Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Hedera index has fallen more than 10% in the past seven days, and the decline is not just a routine pullback. HBAR’s price structure is weakening, capital is flowing, and sentiment is at multi-month lows.

Together, these signals indicate an increased risk of a deeper correction. At the same time, dip buyers and derivative positions provide a narrow path to recovery. Whether HBAR will degrade or stabilize now depends on several key levels.

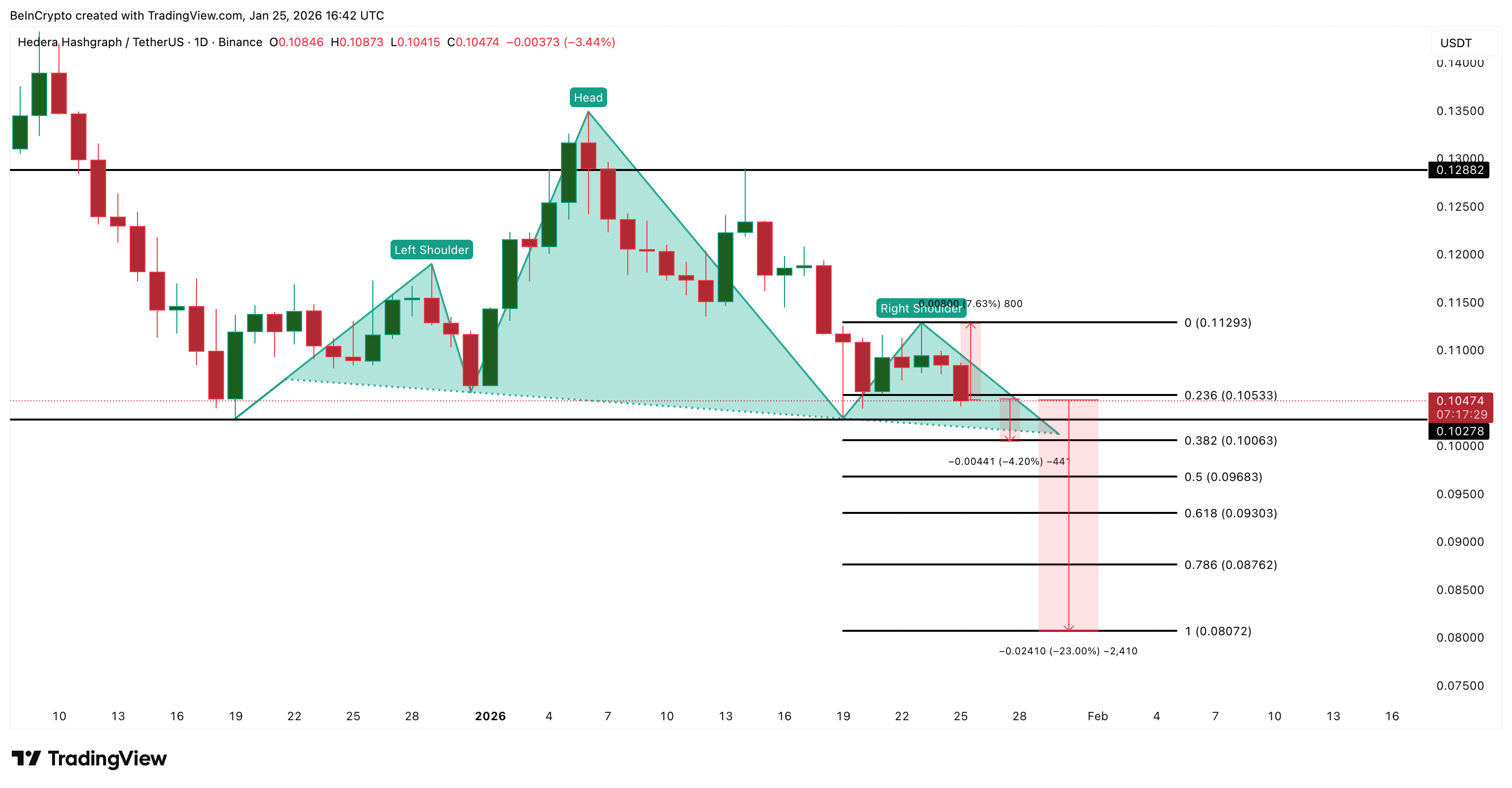

The price chart shows Hydra approaching the completion of the head and shoulders pattern. It often indicates a bearish reversal once the neckline is broken.

