Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

BitMex co-founder Arthur Hayes has made bold moves in DeFi tokens, signaling a clear shift from Ethereum to protocols he believes will recover by 2026.

On-chain data shows that Hayes distributed more than $3.4 million in four DeFi assets: $1,970,000 in ENA, $735,330 in ETHFI, $515,360 in PENDLE, and $259,960 in LDO.

Sponsored

Sponsored

This accumulation comes at a time when these tokens are trading at levels well below their all-time highs, reflecting a broader decline in the decentralized financial sector.

LowCounchain reported that Hayes transferred another $5.5 million of Ethereum to a set of DeFi protocols, which include:

The largest part of its distribution, more than 50%, is in PENDLE, a performance tokenization protocol.

Arthur Hayes continues to accumulate these assets during the price decline, demonstrating his belief in their long-term value. Ted Bellows, a cryptocurrency analyst, confirmed the recent withdrawals.

Ted Bellows explained that Arthur Hayes continues to buy DeFi tokens, as today he withdrew $1,969,780 from ENA, $735,330 from ETHFI, $515,360 from PENDLE, and $259,960 from LDO. books Ted.

Sponsored

Sponsored

These ongoing accumulations reflect a portfolio strategy based on intrinsic value, not short-term speculation.

Each symbol in Hayes’ new customization is associated with a special narrative of his future growth.

ENA can take advantage of Bitwise’s recent ETF offering, which includes 11 cryptocurrencies, which could open the door to institutional flows.

Sponsored

Sponsored

Pendle has demonstrated a strong ability to generate revenue despite declining token prices, providing consistent quarterly cash flow to token holders.

Market analyst Niu Nguyen wrote that the income data shows that cash flow is still ongoing and accelerating in places that matter. For Bindel, 2025 follows a clear cycle. Revenues were $12.88 million in the first quarter, $7.52 million in the second quarter, $16.17 million in the third quarter, and $8.02 million in the fourth quarter.

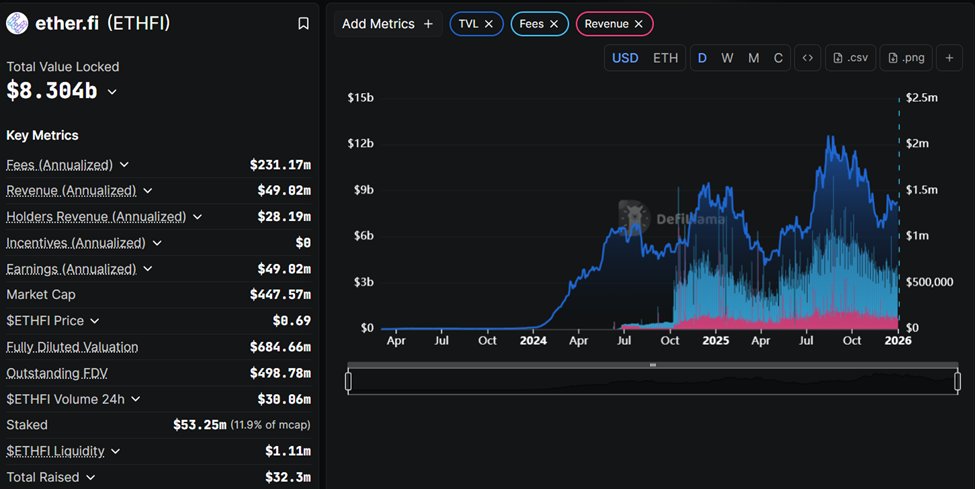

Ether.Fi (ETHFI) sees record revenue as it moves to… neobank cryptowith the volume of monthly card payments approaching $50 million.

He specified that the buybacks of the protocol, currently between $ 500,000 and $ 1.5 million per week, will coincide with a drop in symbolic emissions in 2026, to face the ongoing sales pressures.

Sponsored

Sponsored

Ethereum storage can be accessed through LDO exposure, with the protocol controlling around 25% of the ETH reserved. This is more than double that of the main competitors.

In addition, Ether.v’s treasury reserves and strong market position have allowed it to benefit from an increased demand for storage revenue.

Hayes’ moves highlighted confidence in the DeFi recovery, but the market remains calm. Regulatory approvals for ETFs, token issuance schedules, and staking competition can all impact performance.

Concentration risk remains significant, as more than 60% of its portfolio is based on a sector that is still emerging from a recession.

Hayes’ systematic accumulations during periods of low prices demonstrated a long-term strategy. And through Transcending from Ethereum Focusing on DeFi protocols that generate revenue, market share and institutional catalysts, Hayes seems to be preparing for a potential recovery of the sector in 2026.