Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

According to the comprehensive analysis of the end of the year Since leading the OTC trading desk Wintermute the nature of the four-year cycle of cryptocurrencies has fallen, replaced by a new market system where the concentration of liquidity and investor positions now choose the price movement.

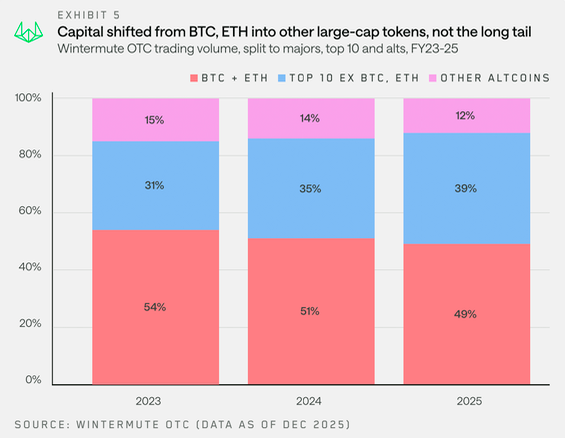

Industry data shows that 2025 has seen a significant change in the way digital assets are traded, with this year’s poor performance indicating a move from speculative pricing to a financial sector linked to institutions.

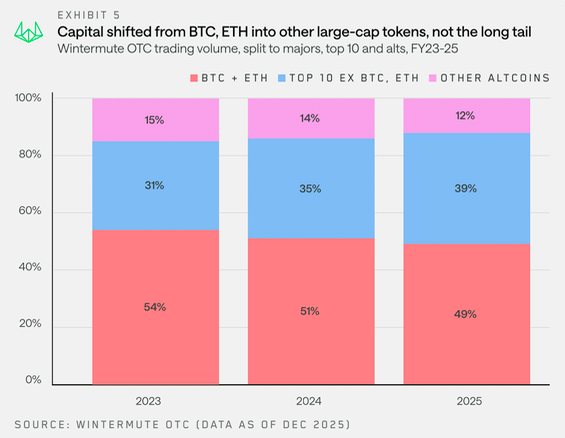

OTC trade flows from Wintermute show a long history of profitable returns Bitcoin to Ethereum Then to the big money (Blue Chips), and finally to other money, it is very weak.

ETFs have changed and digital asset storage companies to what the company describes as ” Walled gardens “, providing a constant demand for capital goods without turning money into the capital market.

As investors’ attention shifts to stocks, 2025 has been a year to focus as a few large, small-cap funds have taken in a lot of new capital while the overall market has struggled.

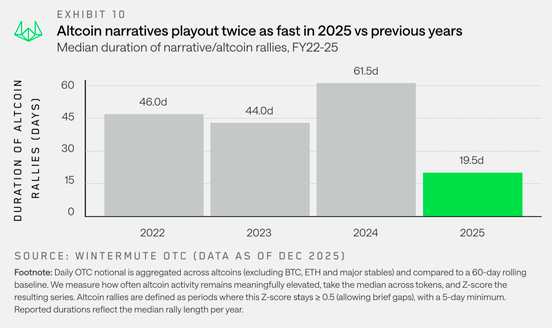

Business activity in 2025 followed a very different path from previous years, breaking what appeared to be seasonal trends.

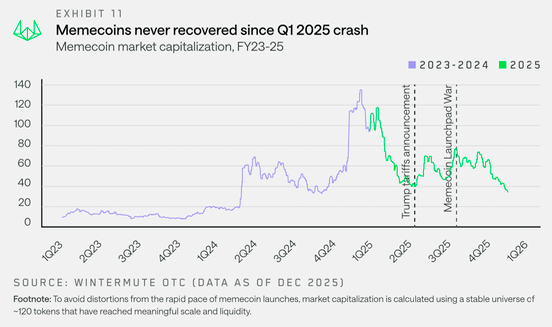

The hope that existed at the beginning of the year of The US administration is pro-cryptocurrencies, The risk increased significantly in the first quarter when the news about memcoins and AI assistants faded away.

Trump announced the tariffs on April 2 This added to the stock market, which led to an increase in activity at the beginning of the year before a sharp decline in the spring and summer.

The expected end of 2023 and 2024 did not happen, which caused the accident. Books related to “Prosperous October” It’s a gathering at the end of the year.

Wintermute’s data shows that this was not true of the weather, but spikes led by special instruments such as the adoption of ETFs in 2023 and the new US administration in 2024.