Sponsored

Sponsored

For the HBAR price, the cut is about $0.102. A daily close below this level would cause an expected downward movement of more than 20%, in line with previous breakouts from similar structures.

This risk is reinforced by Chaiken Money Flow, or CMF. CMF measures whether capital is flowing in or out of an asset by combining price and volume. When the CMF falls below zero, it indicates a net capital outflow.

HBAR’s CMF indicator has now broken below the fallen support line and has fallen decisively below zero. The last time CMF fell this sharply was in early December, before Hedera fell by nearly 25%. This tells us that the current price weakness is supported by real selling pressure, not just low volume drift.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

While the CMF remains negative and the collar remains under pressure, the bearish structure remains active.

Sponsored

Sponsored

The price weakness is now reflected in the sentiment data.

Positive Sentiment tracks the extent of positive discussion and commentary surrounding an asset in social and market sources. When positive sentiment drops to local lows, it often reflects fading confidence and declining purchase intent.

Positive sentiment for Hedera fell to its lowest level since late October. Historically, similar lows have been closely aligned with falling prices.

On November 9, the waves reached a local minimum while HBAR traded close to $0.17. In two weeks, the price dropped to about $0.13.

The current setup is similar. The mood is starting to weaken earlier, while the price is still hanging above the key support. This type of divergence often causes the price to fall to match the confidence levels. With the lower structure and feeling, the risk of collision is clearly high.

Sponsored

Sponsored

Despite the bearish signs, there are early signs of support returning below the surface.

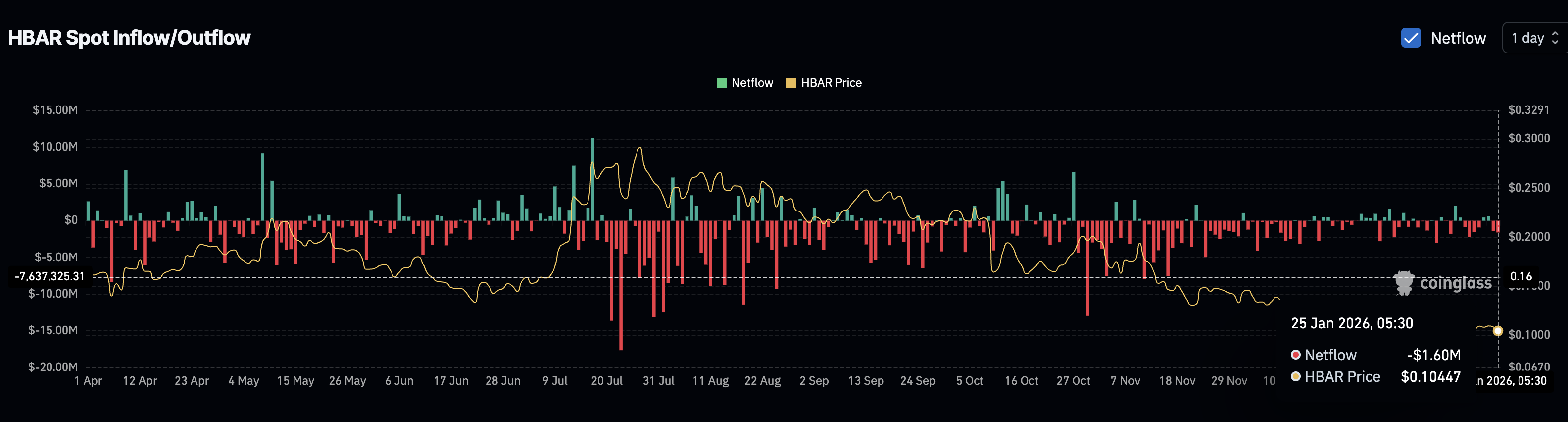

Spot exchange data show that net flows have increased over the past two days with the HBAR price correcting by around 5%. Net flows occur when more tokens exit the exchanges than enter the exchanges, and this usually indicates a long-term purchase or holding. On January 24th, net inflows were approximately $1.41 million, resulting in approximately $1.60 million on January 25th. This indicates that dip buyers are starting to enter after the recent selloff.

