Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Welcome to the US Cryptocurrency Morning Newscast – a summary of the most important developments in the world of cryptocurrency for the day ahead.

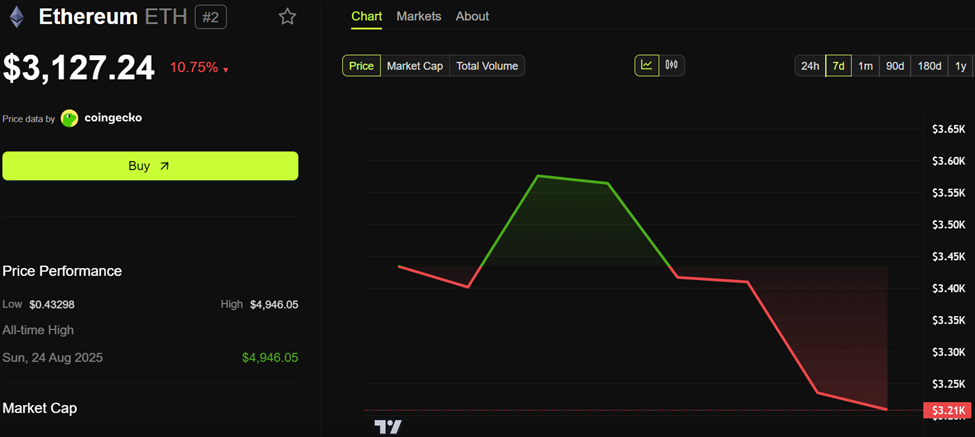

Drink your coffee while the whales part. Institutions are charging silently, and Tom Lee’s Bitcoin is moving faster than everyone else as a major pattern is found in on-chain analysis. With ETH hovering in the $3,100 range, and volatility rising in the market, a new battle line is forming between panic-selling sellers and high-conviction buyers.

The biggest players in Ethereum split immediately, and Bitcoin by Tom Lee Move faster than everyone else. As ETH remains near $3,100 with mixed technical signals, whales are either panic selling at breakeven or buying in record volumes. Bitcoin has firmly chosen its side.

Sponsored

Sponsored

Despite the sharp decline in the market, Bitcoin continues to accumulate on a large scale. Lookonchain data shows that a new wallet linked to Bitcoin 0x9973 received 9,176 ETH, worth $29.14 million, directly from the Galaxy Digital OTC wallet.

According to Lookonchain, “Despite the market decline, Tom Lee’s Bitcoin is still buying $ETH”, which highlighted Lee’s aggressive strategy.

This followed previous activity that confirmed a total pool of 19,500 ETH in Bitcoin, which placed the company among the most active buyers in November.

We look more closely at the additional chain transactions, as they indicate that the wider whaling activity is fragmented. A long-term holder, wallet 0x0c19, sold 2,404 ETH tokens, worth $7.7 million, which it had held since August 2021. At today’s prices, the whale appears to be exiting at breakeven, indicating declining confidence after years of inactivity.

Meanwhile, a big whale known as #66kETHBorrow is doing the opposite. He added another 16,937 ETH ($53.9 million), bringing his total holding to 422,175 ETH ($1.34 billion) in just a few days. Despite having almost unrealized losses amounting to $126 million, this whale continues to accumulate with conviction.

Sponsored

Sponsored

Traders Big Brother Machi and Little Brother Machi doubled down on their bet. Both increased their long positions on HyperLiquid:

LeConchine notes what you do Both traders added extra margin as ETH fell to avoid liquidation, signaling confidence in a rebound despite significant risk exposure.

Sponsored

Sponsored

Elsewhere, he rose A wallet linked to Tornado Cash0xa13C, sold 4,978 ETH ($16.29 million) at $3,273. Data on the chain shows that the same entity previously deposited 162,937 ETH, money that analysts link to Richard Hart, founder of HEX and PulseChain.

No confirmation has emerged, but the sale adds to the narrative of whales sharing.

said DeFi researcher 0xNobler what you do “The build-up of madness lies behind the scenes.”

The next big incentive for Ethereum is coming in December, the update Fusaka. Crypto Rover noticed that the update Pectra The smaller ones pushed ETH higher by 50%, adding weight to the expectation of new volatility.

Sponsored

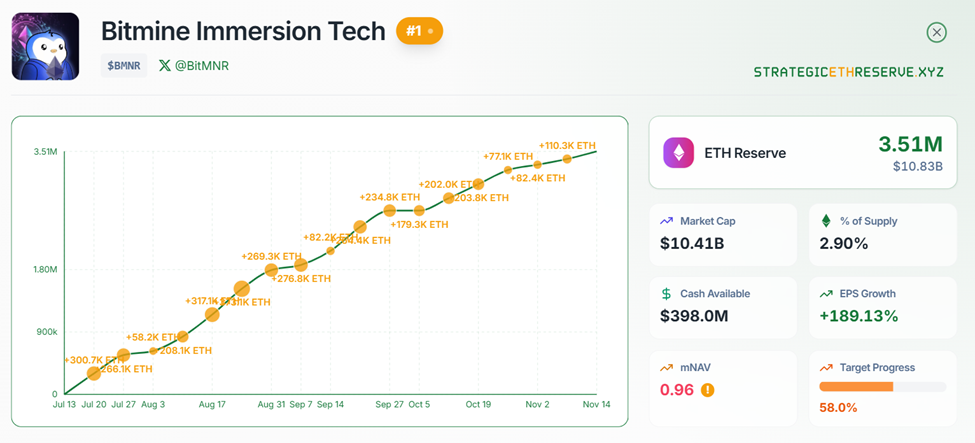

With whales deep forking and institutions quietly accumulating, Ethereum’s next move may depend on whether Bitmain and other big buyers can change their mood before the December update window.

Here’s a roundup of US cryptocurrency news to follow today:

| Company | Closes November 13th | Early market overview |

| Strategic (MSTR) | $20.54 | $202.41 (-2.94%) |

| Coinbase (COIN) | ٢٨٣, ١٤ $ | $2٧٤.5١ (-٣.٠٥%) |

| Galaxy Digital Holdings (GLXY) | ٢٧, ٢٤ $ | $26.06 (-4.33%) |

| Mara Holdings (MARA) | 12, ٧٨ $ | $12.35 (-3.36%) |

| RIOT Platforms | $13.88 | $13.30 (-4.18%) |

| Core Scientific (CORZ) | $15.16 | ١٤.٨٧ $ (-١.91%) |