Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

XRP is trading near $1.86, down about 2% in the last 24 hours and about 15% in a month. The price of XRP remains trapped in a bearish channel that carries a 41% risk of collapse if key levels fail.

What makes this deal unusual is that multiple buyer groups are ultimately involved. Long-term holders bought again, short-term holders added, but there is a group that is not convinced. This discrepancy explains why the graph always tends to go down.

Sponsored

Sponsored

price XRP Since the beginning of October it has been trading in a bearish channel. Each bounce fails near the upper trend line. The model predicts a potential decline of 41% from the breakeven point. While XRP is now trading closer to the upper trend line, some support in the chain seems to be emerging in the chain.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

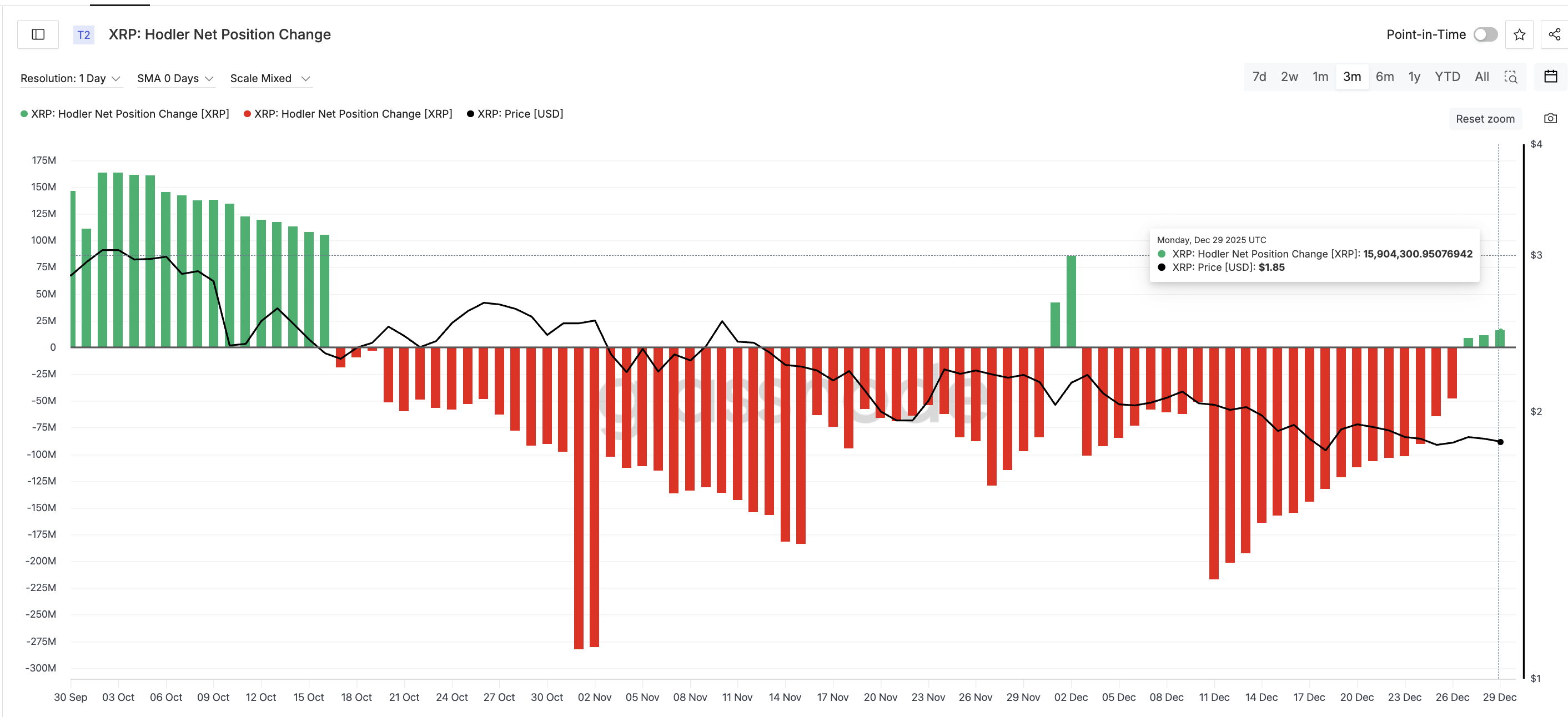

Long-term holders have finally changed their behavior, as shown by Hodler’s measure of position change.

After nearly three weeks of net sales, December reversed the trend. From December 3 to 26, Hodler’s XRP gauge saw a net negative change in position every day. That changed on December 27, when long-term holders added 9.03 million XRP. The next jump came on December 29, when the stock reached 15.90 million XRP. The purchase price increased by about 76% in 48 hours.