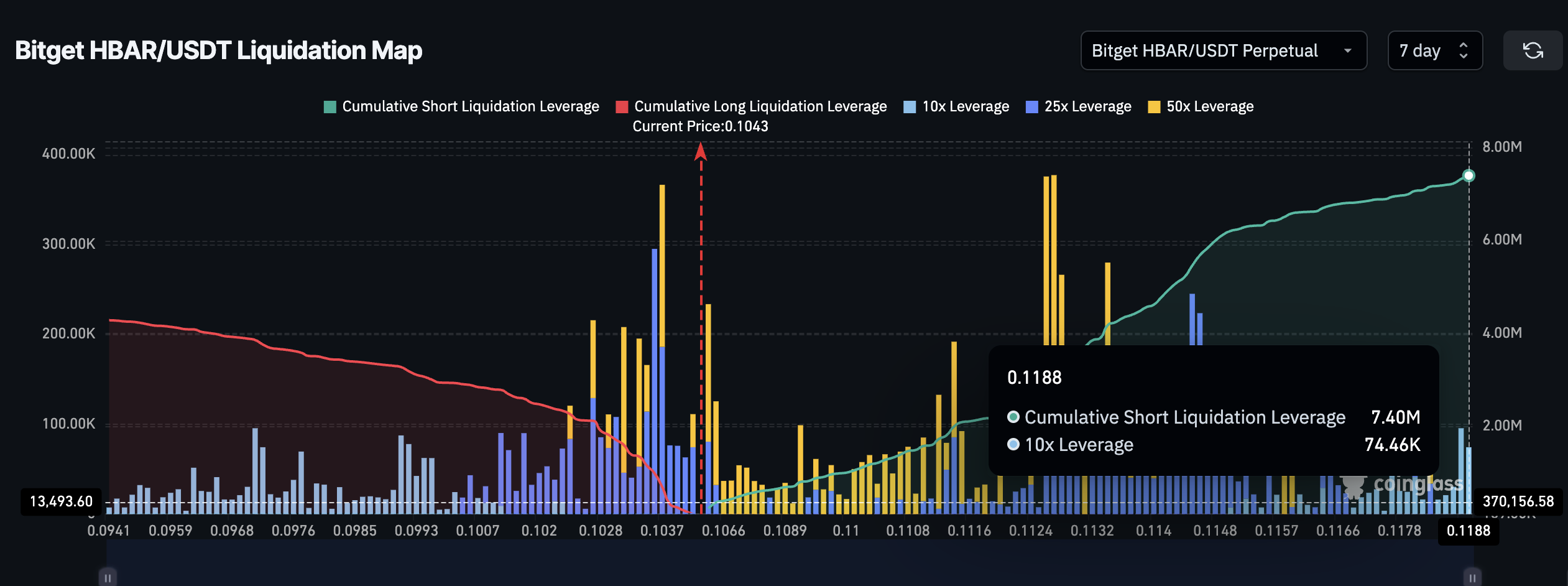

Derived data adds another layer. In Bitget’s permanent HBAR market, cumulative short liquidation exposure over the next seven days is about $7.40 million, compared to about $4.28 million in long liquidations. This disparity of 70% in short positions means that a large part of the traders are positioned for more disadvantages.

by the time Exposure exceeds sales by this margin investment, even a moderate price rebound can lead to a short liquidation. These forced buy orders can accelerate upward moves. This creates a narrow window in which a bearish position can lead to a rebound.

Sponsored

Sponsored

The movement of the HBAR price Now hold the final answer.

As for the decline, it is the basic level between $0.100 and $0.102. A daily close below would confirm a break of the head and shoulders and open the way towards $0.080, in line with the 20% decline forecast.

On the positive side, Hedera should first claim $0.105 to demonstrate short-term stability. The real test comes at $0.112, which corresponds to the key Fibonacci level and the right shoulder resistance. A clean move above $0.112 will cancel the right shoulder, weaken the bearish pattern, and likely trigger a large series of short ratings.

If this happens, the HBAR price may extend towards $0.128, where supply and previous resistance are present.

For now, the budget remains fragile. Bearish indicators are rising, but buying low and short positions leave the door slightly open for a reversal. The next closes of each day will determine which side will dominate.