Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin has seen a sharp decline in recent days, falling to a six-month low as bearish momentum strengthens. This decline pushed Bitcoin below key psychological levels and left traders preparing for further declines.

Despite the weakness, several indicators indicate that a potential possibility is bubbling under the surface.

The RSI has entered oversold territory for the first time in nine months, indicating intense selling pressure. The last time Bitcoin was officially in oversold territory was in February, a period that preceded a remarkable recovery. Oversold conditions often indicate impending reversals, but the timing remains uncertain.

Sponsored

Sponsored

During the previous oversold event, Bitcoin fell by an additional percentage It reached 10% before the rebound started. A similar pattern could now send Bitcoin towards $77,164 before buyers take back control. If the decline is contained and a deeper decline is avoided, Bitcoin could recover soon.

Want more insights into icons like these? Subscribe to Editor Harsh Notaria’s daily cryptocurrency newsletter here.

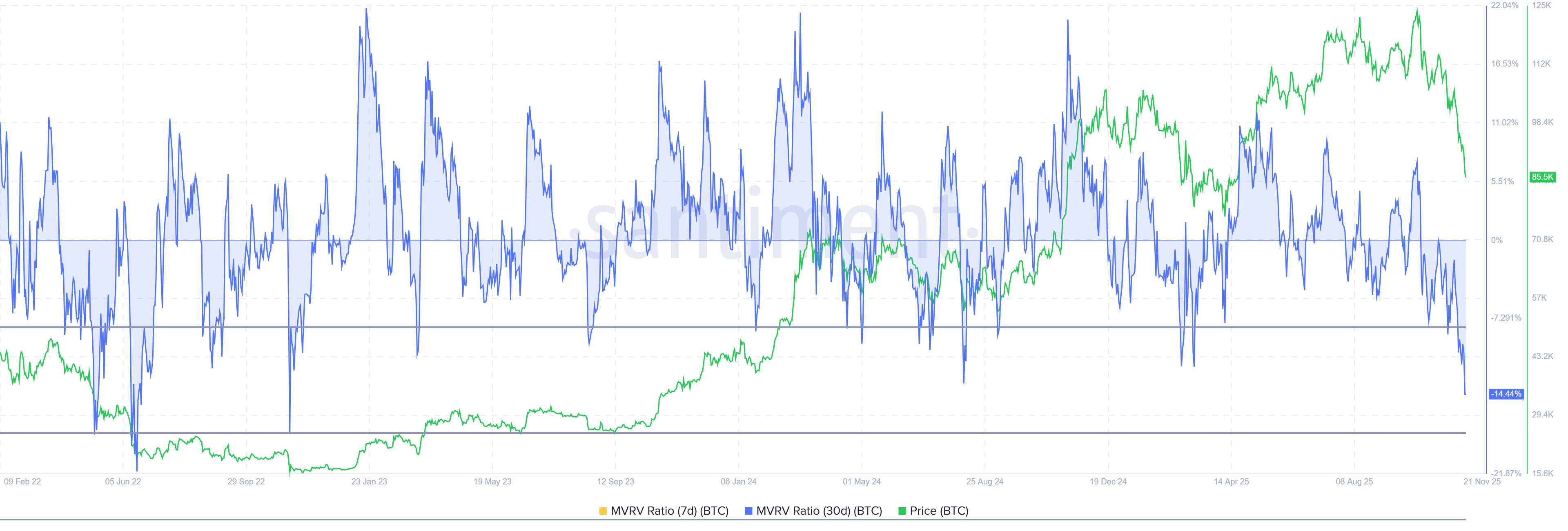

Macro momentum indicators also indicate a low valuation. MVRV report for Bitcoin It stands at -14%, registering its lowest level in three years. The 30-day MVRV report indicates two clear signals: Bitcoin holders are currently at a loss, and Bitcoin is valued below historical standards. This situation tends to slow down sales and increases accumulation.

The area between -8% and -18% is traditionally known as the “opportunity zone”, a ratio where downward pressure usually saturates. Sales depletion usually leads to stable accumulation, which supports the recovery.

