Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

As the market shifts from bullish to bearish, the question arises as to whether or not the recent altcoin rallies will continue. While some altcoins may rely on external developments, others also follow Bitcoin signals.

So, BeInCrypto analyzed three such altcoins that may surprise investors over the weekend.

Sponsored

Sponsored

Chili’s is looking at a potentially optimistic weekend after unveiling its vision for Chili’s 2030. The long-term roadmap focuses on scaling blockchain sports. and expand adoption in the real world. This strategic update has improved sentiment towards CHZ, putting the altcoin in a favorable position as investors assess the network’s future growth prospects.

Although the announcement alone cannot trigger a full recovery, it can support interest after the weekly increase of 30% of CHZ. Trading at $0.057, CHZ may consolidate near current levels. Keeping the price above $0.053 indicates stability, indicating that buyers will continue into the weekend despite limited immediate catalysts.

Want more icon insights like these? Subscribe to publisher Harsh Notaria’s Crypto newsletter here.

Downside risks continue as momentum indicators warn. The Money Flow Index indicates overbought conditions, suggesting that buying pressure may be saturated. If profits emerge, CHZ could fall below $0.053. The deepest pullback is towards $0.050 It will invalidate neutral expectations Confirms short-term downward pressure.

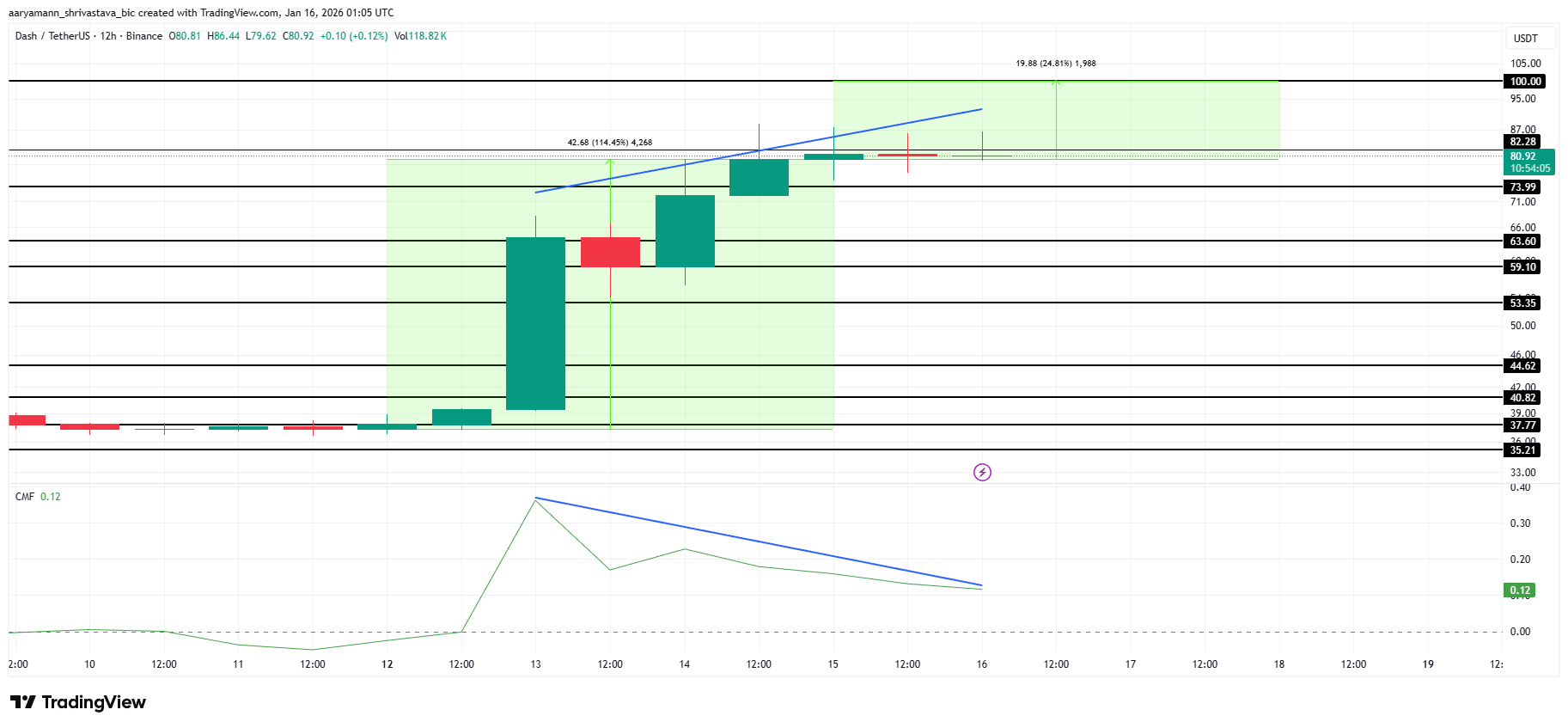

DASH emerged as one of the best performing markets of the week, rising 114% in just seven days. You trade Altcoin now Close to $80, driven by aggressive buying momentum. Despite the strong rally, the DASH is still 24.8% below the $100 mark, keeping traders focused on whether the upward momentum will continue.