This buying level helped XRP stay close to the upper trend line of the channel, but did not break the channel towards the top.

Sponsored

Sponsored

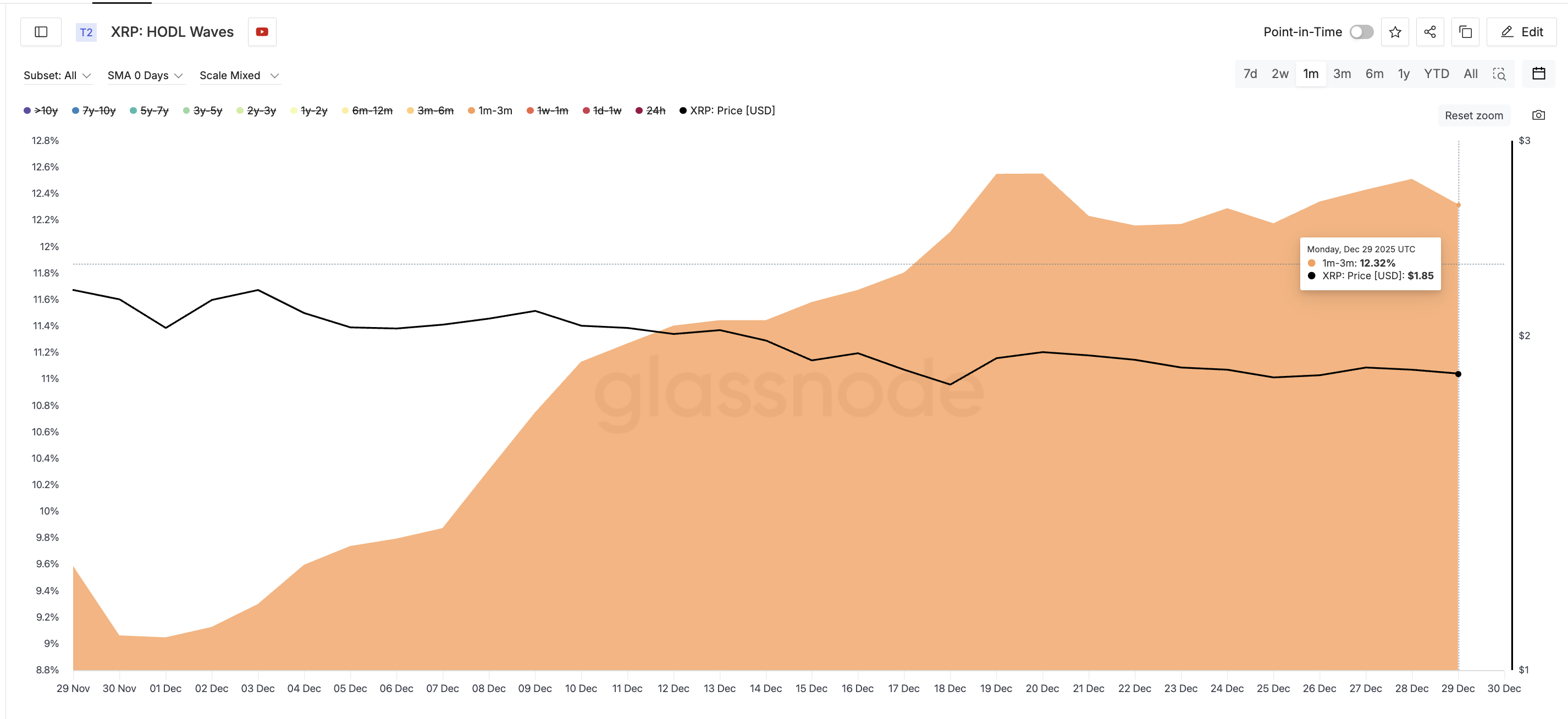

The proportion of short-term rights holders (one to three months) expanded from 9.58% of the supply on November 29 to 12.32% on December 29, as shown by the HODL Waves metric. The HODL Waves measure typically separates groups by age.

This group usually leads rapid upward movements, but it is also the first to exit from volatility. The acquisition is a double-edged sword: it helps limit collapses, but also creates exit pressure if rallies remain weak.

