Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin fell below $87,000 on November 20, 2025, amid a storm of quantum security concerns and a $1.3 billion “WILL” collapse. In the process, he dropped nearly $220 million in long positions.

That sharp drop extended a two-day pattern of Asian rallies marred by a selloff in U.S. markets. Traders struggled with mixed signals from institutional buyers and a wave of panic selling.

The latest sell-off accelerated after billionaire Ray Dalio expressed concerns about… Scalability of Bitcoin To advance in Quantum computing.

Sponsored

Sponsored

His statements sparked debate in the cryptocurrency community, focused attention Cryptographic Security Risks.

But market analysts have pushed back against the quantum panic narrative. Mel Matteson, a financial analyst, argued that these concerns are overblown and ignore the strength of Bitcoin crypto compared to traditional banks.

This debate reflects a major divide in how investors assess long-term technology risks. While Dalio highlighted theoretical loopholes with the development of quantum computing, critics pointed out that Bitcoin’s SHA-256 provides stronger security than the RSA standard used by most banks.

If quantum computers pose a threat to Bitcoin, global banks could face much greater risks.

Adding to the quantum security concerns, blockchain analytics firm Arham has reported a major collapse. Owen Gunden, an early adopter of Bitcoin who had accumulated holdings since 2011, sold the entire 11,000 BTC for about $1.3 billion.

Sponsored

Sponsored

Gonden exit is entered A difficult time for morale. According to data from BeInCryptoBitcoin was trading at $86,767 when last updated, down 2.55% in 24 hours.

This whale’s decision to sell after 14 years highlighted a change in the usual mindset of long-term holders. The reasons are not clear, whether to take advantage of profits, rebalancing, or concerns about the future of Bitcoin.

However, the sale injected additional supply into an oversold market and deepened the price decline.

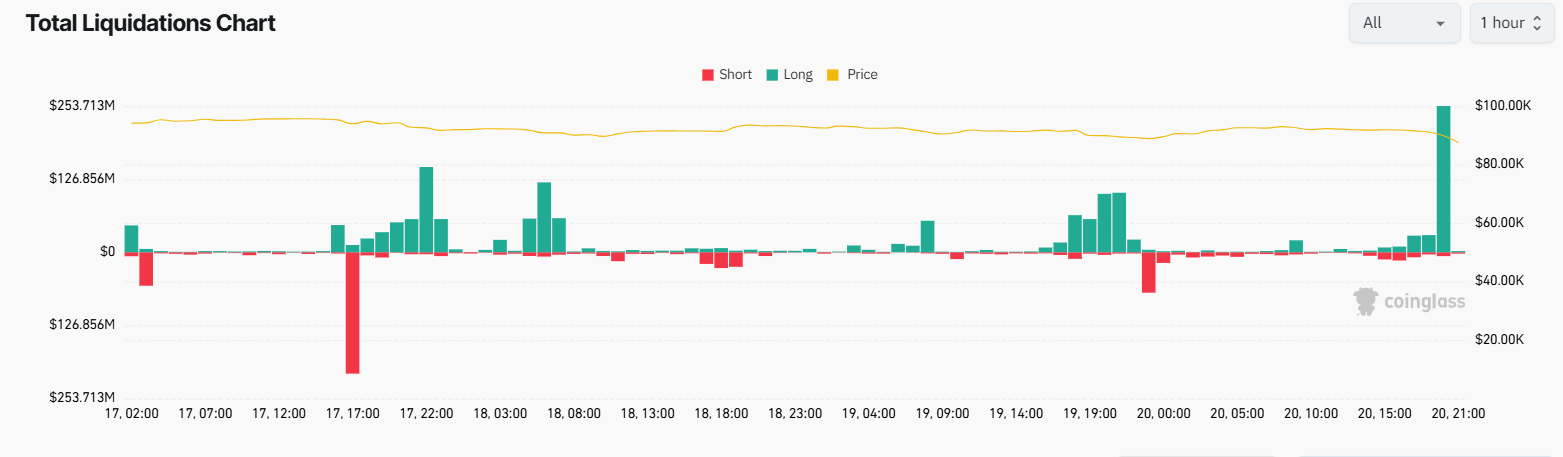

Quantitative fears and whale sales have sparked a series of large liquidations on exchanges. Show data CoinGlass More than $910 million worth of cryptocurrency positions were liquidated in 24 hours, forcing 222,008 traders to exit.

Sponsored

Sponsored

During one hour in early US trading, the liquidation of long contracts rose to $264.79 million while short contracts reached $256.44 million.

These forced shutdowns have highlighted the high leverage in cryptocurrency markets and how… Positions expire quickly During strong market movements.

This collapse also exposed structural weaknesses in cryptographic derivatives. As Bitcoin fell from above $91,000 to $86,000 in 48 hours, leveraged traders were faced with margin calls and their positions were automatically closed.

This spontaneous selling led to further price declines and additional liquidations, resulting in a cycle of volatility.

Sponsored

Sponsored

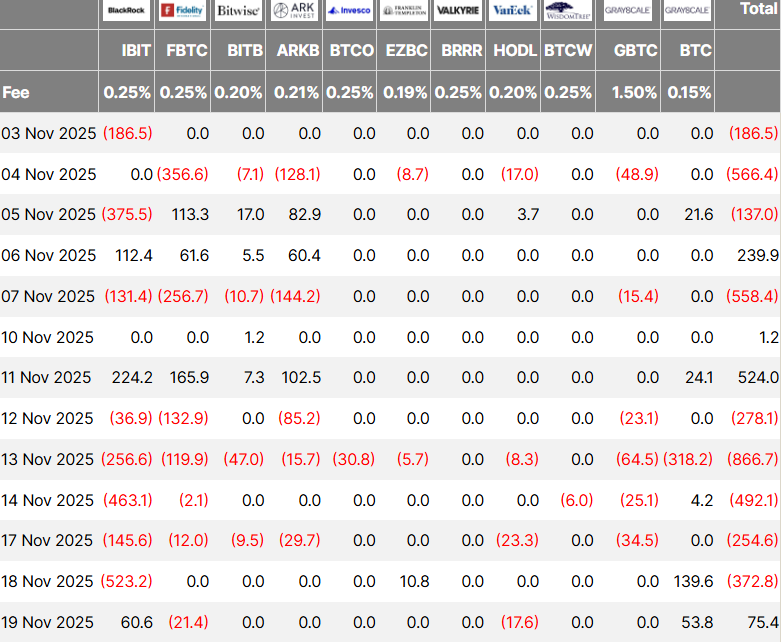

Despite heavy selling, US Bitcoin ETFs saw a net outflow of $75 million on Wednesday, ending a five-day streak of outflows.

Ebit BlackRock The Grayscale Mini Index Fund accounted for all the inflows, which shows that some institutional investors saw the decline as a buying opportunity.

However, the sentiment among ETF issuers was mixed. Van Eck, Fidelity, and other major issuers reported flat or negative flows, suggesting cautious optimism.

This split highlights the mixed outlook in Bitcoin markets. Some institutions see the current levels as valuable, while others hesitate because of the near-term uncertainty.

The collision of whale sales, quantitative safety issues and institutional buying have brought about strong volatility. Investors are now faced with the question of whether quantitative history signals real risks or just profits after Bitcoin’s rally this year.

The coming days will show if the institutional support can keep prices stable or if there is a further decline as the market processes these risks and provides long-term holder flows.