Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin price is under pressure near the $89,800 level, due to a combination of financial issues, ETF outflows, and technical issues. The intense debate in Davos over the legality of Bitcoin, heavy losses in the US stock market due to threats of tariffs, and the withdrawal of about US$500 million from ETFs, dampened sentiment. However, the gathering of whales and the idea of a stable supply of Bitcoin remains a long-term confidence, as the charts show that the level of $ 86,000 represents a definite test of the price decline.

At the World Economic Forum in Davos, Brian Armstrong, CEO of Coinbase, had a heated argument with François Villeroy de Galhault, governor of the French Central Bank, during which Armstrong defended Bitcoin. The French official questioned the legality of Bitcoin, saying that he believed in independent central banks more than what he said were “private issuers” of cryptocurrency, during a panel discussion on the tokenization of goods.

He also pointed to the scarcity of Bitcoin and the lack of a “money printer,” emphasizing that, like gold, it acts as a check on large government spending.

Despite the recent price fluctuations, Armstrong expressed his belief that Bitcoin could reach $1 million by 2030 and advised investors to think about the long term.

These advanced discussions reinforce the idea of Bitcoin as a neutral and independent entity. Although short-term market volatility continues, this will help strengthen acceptance and confidence in Bitcoin in the long run.

Ethereum and Bitcoin exchange-traded funds (ETFs) saw the worst, as institutions were forced to reduce risks amid uncertainty surrounding the global economy. Withdrawals from Bitcoin ETFs traded on Tuesday totaled $483 million, thanks to investments in Grayscale’s GBTC and Fidelity’s FBTC. XRP ETFs also saw record losses, while Ethereum ETFs lost $230 million, ending a five-day streak. In contrast, Solana ETFs saw only modest gains.

The sale came as a result of institutional caution amid the global financial crisis. Global currencies fell due to escalating tensions between the United States and the European Union, inflation concerns, and a sell-off in Japanese government bonds. As a result, the price of Bitcoin fell below $89,000, and Ethereum below $3,000.

The number of large Bitcoin holders is still rising, according to blockchain data, which suggests that long-term confidence will remain even after the ETF is withdrawn.

Withdrawals from ETFs may cause short-term pressure on the cryptocurrency, but continued accumulation by large investors points to a bright future. Institutional demand for Bitcoin can quickly rebound once the financial crisis subsides.

Expectations indicate a fall in the price of Bitcoin, as it is currently trading near $89,800 after recovering from the level of $92,000 to $93,000. On the 2-hour chart, the price has fallen below the January uptrend line, indicating a clear loss and not just a temporary rebound. Strong bearish candles have supported selling, while small bearish candles indicate continued selling as buyers hesitate.

The price is in a downward trend. EMA 50 and 200 are acting as resistance levels near $92,000. This low corresponds to the 38.2% Fibonacci retracement, and indicates this phase of volatility. Major support levels are at $87,400 and $85,900, while resistance levels are at $90,400 and $92,300.

The Relative Strength Index (RSI) has bounced back from 25 and is now below 50, indicating weak strength and no clear change.

Trading idea: Sell low $90,500, target $86,000, stop loss $92,600.

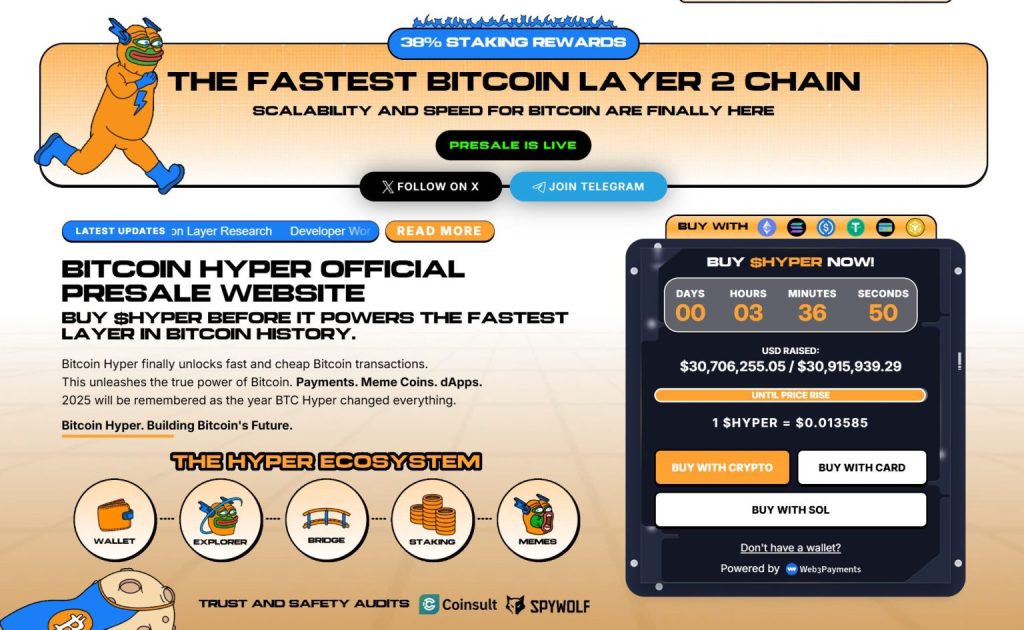

Launches Bitcoin Hyper ($HYPER) A new stage in the Bitcoin universe. Although Bitcoin is still the gold standard for security, Bitcoin Hyper adds what has been missing: Solana-like speed. The result: high-speed, low-cost smart contracts, embedded software, and the creation of meme-specific cryptocurrencies, all secured by Bitcoin.

After the previous search Company Application The project focuses on reliability and scalability as demand increases. The project has already gained momentum, with the pre-sale amount exceeding $30.8 million, and the token price standing at only $0.013605 before the increase.

With the rise of Bitcoin services and the high demand for powerful software based on this, Bitcoin Hyper is seen as a bridge between two of the biggest cryptocurrency brands. If Bitcoin has set the foundation, then… Bitcoin Hyper Being able to make it fast, flexible and fun again.

Click here to participate in the pre-sale

A note Bitcoin Price Prediction: ETF Outflows Jump and Controversy Heats Up in Davos – Is $86K a Safe Line? appeared for the first time Cryptonews Arabic.