Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin price remains stable. BTC has traded flat in the last 24 hours and is down about 6% in the past week. On the surface, nothing dramatic happens. But underneath, four separate risk signals began to match. A bearish chart pattern is forming. Longer holders sell faster. ETF demand had its weakest week since November. Buyers replacing sellers have become more short-term and speculative.

None of these signals alone would have hit the market. Together, they indicate that Bitcoin is losing its conviction at a sensitive level.

On the 12-hour chart, Bitcoin constitute parallel model. This pattern reflects a loss of upward momentum, as each attempted uptrend reaches higher than the previous one. The length of the neck is about $86,430.

Sponsored

Sponsored

If the price breaks the neck, the measured move would mean a downside of 9-10%.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

Momentum supports this risk. The 20-period EMA turns and closes on the 50-period EMA. EMA gives more weight to recent prices and helps track the direction of the trend. A negative move will make it easier for sellers to push the price down.

This weak structure becomes even more worrisome once you add the behavior of the carrier.

Long-term holders, wallets that hold Bitcoin for more than a year, increase the selling pressure.

Sponsored

Sponsored

On January 21, long-term holders sold about 75,950 BTC (outflows). As of January 22, this number had jumped to about 122,486 BTC. This is an increase of about 61% in one day, which is a sharp acceleration rather than a flat distribution.

This sale is not due to fear, but rather due to a lack of conviction in higher prices. The long-term NUPL, which measures unrealized profit or loss, fell to a six-month low, but remains in faith territory. Holders are still waiting for dividends.

This means that the sale is voluntary. They are choosing to reduce exposure, not force. While those who are very confident will sell, the type of buyers that come in is important. As X’s experts point out:

Sponsored

Sponsored

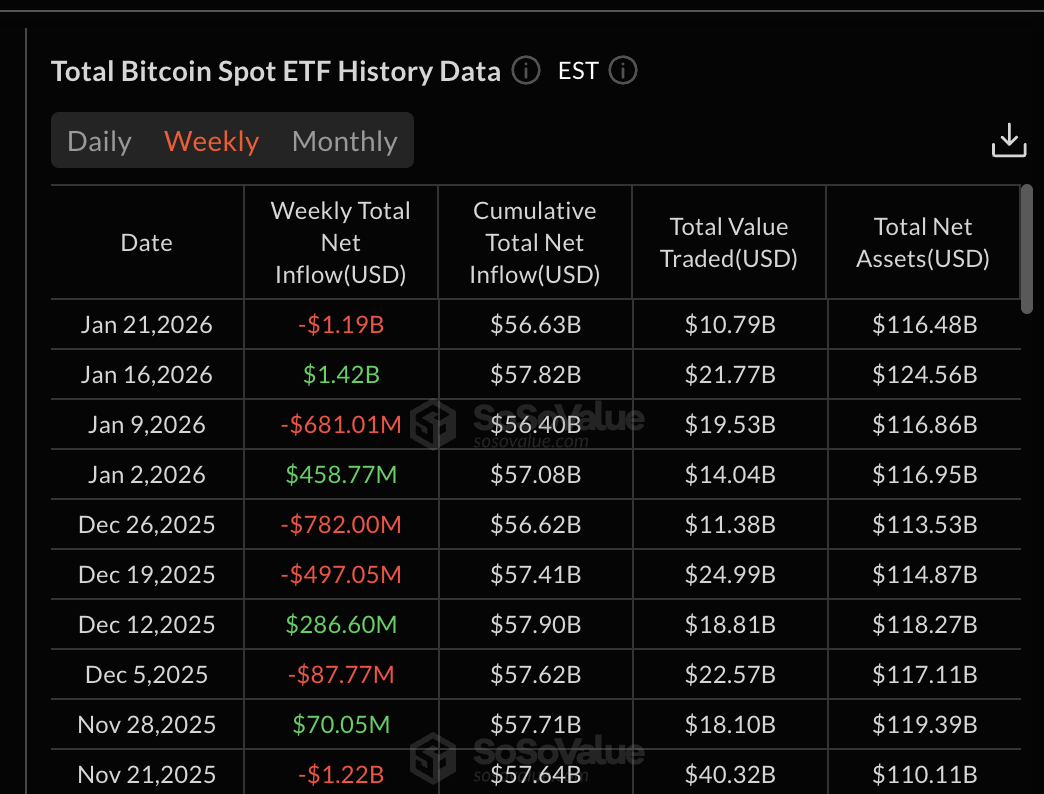

I registered Bitcoin spot funds Its weakest week in 2026 and weakest weekly demand since November.

In the week ended Jan. 21, index funds saw net sales of about $1.19 billion. This removed a major source of steady demand that had previously absorbed kingdom sales during a recession. So, like the holders, even the ETF players are not averse to condemning the price of Bitcoin at the moment.