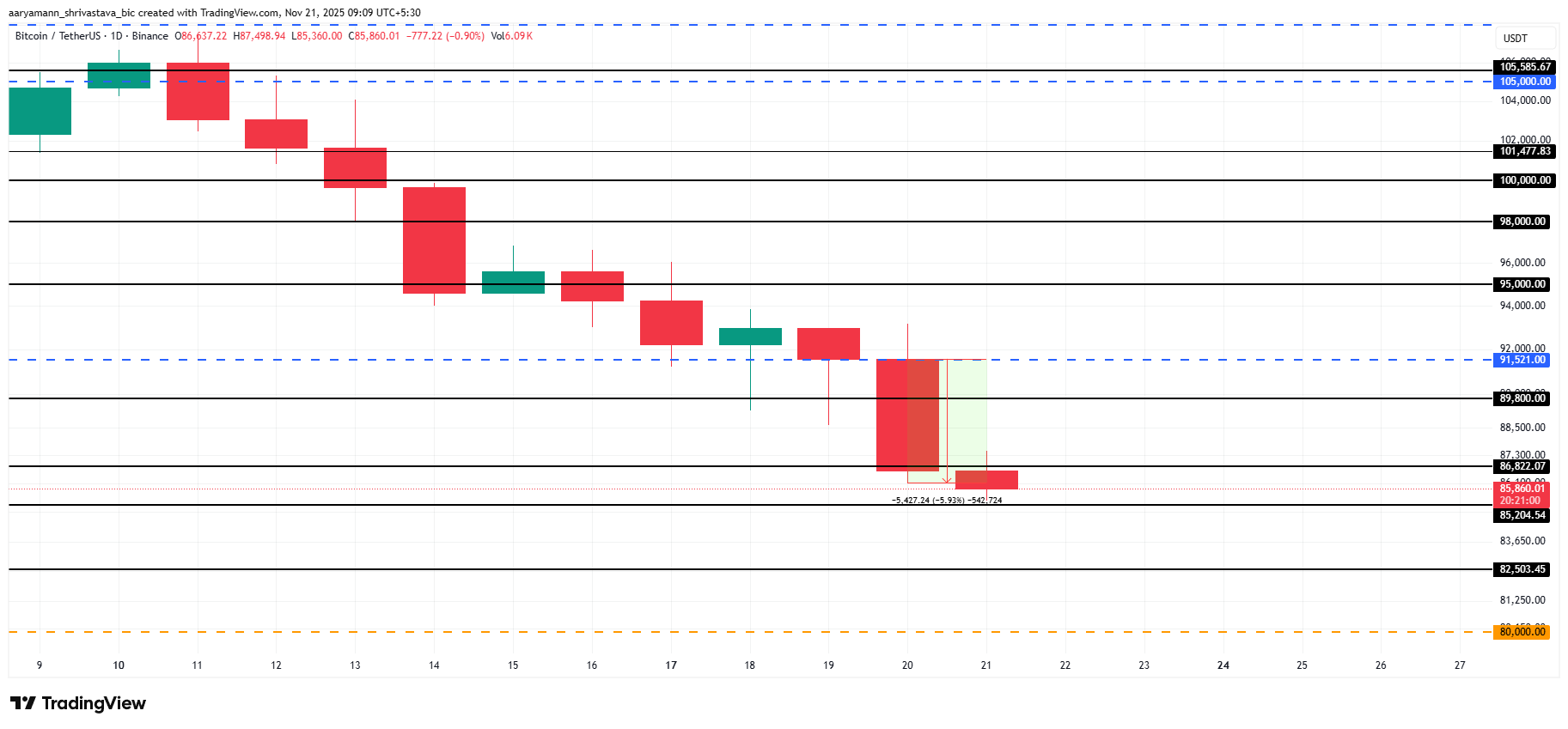

Bitcoin is trading at $85,860 at the time of writing and is holding above the crucial $85,204 support level. Based on current indicators, Bitcoin may face a slight further decline before rebounding, especially if oversold conditions intensify.

A continuation of the downtrend could push Bitcoin at $77,164, which is in line with the historical RSI pattern. It could slide to $80,000 if Bitcoin loses support at $85,204 and then $82,503. Both scenarios represent continued selling pressure before stabilization.

If he can Bitcoin rebound From current levels, it can break above $86,822 and retest $89,800. A successful move higher will allow BTC to target $91,521 as support and push towards $95,000. This will negate the downtrend and signal a stronger recovery.