Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

XRP remains under pressure as a monthly trend continues to push the altcoin towards the key $2 level. At the beginning of the month, XRP tried to break out of this bearish pattern, but failed to maintain the momentum.

Adding to this pressure are investors who tend to sell at the moment. So, the question now is whether the growing anticipation around the chances of ETFs endorsing XRP can prevent a deeper fall.

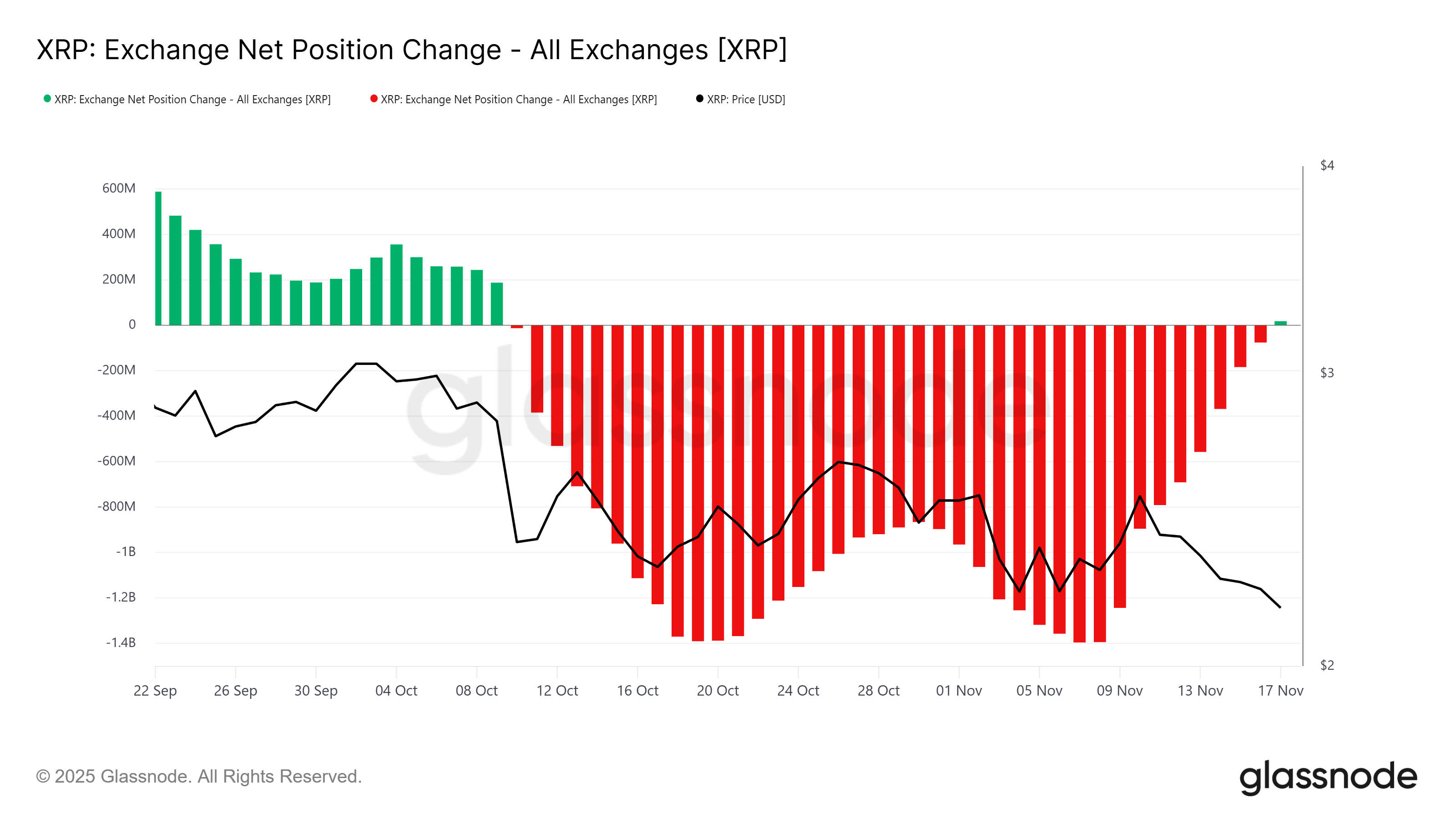

Data on the net position of XRP on the exchanges show its first confirmed inflow in more than a month, due to the decrease in prices. After weeks of declining flows, the last 24 hours have seen a clear return of capital to the exchanges, indicating a sell-off. This change is notable because inflows typically reflect weakened investor conviction and renewed selling interest during periods of uncertainty or pessimism.