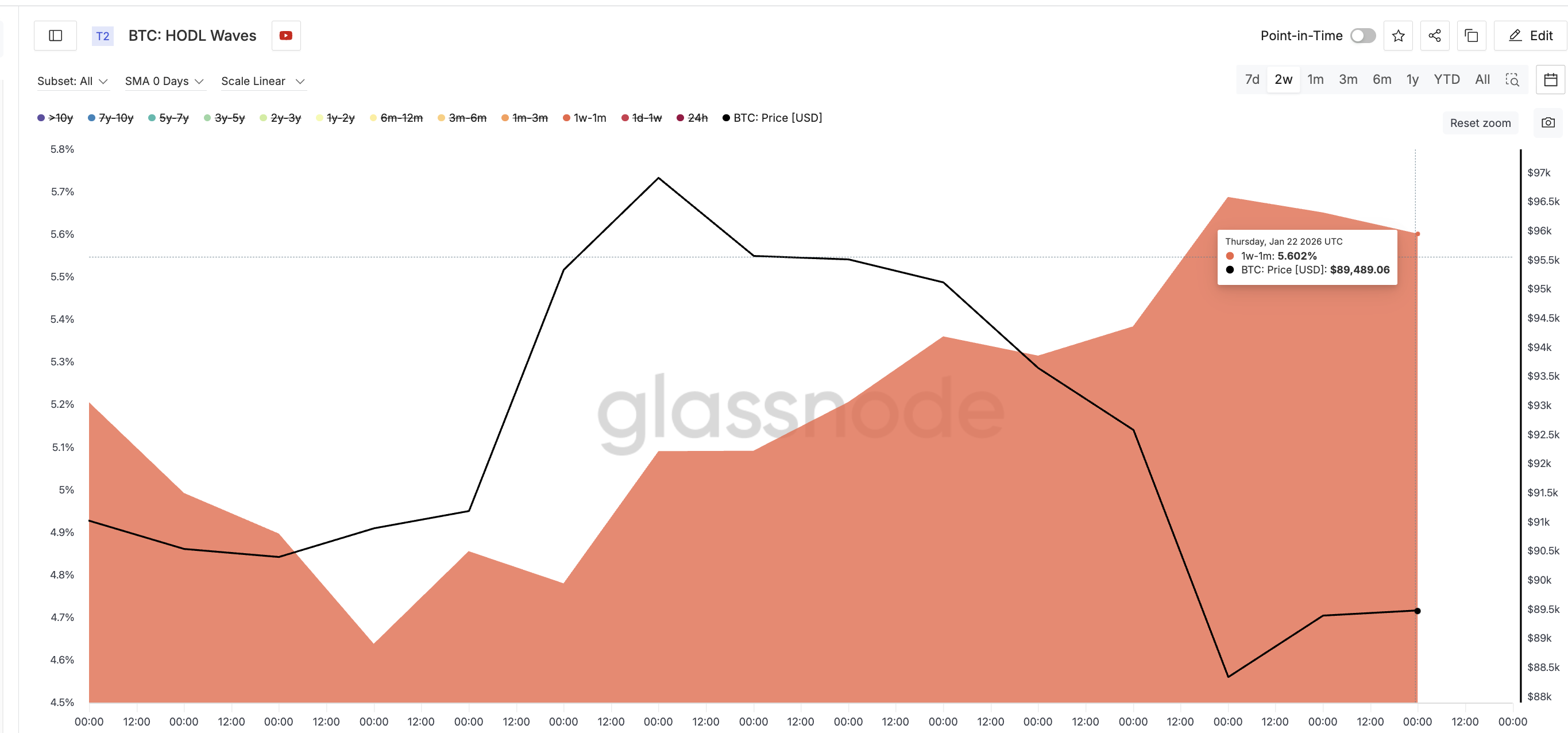

At the same time, HODL Waves data (a time-based measure of holding) shows speculative participation growing. Week-to-month holders have increased their share of supply from about 4.6% on January 11 to about 5.6% now. This represents an increase of about 22% in the category share in a short period.

This is important because these players usually buy the dip and sell the bounces. It does not provide permanent support.

Sponsored

Sponsored

So Bitcoin is seeing a move from long-term holders and index funds to short-term traders. This transition often results in a maximum of positives and increases sensitivity to negative damage.

All four risks (technical, long selling, ETF vulnerability and speculative flow) are now moving in a narrow price range.

On the upward side, Bitcoin needs a strong 12-hour close Above $90,340 for immediate pressure relief (above right shoulder). The recovery of $92,300 will be even more important, as it will push the price above the major moving averages.

Until then, the bearish mode remains active.

On the other hand, a loss of $ 86,430 will confirm a major collapse of the index. With long holders selling faster, demand for ETFs at a multi-month low, and speculative buyers taking control, downward moves can accelerate quickly once support fails.