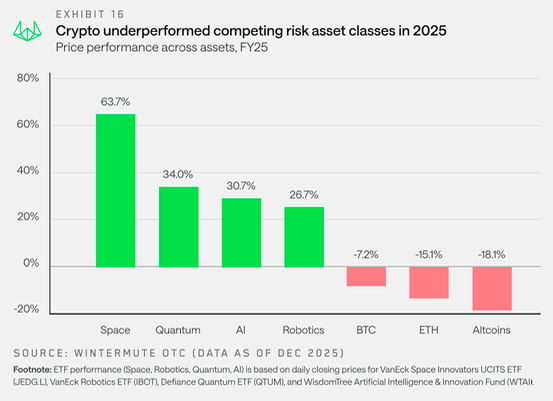

Markets have become more volatile as major financial forces take hold, and trends are turning into headline-grabbing issues without stability.

Altcoin rallies have fallen significantly, averaging 19 days in 2025, down from 61 days last year.

Topics such as cryptocurrency meme startup platforms, And a stable decentralized trading platform and x402 The meta sparked a short-term boom but failed to grow in the market, largely due to the economic downturn and market fatigue following the 2024 boom.

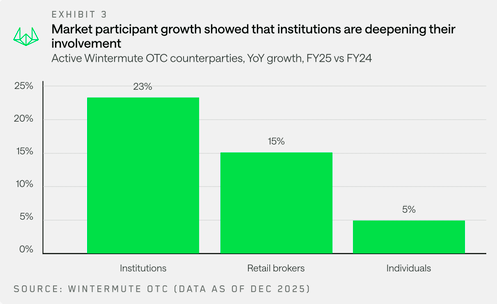

Even at low prices, the corporate sector has shown resilience until 2025.

Wintermute saw 23% year-over-year growth among its participants, including cryptocurrencies, asset managers and financial institutions.

Partnerships have grown significantly, and work is becoming more structured and focused on practice rather than research.

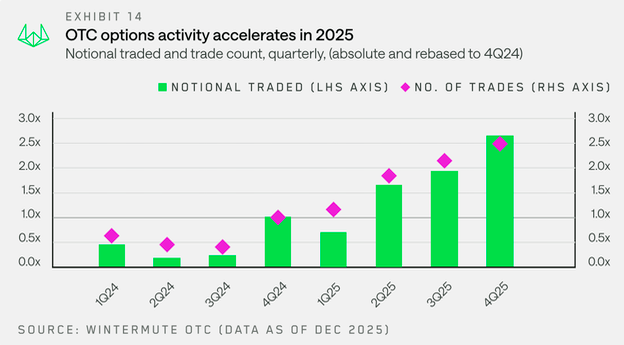

The data from the company also shows that options services have doubled annually, with systematic returns and risk management strategies that dominate the flow for the first time instead of individual bets.

By Q4, the nominal order volume reached 3.8 times that of Q1, while the sales figures doubled, indicating continuous and frequent growth.

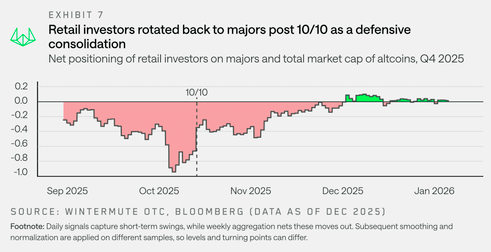

Institutional investors and traders returned to investing in large companies at the end of the year following an event on October 10 that resulted in the withdrawal of approximately $19 billion within 24 hours.

Open positions in altcoins also fell by 55%, from about $70 billion to $30 billion in December, as they were forced to liquidate the removal of extra income from Bitcoin and Ethereum.

Wintermute cites three conditions that must be met for the stock market to recover and surpass the growth of large companies.

First, exchange-traded funds (ETFs) and digital assets (DATs) should increase their investment, with the first signs appearing in ETF documents. Solana and XRP images .

Second, strong rallies in Bitcoin or Ethereum could lead to an increase in capital in the broader market, similar to 2024, although the recovery of capital remains uncertain.

Third, and less likely, investor interest may shift from AI topics to cryptocurrencies, leading to new capital flows and the creation of stablecoins.

” The year 2025 did not achieve the expected rise, but it could be the beginning of the transition of cryptocurrencies from a concept to a stable group of assets. This is what Wintermute’s assessment concluded.

It confirms Independent analysis of Adler Asset Management: The reduction theme continues, until 2026.

Adler said that the Advanced Bitcoin Sentiment Index fell from a bullish high around 80% to 44.9%, crossing the 50% neutral point, indicating a change in the market.

A note Wintermut says the cryptocurrency bull cycle is over – three things will drive 2026 appeared for the first time Cryptonews Arabic.