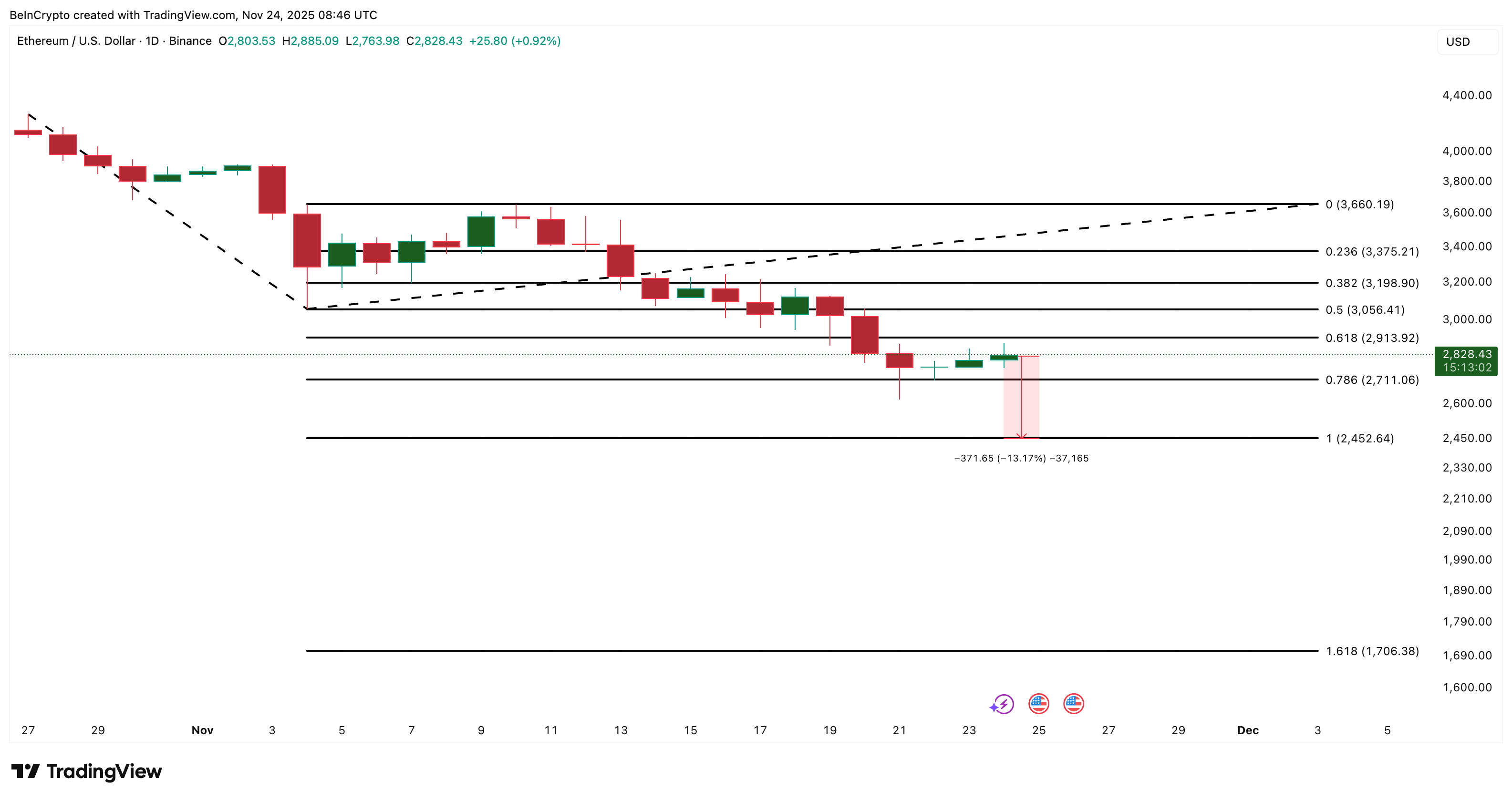

At the same time, a cross of death is almost taking shape. A death cross occurs when the 50-day exponential moving average (EMA) falls below the 200-day EMA. The exponential moving average gives more weight to recent prices, so it reacts faster than the simple moving average.

When the 50-day EMA crosses below the 200-day, it indicates strong downside momentum. This could significantly affect ETH prices if the selling pressure continues to increase.

Here is the basic link:

Sponsored

Sponsored

The selling of the holders of the coin increases sharply at the moment when the exponential moving average structure turns bearish. This means selling pressure will strengthen the deadly crossover signal instead of slowing it down. When these two signals appear together, The recovery of the price usually stumblesRetest lower support levels.

Ethereum is now trading near $2,820, but the chart shows more pressure at the top than support at the bottom.

ETH must defend the first level $2,710, which is the zone of 0.786 Fibonacci. A loss at this level would pave the way for a drop to $2,450, representing a decline of about 13% from current levels. If the fatal cross completes while holders continue to sell, ETH could fall directly towards and below this level if market conditions weaken.

Sponsored

Sponsored

Below $2,452, the next deepest support is near $1,700 – the widest extension of the bearish structure. This only comes into play if the trend accelerates and sellers remain dominant.

Ascension remains limited unless he can ETH price restored: :

In the current conditions, hitting these levels seems difficult because the two bearish signals – the rising sell holder and the death cross – remain active.