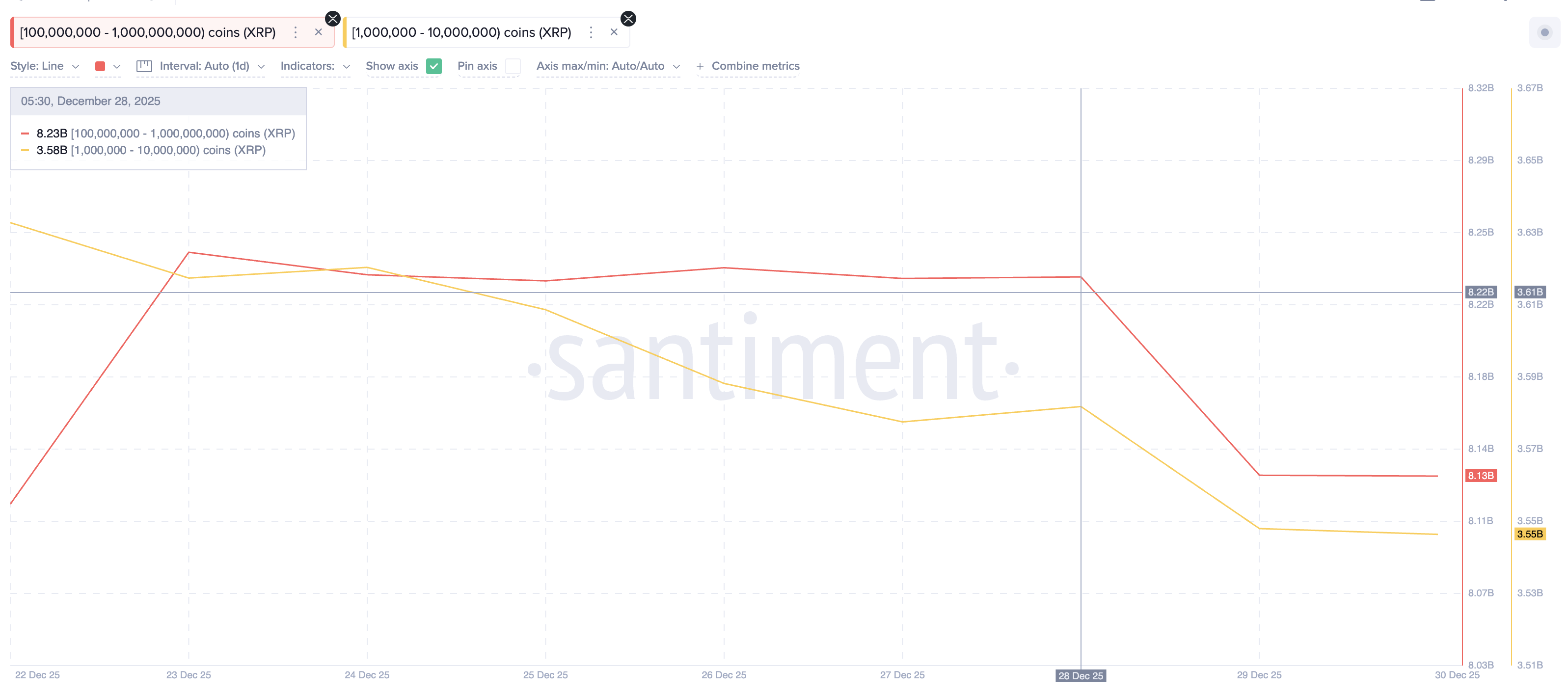

Whales are moving in the opposite direction, perhaps after seeing a big increase from short-term holders amid a weak price pattern.

Sponsored

Sponsored

The number of holdings holding 100 million to 1 billion XRP decreased from 8.23 billion to 8.13 billion on December 28, a decrease of 100 million XRP, or about $186 million, sold.

The number of batches of 1 million to 10 million XRP decreased from 3.58 billion to 3.55 billion, a decrease of 30 million XRP, which is equivalent to about $ 55 million in sell-side squeeze.

The whale comes out against two layers of transport flow which create friction. This prevents any attempt at a clean breakout and explains why the price continues to return to the intermediate range instead of challenging resistance. If short holders sell on any rebound, reducing positions can accelerate the decline of the position.

Sponsored

Sponsored

The market is at a crossroads. XRP price Stay in the channel. It must stay above $1.79 to avoid an early collapse. Continuing above this level as long-term holders continue to buy could push the price towards $1.98. A daily close above $1.98 neutralizes the bearish structure and opens a path back to $2.28, where the bullish momentum returns.

But the danger is clear.

If $1.79 fails, the… The next support for the XRP price It would be $1.64 and $1.48. A loss of $1.48 breaks the channel and reveals a 41% risk towards $1.27 or lower.

Currently, the acquisition of broad transport holders has not changed the organizational structure. This only slowed down the collapse. To change the narrative, the whales must return. Even then, every jump in the channel brings an exit pressure.