Sponsored

Sponsored

The recent rise in DASH prices came after increased merchant adoption, and was marked by Alchemy Pay joining the network. However, momentum indicators sound caution. The Chaikin Money Flows indicator shows a bearish divergence, as the price makes higher while the CMF indicator weakens. This suggests that capital flows are rising under the rally, increasing downside risks.

If the selling pressure accelerates, the DASH may lose the $74 support and slide towards $63 in the short term. Such a movement confirms a corrective phase. On the contrary, renewable flows can stabilize the movement of prices. Continued demand will allow DASH to extend gains and challenge the $100 level next week.

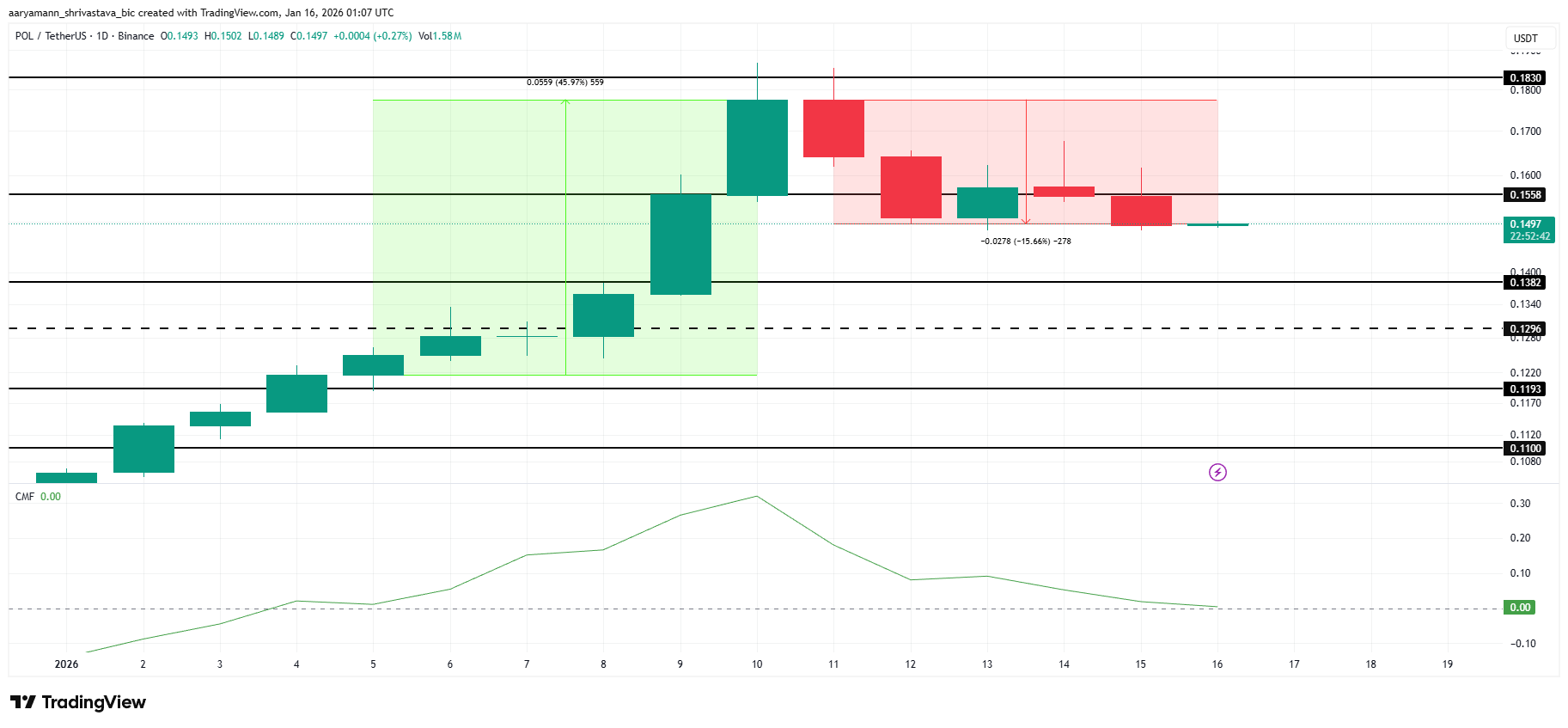

Another altcoin to watch this week is POL, which had a volatile performance in January, rising 46% last week as bullish sentiment dominated early trading. That momentum quickly faded. Growing market uncertainty has led to strong volatility, pushing POL up 15.6% this week.

This sudden reversal highlights fragile confidence and highlights how quickly speculative demand is rebounding.

Capital flows have deteriorated significantly in recent sessions, making POL One of the first altcoins That lost the support of investors. Chaikin’s cash flow shows that inflows are starting to dry up completely. If flow rates dominate, downward pressure may increase. In these conditions, the price of open points risks sliding towards the support area of $0.138.

A bullish reversal could also occur if sentiment improves in the broader market. Renewed rally may allow POL to recover $0.155 as support. Maintaining this level will restore confidence in the short term. With continued buying, POL may extend a recovery move towards $0.183, negating the current negative outlook.