Sponsored

Sponsored

This 30-day reversal highlights the deterioration in sentiment Among the holders of XRP. Instead of buying during periods of weakness, investors appear to be preparing for a potential downturn by selling their holdings. A change from steady flow to early inflows indicates a bearish bias, weakening short-term support.

Want more insights into the token? Subscribe to Harsh Notaria’s daily crypto newsletter here.

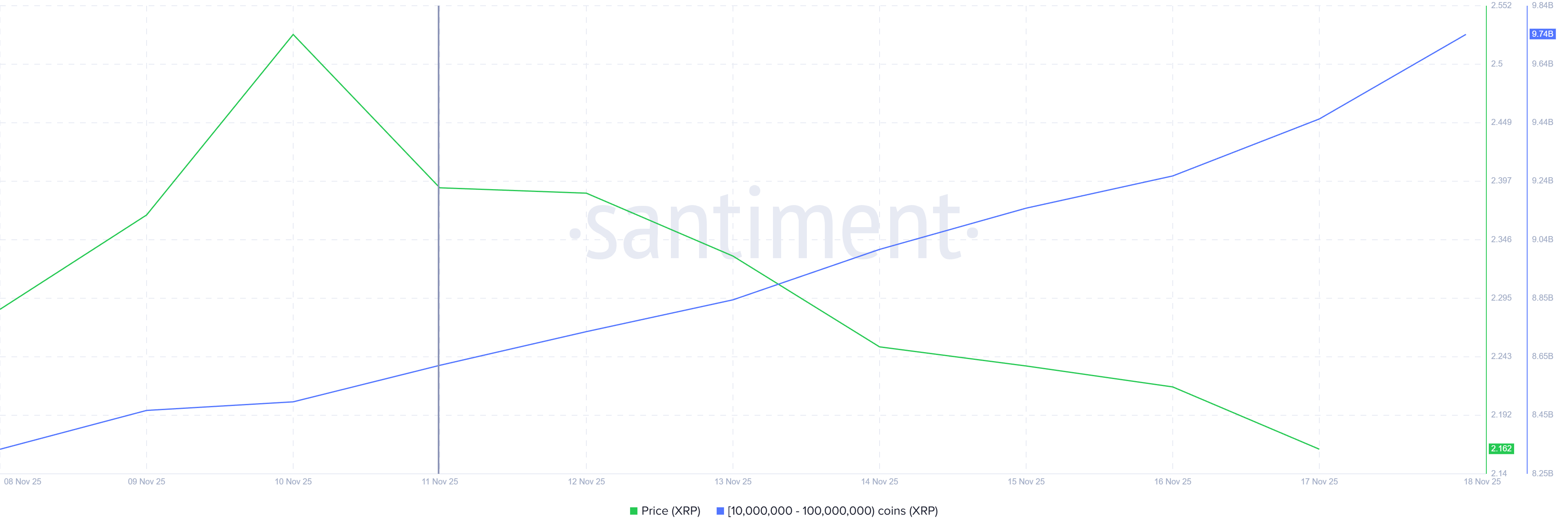

While the activity of the whale, on the other hand, tries to counteract the impact of the general sale, which indicates confidence in Ability to recover XRP. Addresses holding between 10 million and 100 million XRP collected an additional 1.1 billion XRP in the past week. This brings their total holdings to 9.74 billion XRP, representing a $2.36 billion increase at current valuations.

Such aggressive accumulations by major holders indicate continued optimism around the long-term stock price. Whales are often considered the most influential movers in cryptocurrency markets, and their buying activity tends to drive overall sentiment.

XRP is trading at $2.14 and is currently leaning on major support at the same level. The asset has been locked in a downtrend for almost a month, struggling to break out despite periodic attempts. Without external stimuli, XRP faces the risk of drift Down with continued downward momentum.

However, XRP may avoid a deeper decline given the increased likelihood of ETF approval. noted an ETF analyst at Bloomberg Eric Balkunas that The Securities and Exchange Commission has issued guidance allowing issuers to speed up filing efficiency, likely clearing regulatory backlogs. Bitwise’s ETF for XRP is rumored to be next in line, and any progress could immediately improve market sentiment.

If the upward momentum continues and expectations for ETFs increase, XRP could go up At $2.28, then $2.36, to break free from its downward trend. But if investor selling increases or ETF decisions are delayed, XRP can resume its potential 6% decline to $2.00. This will disrupt the bullish theory.