Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

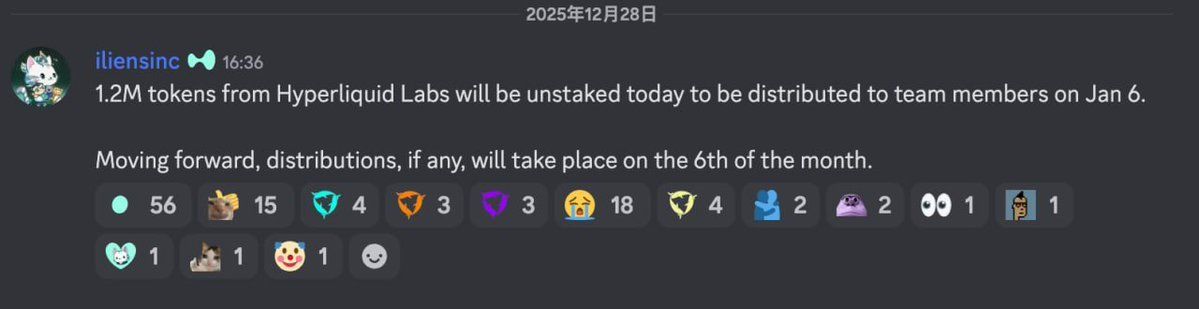

Hyperliquid Labs co-founder ElenSync reignited the debate on Sunday, after revealing via Discord that 1.2 million HYPE tokens from Hyperliquid Labs will be unfrozen today (December 28, 2025) and distributed to team members on January 6, 2026.

The announcement also clarified that the team’s future distributions, if any, will take place from the 6th of each month, regulating the project’s token release schedule.

Sponsored

Sponsored

This revelation came amid speculation about… Economy of hyperliquid tokens. Major shareholders currently hold 23.8% of the total supply of 1 billion HYPE tokens. A one-year freeze and a gradual payment plan extending until 2027 would control this.

This three-year period ensures that the team is aligned for the long-term success of the decentralized derivatives platform. Decentralized platform for derivatives. It includes places like HyperliquidSpot, LBank, Bitget, Gate, KuCoin and OKX. HYPE, a local ecosystem asset, is most traded against USDT and USDC.

Despite concerns from chain followers that 9.92 million tokens could be released on December 29, the team emphasized that distributions will be predictable and controlled, reducing concerns about sudden sales.

At press time, HYPE is trading near $25.38. It fell by 0.65% in the last 24 hours, with a market capitalization of $8.6 billion, indicating relative stability despite the distribution talks.

Sponsored

Sponsored

Community reactions vary. Some traders welcomed the transparency, acknowledging the clarity of Elliesink’s Discord post.

A user mentioned That there is good clarity around the future thawing operations. The key word here is “distributions, if any.”

Others have expressed doubts citing previous large sales by early investors, however, some have expressed concerns about the potential short squeeze, which is common in token unlock events.

The monthly unlocking schedule gives stakeholders visibility into upcoming supply increases, allowing investors to plan for expected symbolic events instead of reacting to surprises.

Applying a gradual release structure reduces the risk of sudden price shocks, and maintains market confidence while allowing the team to gradually realize the value of their holdings.

The key variable remains whether team members will hold or sell their unlocked HYPE, as early January trades could set the tone for 2026, affecting investor sentiment and short-term price momentum.

The clarity of the vesting schedule reassures long-term token holders, but the increase in circulating supply will continue to be a factor in the market.